Home buyers would rather spend money to improve the look of a kitchen than pay for less-conspicuous technology that cuts their utility bills, national home builders say.

By: Nick Zieminski: REALTOR® Magazine Online

Home buyers would rather improve the look of a kitchen than pay for less-conspicuous technology that cuts their utility bills, an Atlanta home builder says.

Ian McCarthy, CEO of Beazer Homes USA Inc., Atlanta, spoke at the Reuters Real Estate Summit in New York. Beazer is specializing in building solar homes. In a Sacramento, Calif., project, the company teamed up with a local utility to install panels that generate electricity during the day and send extra power back to the grid, balancing out the energy that residents used in the evening and at night.

"What we're trying to do is produce zero-energy homes," McCarthy says.

Other builders listening to the Beazer presentation agreed with McCarthy’s conclusion that most home buyers aren’t ready to spend much money on energy-saving technology.

“Zilch,” says Robert Toll, CEO of luxury home builder, Toll Brothers Inc. “So far, I’ve gotten one call in the last year about solar panels. The buyer is not willing to trade granite for efficiency.”

Read more!

Friday, June 30, 2006

Buyers Choose Beauty Over Energy Efficiency

Thursday, June 29, 2006

The Weekend Guide! June 29 - July 2, 2006

The Weekend Guide for June 29 - July 2, 2006.

Full Article:

Read more!

First-timer schooled in all-cash real estate purchase

Inheritance may be best split in stocks, mortgage

By: Ilyce R. Glink: Inman News

Q: I recently moved to the Philadelphia area for a job. I'm currently reading your book, "100 Questions Every First Time Home Buyer Should Ask," and would like to look into purchasing my first townhome this summer.

Last year, I inherited a lump sum that is now invested in the stock market. Do you think that it would be a wise move to pay cash for the property and pay myself back the cash over time, or keep it invested and take out a mortgage?

I'm also thinking about working with a buyer broker in my area. Do you think that if I make a cash bid, or if my broker knows that I will be paying cash, that I will get squeezed for a higher price?

A: I'm glad you've taken the time to immerse yourself in knowledge and think through the possibilities before you buy your first home. So many people simply jump in and then find themselves underwater.

Let's start by looking at your finances. I'm impressed that you inherited a lump sum and within a year have invested it in the stock market. Clearly, that is long-term cash for you. Should you withdraw the cash now, there's a chance you might lose money if the value of your stocks has declined (although your current losses can be used to offset future gains on your federal income tax form). But if the value of the stocks you sell has increased, you will be subject to paying taxes on your gains.

Overall, paying for your first home entirely with cash is a very conservative financial move. Whether you choose to do it depends on how nervous you are about being able to make your payments each month and what kind of return you expect from the money you invested in the stock market.

If you have a good job and can make the payments on your mortgage, plus insurance and taxes, then I think you should use some of your inheritance to pay for part of the home. You could sell enough stock to put down 20 percent of the purchase price in cash, and get a mortgage for the rest. That will allow you to avoid paying private mortgage insurance.

Depending on your financial circumstances, you might benefit from the tax deductions available to you for the interest payments on the loan for the home and your real estate tax payments. Your accountant or tax preparer can help you work through the numbers.

Besides, long-term interest rates are still historically low, under 7 percent as of this writing. On the investment side, you can get a CD that pays more than 6 percent. The spread between what you're paying to borrow cash and what you can earn on your cash is shrinking. So there is less risk that you'll pay more for the cash you borrow on your mortgage than you can make in your investments.

Lock in now for a long-term fixed-rate mortgage (preferably 15 years, which will save you a ton of money in the long run, but if that's not affordable then do a 30-year) and buy a home you can stay in for the next five to seven years. That way you'll ride out any short-term shakeout in the marketplace.

When it comes to using agents, you know that I'm a big believer that all buyers should use them. But this advice applies particularly to first-time buyers.

First-time buyers often and wrongly assume that if they go it alone, they'll get a better deal. Unfortunately, the conventional real estate world doesn't work like that. If you go to see a home that's listed by an agent, the agent and seller have already come to terms on a listing agreement that spells out exactly how much commission will be paid - whether you have a buyer's agent in tow, or not.

If you're going to see homes that are for sale by owner, it's likely that these homes are mispriced to begin with - and not in your favor. Without an agent, you won't know if you're paying the right price, or getting fleeced on the purchase. Savvy FSBOs will usually agree to pay your agent at least a partial commission (2 percent to 2.5 percent or more), or there are other ways to wrap the buyer's agent fee into the deal.

As for paying cash or using a mortgage, he or she will be thrilled if you use cash because it eliminates one major issue - whether you qualify for financing. But as long as you're preapproved for a loan, I don't think it matters much to your agent.

He or she will want to know how much you can afford to spend, and will find homes in that price range. Just remember that you control the information you share. If you only want to pay $200,000 for a home, don't tell her you've been approved for a mortgage up to $300,000 - even if that's true.

Read more!

Wednesday, June 28, 2006

The boom is over, but what’s ahead is far more sustainable

Resist misty-eyed look back

BY: DAVID LEREAH: REALTOR® Magazine Online

Faced with the prospect of home sales cooling through the end of this year, it’s tempting to pine for the boom of the last five years, when we saw home sales volume and price appreciation jump 33 percent and 42 percent, respectively, over the period on a nationwide basis. But I would resist the temptation.

Along with all that was good about the last five years, the boom also ushered in an unhealthy rise in market speculation and reliance on exotic financing such as interest-only loans, two trends that helped accelerate price appreciation and thus the affordability problems we’re seeing even among middle-income households.

Make no mistake, a soft landing with cooling sales and easing appreciation this year will help settle the market in two ways. First, it’ll give household income a chance to gain ground lost to home prices. Second, it’ll drive safety-conscious buyers back into more stable fixed-rate financing products.

I’m forecasting for this year 6.62 million existing-home sales, down 6.7 percent from 7.1 million sales in 2005, and 5.7 percent appreciation, a much more sustainable rate than the spectacular 12.5 percent rate we saw in 2005.

These are strong numbers by any measure—the fourth best for existing-home sales on record. The numbers will get even better in 2007. Existing-home sales are forecast to rise to 6.7 million and appreciation to stabilize further at 4.2 percent.

Despite what you hear in some media reports, there’ll be no hard landing. Even in the areas seeing the most pronounced leveling of home sales, such as Los Angeles and Phoenix, new jobs and economic growth remain strong. That vibrancy combined with continuing favorable trends in demographics and interest rates, among other things, will sustain solid housing demand. And we’re continuing to see a pick-up in demand in many markets, such as Dallas and St. Louis, which didn’t see strong growth during the boom.

So, I would resist getting misty-eyed over the passing of the boom. Although some dark clouds like rising oil prices and an unexpected interest rate hike could bring a chill, a cool breeze is just what we need now to ensure a temperate tomorrow.

Lereah is senior vice president and chief economist for the NATIONAL ASSOCIATION OF REALTORS®.

Who’s your perfect second-home buyer?

A married baby boomer couple with a household income of around $100,000 and no children living at home.

Business Confidence

Cooling unabated Sales are expected to keep cooling in the coming months as buyer traffic continues to slow. Seller traffic is expected to pick up in the months ahead, which would help grow inventories and hold down prices, enhancing affordability. Practitioner confidence was surveyed in April and looks ahead six months.

Results are based on 415 responses to 3,000 surveys sent to large and small real estate offices. The survey asks practitioners to indicate whether conditions are strong (100 points), moderate (50), or weak (0). Responses are averaged to derive results.

Home Sales

Softening to continue Sales of existing homes eased in April, continuing a long-anticipated softening trend that NAR’s leading home sale indicator suggests won’t abate in the next month. Total existing-home sales, which include single-family houses, townhomes, condominiums, and co-ops, eased in April by 2 percent to a seasonally adjusted annual rate of 6.76 million units from a pace of 6.9 million* in March. Meanwhile, the April pending home sale index dipped 3.7 percent to 111.8 from 116.1 in March.

*Revised downwardly from a figure reported in the June issue.

**Seasonally adjusted annual rate, which is the actual rate of sales for the month, multiplied by 12 and adjusted for seasonal sales differences.

Read more!

Tuesday, June 27, 2006

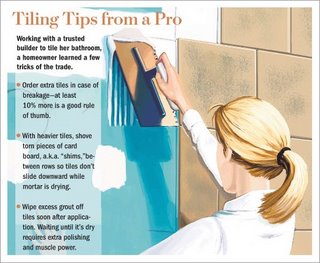

Hiring a Contractor to Tutor You On Tricky Do-It-Yourself Projects

Deciding whether to take on a challenging job or call in a professional is a dilemma for passionate homeowners. But there is a little-known third option: Call in a pro and work together.

By: Gwendolyn Bounds: From The Wall Street Journal Online

For nearly a year, my guest bathroom languished in home-improvement purgatory. I had laid new wood flooring and ripped out the 1970s flowered tiles, no problem. But putting in the new tiles - that had me procrastinating.

I'd splurged on some pricey and fragile natural stone and glass mosaic tiles, and I was reluctant to touch them. Crack a $2 ceramic tile and it's no big deal. Not so with the iridescent green glass mosaics I'd bought for $32 a square foot for my tub face and backsplash.

It's a dilemma every passionate do-it-yourselfer can face when confronted with a challenging project: whether to jump in and risk messing it up or to bow out and call in a professional. But there's a little-known third option: Call in a pro and work with him or her to get the job done.

Increasingly, some experts are willing to consider letting you apprentice with them in your own home. For the professional, it's a paying job with a free - though potentially clumsy - assistant. For the homeowner, it's a chance to make sure a critical project is done correctly and learn the skills you need to do it yourself in the future.

As homeowners drop some $155 billion annually on renovations, and the fix-up industry pushes us to tackle ever-tougher tasks, we can turn to books and videos and in-store classes at retailers. But sometimes there's no substitute for hands-on experience. So for my languishing bathroom project, I broke down and hired a pro. For a week, I apprenticed myself to a local builder and worked alongside him in my own bathroom.

Such collaboration can take many forms: Tim Carter, who runs the Web site www.askthebuilder.com, extols sweat equity. He says homeowners can pick up new skills while being useful - and even saving money - if they do the dirty work, such as moving materials around a job site, demolition and cleaning up. "Even the laborer doesn't want to do that," he says.

Beyond that, you can participate in almost every part of the job, as I did, if your expert is open-minded. At day's end, it's like having your cake and eating it too: You can boast about "doing it" and still get a professional's touch.

Some pros are reluctant to take on proteges because of liability issues. Attorney Scott Gurney with Frost Brown Todd's Construction Practice Group in Cincinnati cautions that both parties should check insurance policies to be sure that injuries or damage are covered if a homeowner is helping out, and look at warranties on materials that might be invalidated if not installed by pros. What's more, you need to be free to work contractors' hours and not hold up progress to answer emails or pick up the kids. "The contractor's main concern is that he's not slowed down," Mr. Gurney says.

Nevertheless, working in tandem is gaining favor. In its March issue, This Old House magazine touted "partnering with a contractor" as a way to save on remodeling. "I think there are a lot of projects where this could work," says Tom Silva, general contractor for the magazine and "This Old House" TV shows. "We'll probably see more of this in the future," agrees Chicago remodeling pro Ted Welch. "I'd probably add two or three days to the time span and charge accordingly."

For my first apprenticeship, I called up Bobby Dodge, a builder in Garrison, N.Y., who'd done renovations for me. I trusted his skills and honesty; he knew he could trust me to pay fairly. Since I'd already purchased materials, Mr. Dodge charged just for his time ($45 an hour) and that of his assistant, Henry Casholle ($35 an hour). If I held things up, it was on my dime - but if I helped, I might save a few bucks.

On the first day at work, I learned I hadn't put enough screws into the cement backer board in my shower area to safely hold the weight of my heavy 12-by-12 marble tiles. What's more, my screws weren't all flush in the wall, which might affect how flat the tiles sat. I wouldn't have noticed the gaffes.

Then came the measuring. I wanted my marble tiles staggered, but didn't want lots of small pieces around the edges. Calculating where to lay the first tile while allowing for the 1/8th-inch grout lines fell to Mr. Dodge. I sat beside him on the tub edge while he explained his system, and his reckoning ended up perfect.

I finally got my hands dirty when we cranked up the wet saw, which uses a diamond blade cooled by water to cut tiles. After Mr. Dodge showed me how to hold the marble so it wouldn't crack, I slowly pushed a piece into the blade, tensing slightly at the high-pitched whine. Then I carried my piece to Mr. Casholle, who was waiting with the "thinset" mortar that would attach the tiles to the wall.

I thought slapping on mortar would be a no-brainer. Wrong. Spreading the mixture smoothly with a trowel without leaving gaps or dropping globs on the floor takes practice. Mr. Casholle patiently gave tips. He also taught me cool lingo - terms like "butter her up" (apply extra mortar on the back of a tile) and "cut it four and a quarter light" (a sliver smaller than 4¼ inches). After one pass, I returned with a tile for Mr. Casholle and proudly pronounced I'd trimmed it "just a blade" like he asked. "Perfect," he said, pressing it to the wall.

Sometimes, I felt surprisingly helpful. The men's hands were too big to install the tiny one-inch glass mosaics in tight spots, so they enlisted me. Every night, I cleaned up. I also did the final polishing.

I definitely got the hang of tiling, but the fellows saved me in many ways. Turns out, one wall bowed outward. That required more calculations from Mr. Dodge to avoid unsightly grout lines. And when the marble tiles kept breaking, he devised strategies to milk scraps so we'd have enough to finish the job.

Ultimately my labor saved me about $200, according to Mr. Dodge, who wrote me a report card on my final bill: "The homeowner assisted in each aspect of the project, providing the materials, cutting tile, applying cement, installing tile, grouting and clean-up."

The best part: My bathroom is done.

Read more!

Monday, June 26, 2006

Caught in Downtown’s Conversion Crossfire

As residential hotels begin to disappear in loft conversions, the L.A. City Council enacted a moratorium. But property owners are now seeking exemptions.

By: HOWARD FINE: Los Angeles Business Journal Online

Steven Tsegay is on the front lines as economic forces transform downtown Los Angeles from a haunt of the down-and-out into what could become a bustling residential district.

Arriving in L.A. six months ago from Washington, D.C., without a job and a spotty credit history, the 47-year-old Tsegay managed to find a room at the Cecil Hotel, a 640-room lodging in the heart of downtown.

But as residential hotels throughout downtown begin to disappear as they are converted into lofts, Tsegay feared the Cecil would be next, until the Los Angeles City Council enacted a moratorium on the conversions.

A month later, Tsegay’s fears have returned.

The owners of the Cecil Hotel, along with the owner of the nearby Frontier Hotel, are trying to get their buildings exempted from the Council moratorium.

“I’m absolutely concerned that if they get out of this ordinance, I will be forced out onto the street,” said Tsegay, who pays a weekly rate that works out to be about $740 a month.

With high price condo construction and loft conversions exploding in the area, Cecil Hotel owners John Deluca and Dale Lohrer are claiming that the majority of the occupants of the hotel, which was renovated in 2003, are tourists and not permanent residents.

That claim, if it is upheld by the city’s Housing Department, would exempt the hotel from the moratorium and allow the two owners to push forward with a remake of the 1920’s-era hotel while the weakening housing market and interest rates are still favorable enough to justify construction.

And while the area’s business district, the Central City Association, has not taken any stand on the owners’ application for an exemption, there is clear opposition to the moratorium from developers, hotel owners and the Central City Association, who fear that it could cripple the revitalization of the area.

“We have no problem with a truly interim ordinance that gives everyone a bit of breathing room to craft a more comprehensive policy,” said Victor Franco, senior vice president of government affairs for the Central City Association. “But nearly every (interim ordinance) that’s been implemented throughout the city has become a de-facto permanent ban on future development.”

Deluca could not be reached for comment, and calls to Lohrer were not returned.

Tourist or resident?

The conversions have alarmed the non-profit organizations that cater to the needs of lower-income people living in residential hotels, also called single room occupancy, or SRO, hotels. These include groups like the Los Angeles Community Action Network, the Legal Aid Foundation of Los Angeles, the SRO Housing Corp. and the Southern California Association of Non-Profit Housing.

However, the Cecil Hotel, which was renovated a few years ago, is hardly a standard SRO. Residential hotels are usually run down and are just hotels in name only. Instead, the 640 S. Main St. hotel has an elegantly restored lobby, a reservations desk and is advertised on Web sites aimed at budget travelers.

But Tsegay and affordable housing advocates say the overwhelming majority of occupants are people who have made the hotel their primary residence. “No one here’s a tourist. There are people who have lived here for years,” Tsegay said.

Meanwhile, Frontier Hotel owner Rob Frontiera has sought to renew permits he originally obtained in 2002 to convert the entire hotel to residential lofts. Over the last couple years, the top two floors of the 12-story building have been converted to lofts, complete with a separate entrance. But the permits expired before work on the remaining floors could begin.

In May, the Department of Building and Safety granted the permit renewals. But after protests from the Legal Aid Foundation of Los Angeles, the department revoked the permits in mid-June, saying Frontiera needed additional approval from the Community Redevelopment Agency.

Calls placed to attorneys who have represented Frontiera were not returned.

However, Franco points to recent guidelines for residential hotels put forth by the Community Redevelopment Agency. Under the guidelines, the CRA will only approve projects that replace the affordable housing units in residential hotels on a one-to-one basis and provide relocation assistance to all displaced tenants. In addition, any new use must be primarily affordable housing and remain that way for at least 55 years.

“If you require that residential hotels remain that way for 55 years, you are essentially keeping blighted areas blighted,” Franco said. “Why would any investor want to fund a project in which a building must remain affordable housing for decades, regardless of the market conditions?”

Growing concerns

Housing advocates say that the lower income residents who have long populated downtown are being lost in the shuffle as the area becomes more and more attractive to high-income professionals who may pay more than $500,000 for a loft.

Over the past five years, nearly 1,000 residential hotel rooms have disappeared throughout the city, the vast majority of those in the downtown market. Many of the occupants who could not find space in other residential hotels have ended up homeless, affordable housing advocates say. That is why they pushed for a moratorium and persuaded Councilwoman Jan Perry to introduce an interim control ordinance last year.

“We need to enforce this interim control ordinance,” said Becky Dennison, co-director of the Los Angeles Community Action Network.

They also point out the city is offering economic incentives for the hotel owners to renovate their building into affordable housing, noting the CRA approved $47 million in bonds and direct financial assistance for the Alexandria Hotel, at 501 South Spring St. also in downtown.

Similar subsidies for other residential hotels could help, especially if voters approve a $1 billion housing bond that appears likely to be placed on this November’s ballot.

In the meantime, affordable housing advocates are concerned with another issue: a continuing stream of reports from several residential hotels of the practice of forcing people out before they reach the 30-day threshold that qualifies them as tenants. This long-running practice, commonly referred to as the “28-day shuffle,” is illegal under the city’s rent stabilization ordinance.

City Attorney Rocky Delgadillo has filed suit against Frontiera and his hotel, alleging he is using this 28-day shuffle to deny paying relocation benefits to people evicted to make way for the loft conversions.

Perry said she hopes Delgadillo’s lawsuit will deter other hotel owners from using the 28-day shuffle.

But Perry said she regarded the attempts by the Cecil and Frontier hotels to exempt themselves from the moratorium as isolated instances, and was not concerned at this stage that other residential hotel owners would follow suit.

Read more!

REITs Remain a Bright Spot in Cooling Market

Real estate mutual funds, which invest mainly in REITS, have climbed an average 139 percent, compared with 21 percent for the average stock fund.

By: John Waggoner: REALTOR® Magazine Online

Is it too late to invest in real estate investment trusts?

REITs have done spectacularly in the past five years. Real estate mutual funds, which invest mainly in REITS, have climbed an average 139 percent, compared with 21 percent for the average stock fund and 10 percent for the Standard & Poor’s 500 Stock Index.

If you’re hoping for that kind of performance during the next five years, you’re likely to be disappointed, says Samuel Lieber, manager of the Alpine U.S. Real Estate fund.

REITs, which invest in commercial real estate, generally pay excellent dividends — in part because they are required by law to pass along to their investors nearly all their income, after expenses. Dividends combined with even modest price appreciation should mean a 7 percent to 8 percent annual return — at minimum.

Can things go wrong? Of course. High borrowing costs and soaring yields on Treasuries can slow growth in the commercial real estate market and put a crimp in REIT returns, Lieber notes.

Read more!

Sunday, June 25, 2006

Solar Energy Emergency

The public is becoming aware that coal burning plower plants are the single largest cause of global warming. That coupled with rising energy costs are pushing solar energy to the forefront of homebuyers minds.

By: Carla L. Davis: Realty Times

Solar energy has been making big waves over the last few years. As energy costs rise and consumer awareness heightens over environmental issues, many homeowners are making alternative energy choices - from buying hybrid cars to installing home wind generators.

It has become almost common knowledge that the number one cause of global warming is coal burning power plants - producing 2.5 billion tons of carbon dioxide poisoning every year. Those plants are what make our electricity. That is a considerably larger amount than automobiles produce - at 1.5 billion tons.

And if you're a resident of the United States, you have even more to be responsible for. While our population is 4 percent of the total world population, we emit 25 percent of the pollution from fossil-fuels.

But Americans are ready to change.

A recent Roper survey has found that "eighty percent of survey respondents would like solar systems available on new home construction; a strong majority of Americans believe solar power is more important than ever."

The study also found that: • 79 percent feel that homebuilders should offer solar power as an option for

While many let initial sticker shock deter them from seriously considering solar energy, this could be a serious long-term mistake - financially and environmentally. With the added government incentives (paying percentages of equipment and installation fees, varying by state) and with the monthly savings over the next 10, 20, or 30 years over conventional electricity methods, solar is a win-win.

all new homes.

• 84 percent of Americans ages 25-49 supported solar on new homes; 69 percent of

those over 65 years agree.

• Those living in the South and West are more likely to favor solar on new homes

(83 percent) than those living in the Midwest or Northeast (74 percent).

• After being told that solar homes have a proven higher resale value, 64

percent would be willing to pay more for home with a solar system.

• 73 percent believe that solar energy technology is more important today than

ever.

• 42 percent say that saving money on monthly utility bills is the most

compelling argument for installing solar power. Other respondents indicated it

was to decrease the nation's dependence on oil (31 percent) or reduce

environmental pollution (18 percent).

With recent studies and congressmen urging action, some states have already stepped up.

It was just six months ago that California legislature approved the $3.2 billion "California Solar Initiative," - a 10-year plan that will provide many Californians (residential and business) with rooftop solar panels all across the state.

And MSNBC reports that "last year, the Texas Legislature updated the state's renewable energy portfolio to require 5 percent - or 5,880 megawatts - of electricity to be generated by alternate sources by 2015."

But the United States is entering late in the game. Japan and many other countries have been pushing the need for solar power for years - and seeing an amazing response.

So what action are you going to take?

Some Americans are pledging to see the new film, "An Inconvenient Truth," being actively pushed by former Vice President Al Gore, in order to better educate themselves on the issues at hand.

Another option - for those guilty of having gas guzzling cars - is to consider the Terra PassTM. You can calculate an estimate of how much carbon dioxide you car emits. For most, "each year, the average car emits about 10,000 lbs (three times its weight!) in carbon dioxide pollution."

Then you buy a "Terrapass" and the company "funds clean energy projects that reduce industrial carbon dioxide emissions."

But in the end, you must raise awareness in your own area and take the necessary steps. And in the end, you might be breathing easier - with lower energy costs, reduced global warming, and a home that is worth more to potential buyers.

Read more!

Saturday, June 24, 2006

Condotels catch on fast - maybe too fast

Thousands of units under way in major real estate markets

By: Glenn Roberts Jr.: Inman News

Charlotte Chipps, an Ohio schoolteacher, bought a condominium-hotel unit last year in Daytona Beach, Fla. A developer had bought up a couple of hotels in the area and converted the buildings into condotels - which allow buyers to purchase individual units and gives them the option to enroll in a rental program that opens their units to hotel guests for a share of the rental income.

"It was sort of a whim," she said. "I do own a house in the Daytona area that I rent. I had just that little bit of experience. I'm not a person with any money. I just thought that this would perhaps be an investment for me. If values continued to go up, I would keep it for two or three years and make $20,000 or $30,000."

Meanwhile, at the southern end of the state, a swarm of new luxury high-rise condotel projects are in the works. The surge of condotel developments has hit other coastal markets too, and there are several high-end projects under development in downtown Las Vegas.

Condotels run the gamut from aging, low-rise hotel conversions to ultra-luxury, new high-rise towers backed by big-name developers and hotel chains. The condotel movement even has its own association, formed this year: the National Association of Condo Hotel Owners, or NACHO.

Condotels are not just a flash in the pan, says Dante Alexander, president and CEO for the condotel association, though they aren't typically a cash cow for owners, either - and buyers should be aware of all of the costs and complexities associated with these properties.

"People like to refer to it as a trend," said Alexander, who formerly worked for Starwood Hotels & Resorts Worldwide Inc. "Now, admittedly, it's a segment. But it is really going to be much more than a segment." Condotels, he said, will represent "a significant quotient of hotel real estate in the country," and they are already making waves in some international markets.

There is a risk of over-building in some popular condotel markets, and lenders have heightened requirements for projects, though Alexander said he expects a cooling-off period and a shift by condotel developers to broaden the range of prices and locations for the projects to appeal to a larger pool of buyers.

"Everybody is pulling back a little and appropriately so. There is a little bit of oversupply going on. It shouldn't be a frenzied environment, and it has been a frenzied environment," he said.

While attending a real estate conference, Alexander said another attendee asked, "What if (the condotel market) implodes?" Alexander's response: "What if it doesn't?" Based on the demographic trends of baby boomers and their children, Alexander said he expects that in the next couple of years "we're going to wish we had more" condotels.

He advises prospective buyers to purchase a condotel unit because they plan to use it, not because they plan to quickly flip it and make a quick buck. A common misconception is that the rental profits of a condotel unit will generate profits for the owner. But with insurance and maintenance and mortgage costs, owners shouldn't expect to earn any money in the short term, Alexander said. "It's an expense. It's going to be like owning any other piece of property."

Jack McCabe, CEO for McCabe Research & Consulting LLC, in Deerfield Beach, Fla., said, "We're seeing a proliferation of condotels here in South Florida. The jury's still out as far as how good they are as investments. Most all of the buyers so far have been somewhat disappointed by the rental revenue that is generated. Usually it's considerably less than they thought when they purchased the unit. As long as they're looking at it as a vacation residence that may have the potential for appreciation and cash flow then it may be a very good buy for them. They should look at it on a more long-term basis."

The appeal of condotels is that owners and guests can enjoy typical hotel services, McCabe said. "They like having new, fresh sheets every night, the bed turned down and a chocolate on the pillow," he said. "They have become accustomed to a higher level of service than a condominium offers."

In the Fort Lauderdale area, a string of eight new luxury condotel projects are under way in a two-mile stretch of beach, McCabe said. The condotels are backed by such major industry players as St. Regis, W and Trump. "Most of these condo hotels are generally in excellent locations. In most cases their architecture is fairly unique, they are generally done by upper-crust developers ... and they provide a level of additional services not found in traditional condos," he said.

Unit prices can range from $1,200 per square foot to $1,450 per square foot, which is pricier than the $850 to $1,050 per square foot for traditional condos in the area, he said.

Owners who choose to enroll their units in a rental program typically are required to purchase additional insurance coverage and to comply with the hotel operator's room decor requirements. Also, these owners typically are not allowed to store any personal property in the units. "There are definitely restrictions on usage, on decorating and on storage," McCabe said.

Condotel units tend to be smaller than comparably priced condo units and have scaled-down kitchens, though larger units are available at the top end of the market. Alexander said that condotel units tend to have a 15 percent to 40 percent markup over traditional condo units, depending on the range of services and amenities and the hotel brand.

While condotels have been around for decades, the latest boom took off about three years ago in Miami, Alexander said. There are about 28,300 condotel units under development in Las Vegas, 11,600 units in the Miami-Fort Lauderdale area, 6,900 units in Orlando, and about 3,200 units in Tampa-St. Petersburg. Other popular U.S. markets for condotel projects include New York, Chicago, Myrtle Beach (South Carolina), Boston and San Diego, he said.

Alexander expects the large supply of condotel units slated for Las Vegas to be absorbed faster than they would in some other hotel-heavy markets, such as Orlando.

Robin Charles Glass, a real estate agent for Coldwell Banker Pacific Properties in Honolulu, said the resale market for condotels in Hawaii has been healthy -- some sellers have realized a profit of about 20 percent or 30 percent, he said. Some lenders have been more reluctant to offer loans for condotel units, in some cases requiring a down payment of 50 percent, though Glass said there are lenders who are willing to offer 80 percent financing for condotel-unit purchasers.

"Generally these units don't generate cash flow (for owners)," Glass said. It's important for buyers to study how well a condotel building is maintained, he also noted. "When it's a brand-new project things look all shiny and new. In a couple of months you can determine how well a building is maintained."

Resale activity lately has been slow for condotel units in Hawaii. "Seldom do I ever see someone selling these things these days."

Charlotte Chipps, the Ohio schoolteacher who bought a condotel unit in Daytona Beach, Fla., said that the Daytona area real estate market has slowed to a crawl since she bought her unit, and she may hold onto it longer than she expected. "Unfortunately I paid top dollar. I bought it last year when prices had gone up. The whole Florida market has sort of stalled now. It is something that I will probably try to hold onto for my grandchildren."

Instead of enrolling her unit in the hotel program offered through the building, which gives back about 45 percent of the room rental proceeds to unit owners, Chipps makes her own arrangements for room cleaning and rents her unit directly to guests. The rental rates are low in the area - it's not uncommon for hotels to rent for $40 a night - and Chipps tends to seek higher rental rates during busy seasons.

It has not been a cakewalk for owners of condotel units in the same building. Chipps said that owners have engaged in a legal battle with the developer, who controls some commercial and common areas of the property.

But she is hopeful that the investment will pay off in the long run. "As Daytona continues to grow that property is going to continue to be more valuable. Change is coming."

Read more!

Friday, June 23, 2006

USC experts predict 'soft landing' in real estate

Real estate prices won't decline substantially

By: Glenn Roberts Jr.: Inman News

Unless there are substantial job losses, the real estate market appears on track for a soft landing, said economists for University of Southern California's Lusk Center for Real Estate.

"We don't believe the housing market is going to fall off a cliff. We don't really subscribe to the hard-landing story," said Stuart Gabriel, Lusk Center director, during a presentation Thursday at the annual PCBC event, a conference for home builders held at San Francisco's Moscone Center.

This is, however, a time of "stagflation," or economic stagnation coupled with inflation, Gabriel said, and the real estate market is losing steam - with a general slowing in price-appreciation and sales.

Higher interest rates and energy costs, and reduced refinancing activity are also taking a toll on consumer spending, which has sunk from about 3.9 percent in 2004 to a current level of about 3 percent.

Despite this, Gabriel said it's unlikely that there will be a major shrinkage in house prices, given the strength of employment numbers. Interest rates, though marching up, are not high by historic standards, he said.

The situation was a lot different in the early 1990s, when job losses contributed to a major downturn in the real estate market. Gabriel said that the impact of job losses in the aerospace sector hit Southern California's real estate market hard during that period.

"Barring that sort of event we don't expect significant falloff in house prices," he said.

Likewise, job losses in the construction and real estate-related industries during this slowing period should not cripple the housing industry, said Raphael Bostic, director of the Master of Real Estate Development program at USC and a Lusk Center expert.

Gabriel's forecast calls for the economy to slow to a 3 percent to 3.5 rate of real gross domestic product growth for the remainder of the year after a rate of about 5 percent in the first quarter.

Delores Conway, director of USC's Casden Real Estate Economics Forecast who also participated in the presentation, said that in California, rising home prices appear to be driving more housing activity to central areas.

"The population is shifting in California more toward the center of the state, where we tend to have more affordable housing," she said.

Some major markets in the state, such as Los Angeles, are still seeing high levels of price appreciation, though sales activity is down from a peak. "The number of sales has declined very significantly in all the cities," she said.

The apartment market, meanwhile, has rebounded in some areas as shrinking housing affordability has diminished the pool of potential home buyers.

"People are in some sense being priced out of the market," she said, while there are year-to-year rental increases of 7 percent to 10 percent in some Southern California markets.

USC economists noted that condo markets - particularly in formerly frenzied areas such as San Diego and Las Vegas - might be the most vulnerable to changing market conditions.

Conway said that some proposed condo projects will actually be built out as apartments because unit sales fell short of expectations. "This is particularly true in San Diego, which has been a bit of a bellwether and a bit of a leading indicator for the rest of the cities," she said.

There is no evidence of price declines in any California markets at this point, though, "If we do see price declines, where we would probably look for them first is in the condo markets," Conway said.

Bostic said, "I've been concerned about downtown San Diego for a long time, particularly in the condo market." He also said the luxury real estate market may feel the weight of the housing slowdown more than the general market.

But he said he is generally bullish on the housing sector, and he noted that the Lusk Center is not predicting a recession.

"I don't think price declines are likely at all, absent significant job loss," he said.

As available land dwindles and housing affordability worsens in California, Gabriel said he expects that buyers will increasingly gravitate toward multi-family dwellings.

Regulators have turned their attention to the popularity of unconventional home loan products and the risk that such products could pose, though the Lusk Center experts said they expect the use of such products will not have a substantial negative effect on the housing market.

Read more!

Wake Up Buyers - Deals Abound

It's not a buyers market officially in a lot of areas, but it's now starting to favor buyers after years of transactions where buyers had to escalate prices by the tens of thousands and nix home inspections, appraisals and the like.

By: M. Anthony Carr: Realty Times

Thus, my advice to buyers - get out there and catch a deal while you can.

All the indicators keep pointing to a healthy, vibrant real estate market in most cities around the country. Slowing down, doesn't mean dead, it just means, well, slowing down.

In the last five years, several markets have created an astounding amount of job growth, which is the first indicator and supporter of a robust real estate market. Washington and its Virginia/Maryland suburbs lead the way in the six markets that created more than 100,000 jobs in five years: Washington DC: 369,000

Economic forecasters predict that in the next four years, the Washington, D.C. area will create 40 percent more jobs over that period than were created in the last four years. With that kind of growth, why the slow down in the market? It's for a multiple reasons:

Miami: 253,000

Phoenix: 221,000

New York: 157,000

Los Angeles: 155,000

Houston: 118,000 1. Rentals are cheaper than owning. In the markets above, appreciation upwards

The challenge for home sellers and buyers is that economic forecasts many times are driven by the "feelings" of people and investors, rather than reality.

to 50 percent priced or shocked some buyers out of the market. Thus they

turned to renting instead, hoping to wait for the market to slow down or slip

back.

"The rental market is very good right now," says Leonard Wood, an apartment

and condo builder from Atlanta and chairman of the National Association of

Home Builder's Multifamily Leadership Board. In an e-newsletter from NAHB,

Mr. Wood said, "Over the past three years, there have been thousands of

rental units converted and sold as condos and, at the same time, few new

rental apartments were being built. This leaves us with a supply-constrained

market while demand is growing."

2. Rising mortgage interest rates. Part of the economic cool is orchestrated by

the Federal Reserve's moves upward on interest rates. A growing economy can

turn into an inflationary economy - which damages buying power for homeowners

and consumers of all products alike. Thus interest rates are raised to slow

down the economy. As interest rates move up, buyers are edged out of the

market.

3. Consumer confidence. A recent Associated Press report pointed out that

consumers are up and down on the economy. "Consumer confidence, which reached

a four-year high in April, lost ground in May," AP quoted Lynn Franco,

director of the New York-based Conference Board Consumer Research

Center. "Apprehension about the short-term outlook for the economy, the labor

market and consumers' earning potential has driven the Expectations Index

down to levels not seen since the aftermath of the hurricanes last

summer."

Here are the facts: Jobs "grew" last month. The Expectations Index was the second highest ever. Interest rates are still historically the lowest they've ever been. We are nearly at full employment. Fear, many times, drives a market, rather than reality. As a homebuyer looking for a house to live in or as an investment - look to the facts.

When a market levels or cools - this is when the smart consumer can really get his or her money's worth. How would you like to buy a house at a 5 or 10 percent discount? It's happening now in markets around the country. Sellers are still mopping up from years of equity growth, but they have to move now and are willing to negotiate downward on their asking prices.

(Sorry sellers, you're not going to like this next paragraph.) Buyers - name your price. If the asking price is $500,000 - start at $20,000 or $30,000 below. Start somewhere and get the ball rolling. Then start your list of add ons: home inspection, home warranty, closing costs (some loan programs allow up to 6 percent), and more. Don't be bashful.

My word to the sellers - don't be offended. If your house has been sitting on the market for 60, 90 or 120 days - consider that any offer is a good offer. Let the negotiations begin.

Read more!

Thursday, June 22, 2006

The Weekend Guide! June 22 - June 25, 2006

The Weekend Guide for June 22 - June 25, 2006.

Full Article:

Read more!

Overdue FHA Reforms Would Help Affordability

FHA's loan limits, down payment requirement, and fee structure haven't kept pace with the mortgage marketplace, says NAR President Thomas M. Stevens.

NAR: REALTOR® Magazine Online

Long overdue reform of the Federal Housing Administration’s single-family mortgage insurance program will provide home buyers an affordable alternative to higher cost loans and help bridge the gap in minority home ownership, Thomas M. Stevens, president of the NATIONAL ASSOCIATION OF REALTORS®, told the Senate Housing and Transportation Subcommittee today.

“FHA’s market share has dwindled because its loan limits, down payment requirement, and fee structure have not kept pace with the current mortgage marketplace,” Stevens says.

As a result, a growing number of home buyers are deciding to use one of several new types of specialty mortgages, and FHA has become a lender of last resort, according to NAR.

FHA loans account for only 3 percent of the overall mortgage market, compared to about 12 percent in the 1990s.

“REALTORS® see first-hand how the decline in FHA mortgages has had a significant impact on America’s home buyers,” said Stevens. “REALTORS® know that for housing to remain affordable, reforms are needed to make FHA a viable mortgage product for today’s home buyers.”

On Monday, June 19, Senator Jim Talent (R-Mo.), joined by Senators Johnny Isaakson (R-Ga.), Saxby Chambliss (R-Ga.) and Mel Martinez (R-Fla.) introduced the Expanding American Homeownership Act (S. 3535), which encompasses the reforms recommended by FHA and advocated by NAR.

The Expanding American Homeownership Act includes: increasing loan limits, eliminating the statutory 3 percent minimum cash investment and downpayment calculation, allowing for extended loan terms from 30 to 40 years, allowing FHA flexibility to provide risk-based pricing, moving the condo program into the 203(b) fund, and lifting the current owner-occupied requirement to qualify condominium units for FHA-insured mortgages.

“First-time home buyers, minorities, and home buyers with less than perfect credit will continue to see fewer and fewer safe, affordable mortgage options, if the recommended reforms are not made to the FHA program,” Stevens says.

According to Moody’s Investors Service, a leading provider of independent credit ratings, more than a quarter of all existing mortgages come up for interest rate increases in 2006 and 2007 when the term rate expires.

While some home owners may be prepared to make the new higher payments, NAR is fearful that many will find it difficult, if not impossible.

A study by the Center for Responsible Lending reported that minorities are 30 percent more likely to receive a higher priced loan than white borrowers, even after accounting for risk. A study by the National Community Reinvestment Coalition found similar results.

“Approving these reforms will go a long way to boost our nation’s homeownership rate, particularly among minority home buyers who have lower rates than the national average,” says Stevens. The minority homeownership rate stands at around 50 percent, compared with nearly 70 percent for the nation as a whole.

“REALTORS® care about the lack of housing opportunities and know that revitalizing the FHA mortgage insurance program could once again promote homeownership to all sectors of the real estate market,” Stevens says.

NAR is committed to working with Congress and the administration to craft legislation that furthers the mission of the FHA single-family mortgage insurance program and makes home ownership possible for millions more families in the years to come.

The FHA program has helped nearly 33 million families achieve home ownership since 1934.

NAR also has a lead role in forming a new coalition whose mission is to advance overdue reforms for FHA in Congress. The Coalition for a Strong FHA is composed of housing industry leaders including the National Association of Home Builders, National Council of State Housing Agencies, National Association of Independent Mortgage Bankers/Lenders One, National Association of Hispanic Real Estate Professionals, National Association of Real Estate Brokers, National Association of Local Housing Finance Agencies, Asian Real Estate Association of America, and the Strategic Alliance for Mortgage Subsidiaries.

Read more!

Wednesday, June 21, 2006

Housing Market to Slow Economy

The UCLA Anderson Forecast predicts a slowing housing market will lead to lower economic growth in California but not an all-out recession.

By: HOWARD FINE: Los Angeles Business Journal Online

California’s economy is headed for a “soft landing” as the slowing housing market puts the brakes on economic growth, according to the quarterly UCLA Anderson Forecast to be released this morning.

But, the forecast says there is little chance of a full-blown recession like the region experienced in the 1990s. A stabilized manufacturing sector and continued growth in other sectors like professional and business services should offset drops in real estate-related employment.

The forecast calls for housing prices to flatten over the next year as rising interest rates take hold and for payroll employment growth to slow to about 1 percent in 2007 from 1.8 percent in both 2005 and 2006.

“The real estate slowdown will lead to a flat housing market and a slower economy. We do not predict a recession, nor do we predict a substantial decline in average nominal home prices,” the forecast states. “There is not enough vulnerability in the usual sources of employment loss to create a recession and the historical record suggests that average home prices do not usually fall without this kind of job loss.”

The forecast does predict some pain over the next year, especially in real estate-related industries like finance and construction. Construction employment, for example, is projected to fall 3 percent in 2007, a sharp contrast to employment growth rates topping 6 percent in both 2004 and 2005.

And there are some wild cards in the forecast, including manufacturing employment. “If we do see another round of job loss in manufacturing, all bets are off,” the Anderson forecast says.

Another uncertainty is impact on consumers if they find themselves upside-down financially from exotic mortgage loans or squeezed by continued high energy costs.

Read more!

What'll Catch Consumers' Eye? Outdoor Living Space

The home features that showed the sharpest increase in popularity are those related to the outdoors, such as patios, decks, and outdoor kitchens.

By: Camille McLaughlin: REALTOR® Magazine Online

Although the overall size of homes continues to level off after decades of expansion, consumer interest in property enhancement, particularly outside the home, showed a sharp increase, according to architects surveyed in the First Quarter 2006 Home Design Trends survey conducted by the American Institute of Architects.

Informal, open designs and accessibility also remain top priorities.

Seventeen percent of architects surveyed said home sizes are declining, 51 percent said they're holding steady, and 32 percent report home sizes are increasing.

The home features that showed the sharpest increase in popularity are those related to the outdoors. The number of architects reporting increased demand for outdoor living spaces, such as patios, decks, and outdoor kitchens, jumped to 64 percent from 47 percent a year ago. Also ranking high were amenities such as pools, tennis courts, and gazebos.

Similar outdoor living features also ranked high in a recent Coldwell Banker Previews study of affluent home owners. Although, 67 percent of owners reported having upscale landscaping, including formal plantings and gardens, an additional 23 percent said they were either considering upscale landscaping or were already committed to making the improvements.

The architects also report that consumers are gravitating toward single-story homes. “Almost 40 percent of residential architects see this as a trend, up from just less than 30 percent a year ago. An open space floor plan also continues to be a popular option in homes," notes Kermit Baker, AIA’s chief economist.

“The need for ease of mobility within the home, as evidenced by wider hallways and fewer steps, is necessary in the design or renovation of houses that will be used by baby boomers entering their retirement years,” says Baker. “On the other hand, younger home owners who grew up with structured, formal living rooms are far more apt to want an open layout with less rigid boundaries.”

Read more!

Tuesday, June 20, 2006

Has Green Hit a Tipping Point?

Green home building isn't a fad, but a trend, and one that's increasing at a rapid rate.

By: Camilla McLaughlin: REALTOR® Magazine Online

More builders are getting onto the green bandwagon, even though consumers are still hesitant to join the parade.

The number of home builders producing environmentally responsible homes increased by 20 percent in 2005, according to a McGraw-Hill Construction/National Association of Home Builders survey. In 2006, the study forecasts, that number will grow by another 30 percent.

Although green construction is rapidly moving into the mainstream, unwillingness by consumers to pay higher upfront costs for energy conserving materials and technologies is perceived as a major obstacle by 79 percent of the builders surveyed.

Green building doesn’t always translate into higher costs. Callie Barker Schmidt, NAHB's director of environmental communications, points out that construction costs for Elevation 314, a mixed-use building in Takoma Park, Md., that won NAHB's National Green Building Award for Multifamily Home Design of the Year, were about $70 per square foot — a figure she categorizes as “really low.”

“Green home building isn’t a fad, but a trend, and one that’s increasing at rapid rates,” says Harvey Bernstein, vice president of Industry Analytics and Alliances for McGraw-Hill Construction. “The data we recently collected indicates builders will reach the tipping point by early next year, where more builders will be producing green homes compared with those who aren’t.”

This finding is a powerful one, Bernstein says. “With more builders creating green homes and more consumers buying them, other [builders] will increasingly begin to incorporate green features into home building products and green practices into building processes.”

How can builders and real estate practitioners convert consumers? Appealing to their altruism in upscale and urban communities might work, says Schmidt. Potential energy savings might carry greater weight in suburban locales.

Some builders, such as Don Ferrier in Fort Worth, Texas, believe consumer values are already undergoing a change, one that he describes as a “paradigm shift.” At his company, he says, calls from potential consumers with green-building inquiries are coming in at 10 times the rate they did just three years ago.

And the leading reason that builders are considering green? “It’s the right thing to do,” say the 92 percent who identified this factor as very important or somewhat important influence behind the decision to go green.”

Read more!

Monday, June 19, 2006

Price reductions escalate in today's housing market

How to tell if you're asking too much

By: Dian Hymer: Inman News

In March, a home seller in Oakland, Calif., put his home on the market and listed it for $925,000, which was above the price his agent recommended. The house, a charming Mediterranean, was newly painted inside and out. It was decorator perfect.

The listing was well received at the agent and public open houses. But, at the end of the first week on the market, the listing agent hadn't received a single inquiry.

The listing was located in a desirable neighborhood. It showed well. And it had a lovely setting. Furthermore, well-priced listings in the area were still selling quickly.

Although the listing was relatively new on the market, the listing agent recommended that the seller reduce the asking price to $875,000. The seller agreed. Within the next week the showing activity picked up dramatically. Three offers were made and the listing sold for over $900,000.

In this case, it was easy to figure out that the listing was priced too high for the market. When listings like yours are selling and yours isn't, it's usually because of the price.

A home seller in Rocklin, Calif., put her house on the market at the beginning of April. During the first three weeks on the market, only one buyer came to see the house. On the surface, it might appear that the price was too high. But, the seeming lack of interest might have been due to local market conditions.

Unlike the Oakland property that is located in a relatively low-inventory market, Rocklin is a high-inventory market. This means there is more competition from other sellers. Buyers have more listings to choose from, so they can afford to be picky.

HOME SELLER TIP: To determine whether your home is priced right in a high-inventory market requires a bit of investigation. First, make sure that your listing has been properly exposed to the market. Minimally, it should be on the Multiple Listing Service (MLS), on the Internet with a photo tour, and it should be held open for local real estate agents.

Then find out how many homes like yours are on the market in your area. Ask your agent to call the listing agents who are handling your competitor's listings to find out if these homes are being shown and how frequently. Have any of the listing like yours sold since you put your home on the market? In general, how long is it taking to sell homes like yours? Then take a good look at the price of your home in relationship to the competition.

If there haven't been any recent sales and listings are taking months to sell, you may need to adjust your expectations about how long it will take to sell your home. However, if other listings are selling, or are at least being actively shown, and your list price is higher than the others, lower your price.

The time to make a price adjustment is when you discover that it's too high, even if this is soon after the property is listed. Staying on the market too long at a high price is risky. If the market softens further, you could end up having to make a bigger price adjustment later.

A minor price reduction is likely to result in a modest response. In order to make a positive impact, reduce your list price enough so that your list price is at or below the level of your competitors whose listings are being shown and sold.

THE CLOSING: If your home has an incurable defect, like a location on a busy street, you might need to make a bigger price concession. In a low-inventory market, buyers will overlook such defects. In a high-inventory market, they are less forgiving.

Dian Hymer is author of "House Hunting, The Take-Along Workbook for Home Buyers," and "Starting Out, The Complete Home Buyer's Guide," Chronicle Books.

Read more!

SoCal Housing Market Cooling

Sellers' new math

The number of days it's taking houses to sell is adding up. So some prices are coming down.

By: Gayle Pollard-Terry: LA Times

As houses stay on the market longer, nervous owners have begun dropping their prices.

FOR four long months, there has been a "For Sale" sign in front of David and Jody Saltzman's Malibu home. Located in Sea View Estates, on a cul-de-sac in a kid-friendly neighborhood with excellent public schools, the 3,100-square-foot Mediterranean has four bedrooms, three bathrooms, a bonus room and a remodeled kitchen with granite countertops. There's no ocean view, but the owners believe garden enthusiasts will love the lush landscaping and tropical plants on the half-acre lot.

"I was hoping it would sell in 60 days," David Saltzman said. When it didn't, the couple lowered the price by $100,000 in April. They took another $100,000 off in May. With the house eventually listed at $1,495,000 — making it the least-expensive listing in the development for a house of its size — they finally entered escrow a week ago.

ADVERTISEMENTThough the median home price is higher in Southern California now than it was a year ago, the Saltzmans aren't alone in their prolonged struggle to sell. Houses throughout Southern California are staying on the market longer than they were a year ago.

Without question, the market has changed. Bidding wars are fewer and farther between. Word-of-mouth sales before a sign goes up are less frequent. And deals struck in the first minutes of open houses are all but history, agents say.

Anecdotal evidence aside, one sure measure of a market slowdown is the number of days homes are listed before a contract is signed. Across the Southland, the median time had grown as of the end of April, the latest period for which figures are available, reports the California Assn. of Realtors.

In Los Angeles County, houses were staying on the market 34 days, according to the trade group, up from 25 days a year earlier. In Orange County, it was 39 days compared with 26, and in the combined San Bernardino and Riverside counties region, 39 days, up from 27.

In some pockets, however, it's even longer. The average time on the market is 85 days for parts of the Westside and Malibu, said Aaron Lider, an agent with Keller Williams Brentwood, citing figures from the Multiple Listing Service.

"The market is normalizing," said Lider, calling the development "quite refreshing."

"It's taken the panic out of the buyers," he said. Today's larger inventory gives buyers more choices.

"It makes pricing accurately far more important than it has been for the last six years," said Michael Edlen, an agent with Coldwell Banker Pacific Palisades.

When Westside homes were increasing at 18% to 20% a year, an overpriced home might sit on the market, but eventually appreciation would "catch up" to the seller's price, he said. That's no longer the case.

Like most things in life, timing is key.

Tuba Ghannadi of Re/Max Palos Verdes listed a 3,000-square-foot house in Palos Verdes Estates during the Christmas holidays for $1,948,000.

"It's nicely remodeled," she said of the four-bedroom, three-bathroom contemporary-style home.

But the house isn't moving.

"In February we lowered the price for the first time. Every month we've lowered the price some more," she said. The asking price is now $1,748,000.

Still, the house sits vacant.

Such price reductions aren't limited to the $1-million-plus market. In San Jacinto in Riverside County, real estate agent Hugo Florez has seen the price of one of his listings drop every month too. The three-bedroom, two-bathroom house came on the market in April at $275,000. "We dropped it to $265,000 in May, and $259,000 in June," said Florez, of Real Team Real Estate Center. "It's not last year's market anymore."

In July 2005, Florez had 13 offers in less than a week on a San Bernardino listing. Now, he said, "it is a complete 180-degree turnaround."

After 111 days on the market, Bruce Kurnik's clients cut the asking price from $1,489,000 to $1,399,000 for their five-bedroom, 4 1/2 -bathroom house in 3,699 square feet in Oak Park, an unincorporated community of Ventura County.

"We had two offers when it first hit the market, and the sellers didn't take it," said the broker with Coldwell Banker Residential, Westlake Village.

Although a price reduction is a standard strategy to move an unsold home, not every seller is willing to settle for less no matter how long the property stays on the market. Some homeowners have the luxury of time. Others require a specific return on their investment. Still others need to maximize the amount they get for their old house to swing the purchase of a new house.

Kurnik has a Van Nuys home that's been listed for 125 days and counting.

"The seller wants a certain price," said Kurnik, who listed the three-bedroom, two-bath house for $589,900.

"We had a very interested buyer … and we were extremely close to putting it into escrow," Kurnik said. "But the seller said, 'We're coming into summer, let's hold out.' "

Even with discounts, houses overall continue to appreciate, albeit in single digits. In April, the median price for the six-county Southern California region was $485,000, a 9% gain over April 2005, according to DataQuick Information Systems, a La Jolla-based research firm.

As sales of single-family homes have slowed, so have those of condos.

As of April, in downtown Los Angeles, where the loft and condo market has been booming, the average days on the market rose from 49 days to 57, at an average sales price of $598,242, according to Condosource, a boutique real estate brokerage firm that specializes in Los Angeles condos and lofts.

Condosource, which tracks Multiple Listing Service statistics, also reported an annual increase in average days on the market from 51 to 71 in the Mid-Wilshire market, where the average price is now $409,810.

Houses and condos can linger on the market for many reasons: price, location, condition or competition from other properties in the immediate vicinity. And sellers, through no fault of their own, can be caught in a market shift.

David Saltzman still doesn't know why their home sat for more than four months, but he's philosophical.

"We don't feel insulted, because there are several houses that have been on the market quite a bit longer than ours."

Read more!

Sunday, June 18, 2006

Home Sale Volume Continues Slowdown

Even as Los Angeles County’s median home price continued to break records in May, the number of homes sold – often a leading indicator of a looming market correction – continued to drop.

By: DEBORAH CROWE: Los Angeles Business Journal Online

The $550,000 countywide median price for existing homes in May was 16 percent higher than a year earlier and 1 percent higher than the previous month, according to data provided to the Business Journal by HomeData Corp., a Mellville, N.Y. company that tracks housing prices nationwide.

Even so, clouds are on the horizon.

There were 8,949 homes sold last month, 17 percent fewer than a year ago. And the 35,558 homes sold to date this year is off 15 percent from the first five months of 2005.

The drop in sales volume has contributed to an accumulating inventory of available homes which are staying on the market longer. The California Association of Realtors estimates that as of April, homes in L.A. County were staying on the market a median 35 days, compared to 25 days a year ago. There was 5.6 months of inventory in the overall Los Angeles market in April, compared to just two months’ worth a year ago.

Six months worth of inventory is generally considered a balanced market for both buyers and sellers. A hot topic among real estate professionals at a statewide CAR meeting in Sacramento last week centered on the challenges of convincing sellers to lower their expectations.

“We’ve transitioned to a slower market,” said Leslie Appleton-Young, the association’s chief economist. “But you’ve got a situation where sellers are still tied to prices that would have been appropriate a year ago, when inventory was significantly lower.”

Read more!

10 cheap fixes to boost your home's value

Short on cash but ready to renovate? Think new door handles, not new doors, and spiffed-up appliance fronts, not new appliances.

By: Teri Cettina: Bankrate.com

Looking for ways to spruce up your home without putting yourself in the poorhouse? Whether you're getting ready to sell your home or want to spiff it up inexpensively for your own enjoyment, we've got 10 good strategies for you to consider.

The actual cost and payback for each project can vary, depending on both your home's condition and overall real estate market values in your region of the country.

1. Make your kitchen really cook. The kitchen is still considered the heart of the home. Potential home buyers make a beeline for this room when they first view a home for sale, so make sure your kitchen looks clean and reasonably updated.

For a few hundred dollars, you can replace the kitchen faucet set, add new cabinet door handles and update old lighting fixtures with brighter, more energy-efficient ones.

If you've got a slightly larger budget, you can give the cabinets themselves a makeover. "Rather than spring for a whole new cabinet system, which can be expensive, look into hiring a refacing company," says serial remodeler Gwen Moran, co-author of "Build Your Own Home on a Shoestring." (Read more about cheap kitchen fix-ups.)

"Many companies can remove cabinet doors and drawers, refinish the cabinet boxes, then add brand-new doors and drawers. With a fresh coat of paint over the whole set, your cabinets will look like new."

If you're handy, you can order your own replacement cabinet doors and door fronts from retailers like Lowe's Home Improvement or The Home Depot and install them yourself.

2. Give appliances a facelift. If your kitchen appliances don't match, order new doors or face panels for them. When Nicole Persley, a Realtor with Real Estate of Florida, in Boca Raton, was sprucing up her own home to sell, her mix-and-match kitchen bothered her. The room had a white dishwasher, microwave and wall oven mixed with other pieces that were stainless steel with black trim.

When Persley called the dishwasher manufacturer to see about ordering a new, black face panel, the customer service representative clued her in on a big secret: Many dishwasher panels are white on one side and black on the other.

"All I had to do was unscrew two screws, slide out the panel and flip it around. Sure enough - it was black on the other side!"

Persley, who has remodeled numerous homes for resale, says that a more cohesive-looking kitchen makes a big difference in the buyer's mind - and in the home's resale price.

3. Buff up the bath. Next to the kitchen, bathrooms are often the most important rooms to update. They, too, can be improved without a lot of cash. "Even simple things like a new toilet seat and a pedestal sink are pretty easy for homeowners to install, and they make a big difference in the look of the bath," says Moran.

Moran also suggests replacing an old, discolored bathroom floor with easy-to-apply vinyl tiles or a small piece of sheet vinyl. "You may not even need to take up the old floor. You can install the new floor right over the old one," she says.

If your tub and shower are looking dingy, consider re-grouting the tile and replacing any chipped tiles. A more complete cover-up is a prefabricated tub and shower surround. These one-piece units may require professional installation but can still be cheaper than paying to re-tile walls and refinish a worn tub.

4. Step up your storage. Old houses, particularly, are notorious for their lack of closet space. If you have cramped storage areas, Realtor Moe Viessi of Miami suggests adding do-it-yourself wire and laminate closet systems to bedrooms, pantries and entry closets.

Firms like ClosetMaid allow you to measure and redesign your closets online. You can also get design details and parts for these systems at many large home-improvement stores. Most closets can be updated in a weekend or less.

In the end, your closets will be more functional while you're living in the house and will make your home look more customized to potential buyers when you're ready to sell. (Read more about taming your closets.)

5. Add a room in a week or less. "If you have a three-bedroom house with a den, the only reason the den can't be considered a bedroom may be because it doesn't have a closet," says Persley. "If you add a closet to that room, you've now got a four-bedroom house. That adds a lot of value."

Persley says it's usually possible to add a custom closet system and drywall it in for less than $1,500.

6. Mind the mechanics. Finley Perry of F.H. Perry Builder in Hopkinton, Mass., advocates spending a few bucks on nitty-gritty stuff. "It's often very worthwhile to hire an electrician and plumber for a couple of hours to look over your electrical services, wrap or fix loose wires, fix any faulty outlets, and check for and fix any water leaks," Perry says. "Those details tell a buyer that someone has really taken care of the home and can really influence its price."

7. Look underfoot. Carpeting is another detail that can quickly update a home and make it look cleaner. A professional carpet cleaning is an inexpensive investment, especially if your rugs are in good shape and are neutral colors.

If your carpet is showing serious wear, cover it with inexpensive, strategically placed area rugs. Unless it is truly hideous, most Realtors don't suggest replacing wall-to-wall carpeting right before you sell your house. The new homeowners may want to choose their own carpeting after they move in. (Read more on flooring trends here.)

8. Let there be light. If you have boring recessed lights in your dining and living rooms, consider replacing one of the room's lights with an eye-catching chandelier. Home stores offer a wide range of inexpensive, but nice-looking, ceiling fixtures these days. If you have a ceiling fan and light, you can also buy replacement fan blades (leaving the fan body in place) to update the fixture's look.

9. Reframe your entry. Do you have a flimsy little knob on your main entry door? If so, spring for a substantial-looking handle-and-lock set. "A nice, big piece of hardware on the front door signals to newcomers that this is a solid home," says Viessi.

Also, if you're stuck with a basic steel front door, Persley suggests painting or faux-finishing it for more eye appeal. "It's becoming a trend in Florida to add wood-grain doors to a home's entry or garage. The good news, though, is that you can easily paint existing metal doors with stain and paint," she says.

After using a good metal primer, Persley gives the door a base coat of paint (again, be sure to use one approved for use over metal). For a cherry wood look, Persley uses a burgundy base paint. After it dries, she brushes over the base coat with a cherry wood stain. "It really looks amazing, and it only takes a few hours," she says.

10. Consider curb appeal. Although it sounds obvious, a nicely mowed lawn, a few well-placed shrubs and a swept walkway makes a great first impression. "What buyers see when they first drive by your home is tremendously important," says Viessi. (For more ambitious ideas for your yard, see "From ho-hum to wow: 4 backyard trends." To stay on budget, read "17 ways to landscape on the cheap.")

If you don't have a green thumb, consider hiring a landscaper to install some new sod, plant a few evergreen shrubs and give your front yard a good cleanup. "These kinds of changes can instantly change people's perception of your home and, therefore, increase its value," says Viessi. And hey, your neighbors will love you for it, too.

Read more!

Saturday, June 17, 2006

HUD releases new anti-flipping rules

Homes sold within 90 days of purchase ineligible for funding

Inman News

Only the actual owner of a home can sell that home with Federal Housing Administration financing, and in an attempt to discourage flipping, homes sold within 90 days of purchase won't be eligible for FHA financing, the U.S. Department of Housing and Urban Development ruled Wednesday.