Inventories are climbing in a number of cities. In another sign of a cooling housing demand, home-builder Toll Brothers reported a 29% drop in new orders.

By: Ruth Simon and James R. Hagerty: The Wall Street Journal Online

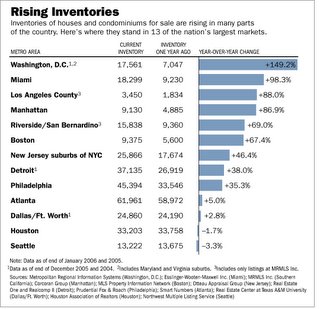

With the key spring selling season about to get under way, the inventory of homes on the market is climbing sharply in a number of major cities.

It is the latest sign that the balance of power between buyers and sellers is shifting as the once red-hot housing market continues to cool. The slowdown is affecting both existing homes and new homes. Yesterday, the nation's largest builder of luxury homes, Toll Brothers Inc., reported a 29% decline in new orders in its first quarter, which ended Jan. 31. That was below many analysts' expectations and prompted a sharp selloff in Toll Brothers stock. And Ryland Group Inc., a Calabasas, Calif., builder that sells homes in a wide range of prices, recently announced that new orders declined 4.7% for its quarter ended Dec. 31.

Nationwide, there were 2.8 million existing houses and condominiums on the market at year end, according to the National Association of Realtors. That is down slightly from November's 2.9 million listings, but up 26% from a year earlier. Adjusted for seasonal variations, inventories have climbed 38% since April, according to Goldman Sachs Chief U.S. Economist Jan Hatzius, the largest eight-month increase on record.

The changing climate is particularly noticeable in once-hot markets such as Miami, Phoenix and Washington, D.C., and in areas such as Detroit, where price increases have been modest but the job market is weak. Some brokers report that traffic has increased in recent weeks. But with plenty of properties to choose from, buyers have become more selective.

The rise in inventories has been good news for people like Mike Perillo, an accountant who has been looking for a home in the Philadelphia suburbs for well over a year. "We're now seeing a lot more properties that appeal to us," says Mr. Perillo. "There's more on the market, and there seems to be a lot less people looking now as opposed to this time last year."

In Phoenix, where inventories have climbed steadily since last spring, open houses are attracting a steady stream of lookers, says Charles McLean, broker-owner of Century 21 Metro Alliance. "But people are taking their time," he says. "They're not just jumping and writing a contract." Mr. McLean says that if a listing doesn't attract enough traffic, within 30 days they will consider lowering the price.

In Detroit, sales fell nearly 10% in the fourth quarter and inventories climbed amid uncertainty about auto-industry layoffs. To stimulate demand, Real Estate One, a Detroit brokerage firm, has been running a companywide "Bonu$ Homes" promotion in which sellers agree to provide $2,000 to $10,000 toward buyer closing costs on purchases made before April 15.

"The creativity to sell homes is coming back," says Dan Elsea, president of brokerage services at Real Estate One. "We haven't needed it for years."

Economists and real-estate experts are watching the inventory numbers closely for signs of whether the housing market is poised for a soft landing - or something worse. When inventories are tight, buyers competing for scarce properties bid up prices. As the supply of homes on the market increases, price increases slow and buyers gain negotiating power.

The recent rise in inventories follows a prolonged housing boom during which strong demand and low mortgage rates triggered bidding wars and fueled double-digit price gains in many markets. But those days appear to be over. The National Association of Realtors said that it expects sales of existing homes to fall by 4.7% this year to 6.74 million and median home prices to rise an average of 5%, down from 12.7% last year.

Some analysts are more pessimistic. In a joint forecast issued last month, housing analytics firm Fiserv CSW, a unit of Fiserv Inc., and economic forecaster Moody's Economy.com, a unit of Moody's Corp., called for home prices to increase by an average of 1.5% this year.

With the number of listings rising and the pace of sales slowing, there is now a 5.1-month supply of existing homes on the market, based on the current rate of sales, according to the National Association of Realtors, compared with a record low of 3.8 months in January 2005. Historically, a 5.5-to-six-month supply has been considered a balanced market, says NAR Chief Economist David Lereah. But with the Internet making shopping for a home easier, he says, it is no longer clear just what a balanced market is.

Another uncertainty: how much of the increase in inventories is due to speculators looking to sell, and whether they will be more willing to cut prices as the market cools. Investors accounted for 9.5% of mortgages to buy homes through October, but their share of purchases peaked during the first half of the year, according to LoanPerformance, a unit of First American Corp. Brokers in markets such as Phoenix and South Florida say they've seen an increase in investor-owned properties for sale.

The sharp rise in inventories isn't universal. In Seattle, inventories have declined modestly over the past 12 months as a robust job market sustains demand. The supply is so tight, "I don't know if it can get any lower," says Michael Skahen, owner of Lake & Co., a Seattle brokerage firm.

In Dallas, inventory has edged up slightly, but the pace of sales is up. "The buzz around my office is that everybody is busy now," says Steve Hendry of Re/Max Associates of Dallas. "Our economy seems to be picking up considerably. It's just night and day compared to what was going on this time last year."

Still, the pinch is being felt in many corners of the housing market. The number of completed new homes currently on the market has risen nearly 40% over the past year, according to Hanley Wood Market Intelligence in Costa Mesa, Calif., a market research and consulting firm. The shift has been particularly noticeable where inventories had been thin: In central California, the inventory of new homes climbed to 238 in the fourth quarter, from just 26 a year earlier, an increase of more than 800%.

As orders slow, builders are engaged in heavy discounting and promotional activity, particularly among homes for the second-time, move-up and luxury buyer. A survey conducted last month by the National Association of Home Builders found that 64% of builders are now using incentives such as offers to pay closing costs and free upgrades; 19% are cutting prices.

Last week Standard Pacific Corp., a major builder, said that new orders, excluding acquisitions, fell about 20% in the fourth quarter compared with the same period a year earlier. Lennar Corp., another builder, recently offered discounts of $20,000 to $30,000, plus help with closing costs and bonuses to brokers, on selected homes in the Tampa area.

Robert Toll, Toll Brothers' chairman and chief executive, indicated that slowing orders appeared to reflect three trends. First of all, speculators, who buy homes as investments hoping to flip them later at a hefty profit, are getting out of the market and canceling contracts. Toll said it also is constrained by long delivery times in many communities. During the first quarter, delivery times have increased to 11 months or more - before the maximum was 11 months. Buyers are reluctant to commit to such a long delivery time when the future of the market is uncertain. Toll also has a big exposure to Washington, D.C., New Jersey, Phoenix and California - markets that appear to slowing more rapidly than some others.

The supply of unoccupied condominiums is also climbing in many areas. In New York's Westchester County, the number of condos on the market jumped to 617 at the end of 2005 from 397 a year earlier. In the Boston area, the number of condos listed at the end of January was 5,114, up from 2,876 a year earlier. In the Washington, D.C., metro area, new-home inventory climbed by more than 900% to 2, 413 in the fourth quarter over the same period a year earlier, largely because of the completion of several condo projects, according to Hanley Wood.

skip to main |

skip to sidebar

With the latest news and trends in the Real Estate Market

ABOUT

Links

ADD VF CONSULTING REAL ESTATE BLOG TO YOUR FAVORITES!

Blog Archive

-

▼

2006

(591)

-

▼

February

(44)

- Plenty of Online Help for 2006 Real Estate Tax Info

- Condo Hotels: The Latest Twist In Buying a Vacatio...

- How to Save for Your First Home As Buying One Gets...

- New Federal Tax Incentives Benefit Homes, Businesses

- How to screen tenants for your rental property

- Work at home, save a bundle on taxes

- Real Estate Investors Big Winners in 2005

- Housing affordability slips for fourth consecutive...

- Predatory Lending, Other Real Estate Scams Targeti...

- The Weekend Guide! February 23 - February 26, 2006

- California luxury-home values increase in 2005

- Real estate purchases pick up

- 3 Easy Ways to Boost Your Home's Value

- Can a Feng Shui Expert Really Give Your Home Good ...

- LOS ANGELES Area Home: OPEN HOUSE Today Sunday 2/1...

- Downtown Los Angeles enjoys real estate 'renaissance'

- Real estate exchange best way to maximize savings

- Housing-Price Growth Still Hot, But Pace Has Coole...

- The Weekend Guide! February 16 - February 19, 2006

- SoCal real estate sales hit 5-year low

- Single Women Add Fuel to Housing Market

- Divorce settlement impacts real estate taxes

- Divorce and Taxes: Is This the End of the Great Am...

- Smathers Mediterranean - OPEN TODAY SUNDAY FEBRUAR...

- Should Holders of HELOCs Consolidate? Calculating ...

- Investors cash in on real estate depreciation

- California real estate affordability falls

- Home sellers benefit from adjusted cost basis

- The Weekend Guide! February 9 - February 13, 2006

- Forecast Looks Good for Commercial Real Estate

- Buying a House Gets Easier As More Homes Stay on t...

- 2006 Home Sales Slower, But Sustainable

- Windermere eyes second-home market

- Home Owners Spend Less on Remodeling

- Housing Counsel: Starker Exchanges Can Defer Your ...

- Bathrooms As Home Offices For Type-A Workaholics

- Living Large, Condo-Style

- Out with the cold, in with the new windows

- Big tax savings for moving costs

- Which Makes a Better Investment, A House or a Mult...

- EPA Proposes Regulating Home Renovations

- The Weekend Guide! February 2 - February 5, 2006

- Pending Home Sales Index Down, But Expectations Up

- Too Many Flips Back Investors Into Tax Corner

-

▼

February

(44)