Marketing exposure a top concern.

By: Robert J. Bruss: Inman News

DEAR BOB: My wife and I are thinking about listing our $425,000 home for sale with a real estate agency, which charges a $1,995 commission. They will list our home for 30 days. During the 30 days, we can sell the home ourselves or if they sell it, we owe only $1,995. If another broker sells the home during the 30 days, he would write in his sales commission on the offer, subject to our approval. During the 30 days, the listing agency will put a for-sale sign in our yard with an information box with flyers about our home. We would have to show our home to potential buyers if the listing agent isn't available to show it. Our home will not be in the local MLS (multiple listing service) until after 30 days if it doesn't sell by then. This agency claims to be a full-service real estate firm. But their competitors put their listings into the MLS within 24 hours after listing. Do you think we should list with this firm? -Don S.

DEAR DON: According to statistics from the National Association of Realtors, at least half of all home sales involve a listing agent and a buyer's agent. Most of those sales originate through the local MLS, the most powerful sales tool available to real estate agents.

Especially in the current buyer's market for homes, why cut yourself off from half the potential buyers? They won't even know your home is for sale if it isn't shown in the local MLS and on the nationwide www.Realtor.com Web site where many home buyers start their searches.

Don't fool yourself. That is not a full-service real estate broker if you have to show your own home to prospective buyers. How will it be shown while you are at work or perhaps out of town for a few days? If your home isn't in the local MLS, and if it doesn't have a lockbox on the door so MLS member agents can easily show your home, how do you expect it to sell?

A yard sign and a few flyers are not enough to get a home sold for top dollar in today's market. You need a successful listing agent aggressively marketing your home. Before you decide to list with that discount broker, please interview at least three successful realty agents who sell homes in your vicinity. Listen to their listing presentations before selecting the best for your situation. Compare their success records with the discount broker.

HOW TO GET $750,000 TAX-FREE PROFITS FROM HOME SALE

DEAR BOB: My brother Joe lives with our parents. He has been paying his share of the mortgage since they all bought the home about 25 years ago. Title is held in joint tenancy with right of survivorship. Joe's name is on the title. They are thinking of selling the home, which was bought for around $200,000 and is now appraised at $1 million. Is Joe entitled to $250,000 capital gains exemption along with the $500,000 exemption for my parents? I heard they need to change the title to tenants in common. -Jeff G.

DEAR JEFF: No need to change the title. Joint tenancy with right of survivorship is fine as long as all three names are on the title. The happy result is when your parents and your brother sell their principal residence, they will each be entitled to a $250,000 principal residence sale tax exemption for a total of up to $750,000 tax-free capital gains.

That presumes each of the three joint tenant co-owners meet the Internal Revenue Code 121 test requiring ownership and occupancy of their primary residence for at least 24 of the 60 months before its sale. For more details, they should consult their tax adviser.

WHAT INSURANCE DOES MOM NEED FOR CONDO PURCHASE?

DEAR BOB: My mom is thinking of buying a condominium. But the insurance is confusing. Is the condo owner or the homeowner association responsible for insurance? Should she purchase coverage for the complete condo just to be safe? -John M.

DEAR JOHN: Insurance is the easiest part of buying a condo. The homeowner's association must maintain adequate negligence liability and hazard insurance on the common areas, including the structure. But that master policy does not insure the contents of individual condos in the event of a loss, perhaps due to a fire.

Your mom doesn't have to buy any insurance. Her mortgage lender won't require any insurance because condo lenders are protected by the homeowner's association master policy in the event of structural damage.

However, I'm sure your mother is a very smart woman who wants to be adequately protected just in case a loss occurs to the contents of her condo or if she incurs negligence liability.

For just a few hundred dollars per year, she can buy a condominium owner's insurance policy from a major insurance company. The policy will include negligence liability coverage, plus insurance for loss by theft, accidental damage to the contents of her condo, and other individual coverages not included in the association's master policy on the condo complex.

SHOULD INVESTOR TAKE DEPRECIATION DEDUCTION?

DEAR BOB: I own a rental property on which I have been deducting the depreciation tax deduction. But I recently read in your column that when I sell my property I will have to pay a 25 percent depreciation recapture tax rate. I am currently in the 15 percent federal income tax bracket. If I will have to pay the 25 percent depreciation recapture tax when I sell, do you suggest I don't even bother to claim the depreciation deduction since I will have to pay back 10 percent more than I am saving? -Marian M.

DEAR MARIAN: Please don't jump to incorrect conclusions. Owners of depreciable rental property must take the depreciation deduction on their tax returns, even if no tax savings result. Although you are in the low 15 percent income tax bracket, the depreciation deduction probably saves you tax dollars.

If no savings result, the deduction from your rental property can be "suspended" for use in a future tax year, or when you sell the property.

More important, you might never have to pay that 25 percent depreciation recapture tax rate. Perhaps you never sell your depreciable building and you die while still owning it. Then Uncle Sam can't "recapture" and tax that depreciation deduction you enjoyed.

Or you might make an Internal Revenue Code 1031 tax-deferred exchange for another qualifying rental property of equal or greater cost and equity to pyramid your holdings. Again, there won't be any depreciation recapture on such an exchange. In summary, because the tax law requires you to claim the depreciation deduction, enjoy it and hope you never have to pay the recapture tax.

CAN PARENTS CLAIM SQUATTER'S RIGHTS BY ADVERSE POSSESSION?

DEAR BOB: I have a "doozy" of a question for you. My parents took care of my aunt and uncle for many years, paying their expenses such as the mortgage and property taxes. My uncle died about 13 years ago and my parents paid off the mortgage about 10 years ago. They took possession of the property after he died and continue to rent it today. But I just found out they don't have any fire insurance because it terminated when the mortgage was paid off 10 years ago. What is the best way for them to take title? Squatter's rights? Adverse possession? Probate? I know they probably need an attorney but is there any way to avoid that? -LaVon G.

DEAR LaVON: Your parents need a real estate or probate attorney to sort out this mess. If there was no probate proceeding or living-trust distribution after the aunt and uncle died, it is necessary to determine who was entitled to receive the property title. The answer depends if there were written wills or, if not, if the title passes according to the state law of intestate succession to the closest relative.

After that is determined, your parents can assert their claim to title by adverse possession. "Squatter's rights" is just another name for adverse possession.

If the occupancy and possession by your parents has been open, notorious, hostile and continuous, plus payment of property taxes, for the number of years required by state law where the property is located, they might qualify to obtain title by adverse possession.

In the meantime, they need to promptly purchase a fire insurance policy.

CAN LANDLORD DEDUCT WALL REPAIR COST FROM TENANT'S SECURITY DEPOSIT?

DEAR BOB: Can I deduct from my former tenant's security deposit the extra cost of scraping and plastering to repair the damage from removing two-sided Velcro tape put all over the walls? -Janet H.

DEAR JANET: Yes. However, you should hire someone to do that work. If you do it yourself, and if the tenant disputes your deduction in local Small Claims or Housing Court, many courts value the landlord's labor at zero.

But if you pay someone to make the repairs, be sure to obtain a receipt marked "paid" and include a photocopy with your security deposit accounting to your ex-tenant.

The new Robert Bruss special report, "Pros and Cons of Today's Five Best Real Estate Profit Opportunities," is now available for $5 from Robert Bruss, 251 Park Road, Burlingame, CA 94010 or by credit card at 1-800-736-1736 or instant Internet delivery at www.BobBruss.com. Questions for this column are welcome at either address.

Read more!

Monday, July 31, 2006

Home seller should rethink listing with discount broker

Sunday, July 30, 2006

A little cash relief is as close as your W-4 form

Home buyers who need a little more take-home pay to afford their bills don't necessarily need a second job or to dip into their savings.

By: Lew Sichelman: Los Angeles Times

By increasing the number of allowances claimed on tax forms filled out at work, they can boost their paychecks considerably. Exactly how much depends on the amount of mortgage interest and property taxes paid. But the more allowances claimed, the less federal income tax will be withheld.

Many people claim allowances equal to the number of people in their household — four, for example, in the case of a married couple with two kids — on Form W-4, the Employee's Withholding Allowance Certificate.

And every April 15, they ante up and square the ledger with Uncle Sam.

Others claim no allowances whatsoever, even if they have several dependents, preferring instead to pay more than their fair share of income taxes in advance and using the Treasury as sort of forced savings account.

In either case, though, these people are using as their banker an institution that pays no interest. They are giving the government free use of their money — money they could use to pay bills or place in an interest-bearing savings account.

Savvy taxpayers try to match their withholding with their actual tax liability. To the best of their ability, they determine in advance what they'll owe when the final tab is figured and adjust their withholding accordingly.

That way, they maximize use of their earnings and meet their income-tax obligations at the same time.

Even the Internal Revenue Service advises taxpayers to strive to have their withholding match their actual tax liability.

"If not enough tax is withheld, you will owe tax at the end of the year and may have to pay interest and a penalty," the federal tax collector says. "If too much tax is withheld, you will lose the use of that money until you get a refund."

By law, you must pay at least 90% of your tax liability in advance via withholding or the government could fine you.

Allowances are not just for dependents. They're also for deductions, and deductions can be taken for any number of expenses, including mortgage interest and property taxes.

To increase your cash flow, you can reduce the amount of income tax withheld each pay period by claiming special withholding allowances for every deduction you intend to take when you file your federal return.

All taxpayers are entitled to the actual number of exemptions claimed on their returns. And a special withholding allowance of one additional exemption is allowed when the taxpayer is single and holds only one job, or is married, has one job and his or her spouse does not work.

Additional allowances are also permitted for "excess itemized deductions," as long as they don't exceed an amount equal to the sum of last year's deductions and the amount of "determinable additional deductions" for the coming year.

Determinable deductions are those attributable to an identifiable event during the year, such as interest on a new or increased mortgage and property taxes.

Of course, you'll have to itemize to take advantage of these write-offs. If you claim the standard deduction, they won't do you any good. And if your total deductions don't exceed the standard one, there's no reason to fill out a long-form return.

But if itemizing makes sense, use the work sheet on the reverse side of the W-4 to determine the correct number of allowances. Each allowance claimed frees $3,300 of annual wages from withholding.

IRS Publication 919 (available online at http://www.irs.gov ) also contains a number of more complicated work sheets to project your withholding.

There are other methods too.

Camarillo mortgage broker Scott Friedman suggests: Multiply your loan balance by the interest rate and add in property taxes.

So, if your balance at the beginning of the year is $300,000 and your loan rate is 6%, the amount of interest you'll pay over the 12-month period will be $18,000. If you're paying $5,000 in property taxes, your total deduction as a result of your housing expenses is $23,000.

Now divide that by $3,300, and you get 6.9, meaning you can claim seven additional allowances. However, because you pay a little less interest every month, it might be better to round down to six extra allowances.

"This is a simplified example, but it's close," Friedman says. "The IRS doesn't pay you interest on taxes you overpay, so it makes sense only to pay what is due."

Another more precise way to determine allowances is to check the amortization schedule for your mortgage (free online at http://www.ourbroker.com , click on "Amortization") and your current property tax bill. Add up the amounts you will pay in interest with each payment. Then add in the property tax for the year, divide the total by $3,300 and the result will equal the exact number of extra allowances you can claim because of these two deductible housing expenses.

Once a new W-4 is filled out, your employer must put it into effect no later than the start of the first payroll period ending 30 days after submission of the revised form. Although there is no limit on claimed allowances, you cannot claim more than you are entitled to. Penalties are severe if you do. And don't think you won't get caught. Employers are required to submit copies of all W-4s from workers claiming more than 10 withholding allowances.

Read more!

Five Tips for Getting Your Home Appraised Before Selling

Here's what you need to know about getting an appraisal in today's cooling market. Determining your property's value before putting it up for sale can save time and money.

By: Amy Hoak: The Wall Street Journal Online

Price your home incorrectly and it could mean a long stay on the market, a final selling price lower than what the house is worth or both.

That's why some homeowners are electing to pay $300 to $400 for an appraisal before putting their homes on the market, said Alan Hummel, past president of the Appraisal Institute and chief appraiser for St. Paul, Minn.-based Forsythe Appraisals LLC.

Presale consultations at the firm rose in the first quarter, he said, as the residential real estate market started to cool in many areas of the country and inventory increased.

Although real estate agents often do their own market analysis to price a property - and many times do a decent job - the appraiser can come in with an independent, unbiased opinion to make sure the price is right, Hummel said. In fact, if a property isn't getting any serious lookers, an agent might even encourage his or her client to invest in the service for a second pricing opinion, he added.

The greater attention to precise pricing is a change from a couple of years ago, when a house could be listed at a lofty price just to see how much it would fetch, he said. "Now you've got to be competitive and you have to know that the offers coming in are reasonable."

Also, if a property spends too much time on the market, the price it will be able to command often decreases, he said, as some buyers will question the reasons for the property's inability to sell.

Through the Eyes of a Buyer

An appraisal will look at the home from a visual standpoint, taking into account considerations from the proximity to schools to cracking or flaking paint, Hummel said.

"We're trying to react the way a typical purchaser would," he said.

The appraisal also will analyze the health of the local real estate market, giving homeowners more personalized expectations for selling their home - a feature especially important with the plethora of national news stories generalizing the real estate market, Hummel pointed out.

Appraisers can also use a cost approach, which will determine the price tag on a new home built to the same specifications of the existing home, Hummel said. The comparison can be helpful for newer houses hitting the market because it lets sellers know what their home is competing with on the new-construction front.

Looking Back to Move Ahead

It also might not be a bad idea to dig through the file cabinet for the appraisal report you paid for when you first bought your home, said Michael H. Evans, president of Evans Appraisal Service Inc. in Chico, Calif., and a fellow of the American Society of Appraisers.

Few spend time reviewing the paperwork at the time it is completed, when people are primarily interested in securing the home and buying the house, he said. "They don't go back and review that paperwork unless there's a significant issue that needs to be addressed."

Doing so, however, can remind homeowners of flaws found the first time around, and sellers might want to address curable problems before hitting the market.

What should you know about home appraisals? Listed below are five nuggets of appraisal insight, courtesy of the American Society of Appraisers: 1. What the appraisal report includes: Your appraisal - which could range in

length from two or three pages to more than a hundred, depending on its

scope - will include details about the house, a description of the

neighborhood and side-by-side comparisons of similar properties. It will also

contain an evaluation of the area's real estate market, notations of major

problems with the property that will affect its value and an estimate of the

expected time it will take to sell the property.

2. How an appraisal report is developed: Appraisals are opinions of value, and

residential real estate appraisals compare your home with similar homes that

have sold. Remember, an appraisal is not the same as a home inspection.

Inspections look for physical imperfections in the home, making sure it is

structurally sound and so forth.

3. How to get a copy of your appraisal: You paid for an appraisal when you

bought your house. If you didn't request a copy of the appraisal at the time,

you can request it from your lender - it's your right under federal law.

4. What to look for in the report before you sell: Focus on items that had a

negative adjustment - they might be a good checklist for elements to update

or remodel. Examples of issues that could cause a negative adjustment: less

than the typical number of baths for the house's size, outdated kitchens and

baths, or a one-car garage or no garage in a neighborhood where two- and

three-car garages are standard.

5. Why an appraisal before your home hits the market might be wise: The fresh

appraisal will help accurately price the home and ensure it will eventually

appraise for your asking price at the time of the sale. Sellers are sometimes

shocked when their house appraises below the asking price, which could cause

a deal to fall through or for the seller to be forced to reduce the home's

price.

Read more!

Saturday, July 29, 2006

Does a Vacation Home Qualify For a 1031 Exchange?

A dwelling that is not rented and does not otherwise produce income does not qualify as 'investment property.' However, it may be possible to exchange out of a residence that has no rental history and defer capital gains, as long as the exchanger can demonstrate it was held for investment.

By: Lew Sichelman: The Wall Street Journal Online

Question: I have been told that vacation homes qualify for a 1031 exchange. Is that true? I have never rented my Maryland beach house, but I also have only occupied it during the summer months. It is otherwise empty. I have owned it for more than 20 years, and needless to say the tax bite would be substantial if I decided to sell. That's why exchanging interests me.

- MA, Ocean City.

Answer: Exchanging properties in and of itself is rather complicated. But exchanging a vacation home may be possible.

For the uninitiated, Section 1031 of the Internal Revenue Code allows investors to sell a property, reinvest the proceeds in a new property and avoid all capital-gains taxes. The regulation states "no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment, if such property is exchanged solely for property of like-kind which is to be held either for productive use in a trade or business or for investment."

The term "like-kind" is often thought to mean that one type of property must be traded for the exact same property type, but that is incorrect. Any real property held for investment or used in a trade of business can be swapped for any other property held for investment or used in a trade or business.

But the properties don't have to be traded directly. Rather, in a 1031 exchange, you can sell a property to one person and buy another property from another person as long as both transactions occur within a specific time period and meet a bunch of other rules.

For example, for an exchange to be structured properly, all proceeds must be reinvested. If not, the difference is considered "boot" that must be recognized as a taxable gain. That is, if you sell a property for $2 million and buy another for $1 million, you'll have a $1 million taxable gain.

Also, if the property being sold is financed, the replacement property must be acquired with an equal or greater amount of debt. If not, the exchanger is relieved of a debt obligation, which is considered "mortgage boot" and is a taxable gain unless it is offset by an equivalent cash investment in the replacement property.

And theses are just the basics, which is why it's imperative to first consult with your tax or legal advisor and then find a "qualified intermediary" to handle the details.

For the answer to your specific question regarding vacation homes, I turned to Michael Brady, eastern region vice president of Asset Preservation Inc. in Calverton, N.Y. API (www.apiexchange.com) is a leading qualified intermediary that has successfully completed more than 120,000 Section 1031 tax-deferred exchanges.

Normally, residential property that is not rented and does not otherwise produce income does not qualify as "investment property." But many investors exchange out of true investment properties - a single-family rental, for example - and into a vacation or second home. And Brady says many tax and legal advisers believe it is possible to exchange out of a vacation property which has no rental history as long as the exchanger can demonstrate it was held for investment.

They base their opinions on a Private Letter Ruling (PLR 8103117) by the IRS that allowed for tax deferral when the exchanger intended to acquire property for personal enjoyment and as an investment. However, a ruling such as this applies only to the facts and circumstances in a particular situation.

"There are no regulations, statutes or court cases which give a definitive answer to the question of exchanging vacation or second homes," says Brady. "Each exchange must be reviewed on a case-by-case basis. But in this particular case, the 'personal enjoyment' of a property did not prevent the owner from benefiting from a tax deferred change."

Intermediaries such as API are not allowed to provide legal or tax advice, so you should choose carefully. But Brady does point out that IRS regulation 1.1031 (b) states that "unproductive real estate held by one other than a dealer for future use or future realization of the increment value is held for investment and not primarily for sale."

Consequently, he says, "it appears that even property owners who have never rented their vacation property but can substantiate that they acquired and held the property because they expected it to increase in value may qualify for a Section 1031 tax deferred exchange."

Armed with this information, your next step is to consult with your tax and legal advisers.

And one more thing: I asked Brady how you might be able to show you were holding the property for investment. He suggested that renting it to unrelated parties for one or two years prior to the exchange should do the trick. But if you go this route, use a written lease and report your rent as income and expenses as deductions on your annual tax returns. Also limit your personal usage.

Additional methods you might use to support your position include documenting that you investigated appreciation rates, capitalization rates and possibly even rates of return prior to purchasing the property; keeping logs of repair and maintenance expenses during the period of ownership and having the property appraised periodically to keep track of its value. Any rental, even to family or friends, also will help establish the property is being held for investment.

Read more!

Friday, July 28, 2006

UPDATE: Housing Bill Headed For Ballot

The Los Angeles City Council on Wendesday voted to place Mayor Antonio Villaraigosa’s proposed $1 billion housing bond on the already crowded Nov. 7 ballot.

By: HOWARD FINE: Los Angeles Business Journal Online

The unanimous vote Wednesday was a mere formality; it came a day after the Council approved the ballot language for the proposal.

The bond, strongly supported by major business groups, would fund the addition of thousands of affordable housing units in the city. It comes at a time when the median home price in L.A. County has soared to $550,000 and when less than 15 percent of L.A. residents can afford to buy a median-priced home.

Five years ago, business groups, including the Central City Association, proposed a $500 million affordable housing bond as a way to address the city’s growing homeless population and the shortage of affordable housing units in the city. There was little progress until last year, when Villaraigosa proposed the $1 billion housing bond.

However, the bond faces a tough uphill battle in November. Not only does it require two-thirds voter approval, but it will be on a record-breaking ballot for bonds, with more than $40 billion in bonds facing voters statewide, including Gov. Arnold Schwarzenegger’s $35 billion infrastructure bond package. In June, voters rejected a statewide library bond, leading many analysts to conclude voters were growing more wary of bonds.

Proponents of the affordable housing bond say that unlike what happened with the state library bond, they would mount a campaign to get L.A. voters to pass the measure, touting its benefits to the poor and middle class.

Specifically, the bond would earmark:

• $500 million for affordable rental housing for low-income individuals and households;

• $100 million for mixed-income developments with affordable housing units; and

• $200 million to help individuals and households buy their first homes, particularly teachers and firefighters.

The remaining $200 million would be allocated to other housing programs as approved by a citizens’ oversight committee, the City Council and the mayor.

Among the individuals targeted for these funds would be the homeless, those in danger of becoming homeless, domestic violence victims, seniors and the disabled.

The bond would be repaid through increased property taxes; according to city staff, it would add roughly $130 per year to the property tax on a home assessed at $500,000.

Separately, on Tuesday, the Council took a preliminary vote to hike trash fees paid by homeowners to pay for the hiring of more police officers. The fees would increase in stages from the current $11 per home to $28 by mid-2009. The vote was 12 to 1, with Councilman Greig Smith casting the lone dissenting vote.

Read more!

Thursday, July 27, 2006

The Weekend Guide! July 27 - July 30, 2006

The Weekend Guide for July 27 - July 30, 2006.

Full Article:

Read more!

Median Home Price in California reaches record high in June

C.A.R. reports median price of a home in California at $575,800 in June, up 6.2 percent from year ago; sales decrease 26.3 percent.

CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

The median price of an existing home in California increased 6.2 percent in June and sales decreased 26.3 percent compared with the same period a year ago, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today.

“While home price appreciation has slowed over the past few months, the median price continues to climb in most areas of the state and reached $575,800 in June, a new record for California,” said C.A.R. President Vince Malta. “For the first time since November 2001, we experienced back-to-back months of single-digit price appreciation, moderated in part by increased inventory levels.”

Closed escrow sales of existing, single-family detached homes in California totaled 483,690 in June at a seasonally adjusted annualized rate, according to information collected by C.A.R. from more than 90 local REALTOR® associations statewide. Statewide home resale activity decreased 26.3 percent from the 656,310 sales pace recorded in June 2005.

The statewide sales figure represents what the total number of homes sold during 2006 would be if sales maintained the June pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The median price of an existing, single-family detached home in California during June 2006 was $575,800, a 6.2 percent increase over the revised $542,330 median for June 2005, C.A.R. reported. The June 2006 median price increased 2 percent compared with May’s revised $564,440 median price.

“Mortgage interest rates continued to edge up for the fifth consecutive month in June, contributing in part to a slowdown in sales,” said C.A.R. Chief Economist Leslie Appleton-Young. “June 2006 was the first time since late 2001 that the sales pace fell below 500,000 for two consecutive months. Home sales declined 26.3 percent last month compared with June 2005, when they hit the third-highest monthly pace on record.”

Highlights of C.A.R.’s resale housing figures for June 2006:

. C.A.R.’s Unsold Inventory Index for existing, single-family detached homes in June 2006 was 6.2 months, compared with 2.5 months (revised) for the same period a year ago. The index indicates the number of months needed to deplete the supply of homes on the market at the current sales rate.

. Thirty-year fixed mortgage interest rates averaged 6.68 percent during June 2006, compared with 5.58 percent in June 2005, according to Freddie Mac. Adjustable mortgage interest rates averaged 5.71 percent in June 2006 compared with 4.24 percent in June 2005.

. The median number of days it took to sell a single-family home was 46 days in June 2006, compared with 28 days (revised) for the same period a year ago.

Regional MLS sales and price information is contained in the tables that accompany this press release. Regional sales data are not adjusted to account for seasonal factors that can influence home sales. The MLS median price and sales data for detached homes are generated from a survey of more than 90 associations of REALTORS® throughout the state. MLS median price and sales data for condominiums are based on a survey of more than 60 associations. The median price for both detached homes and condominiums represents closed escrow sales.

In a separate report covering more localized statistics generated by C.A.R. and DataQuick Information Systems, 78.7 percent, or 322 out of 409 cities and communities showed an increase in their respective median home prices from a year ago. DataQuick statistics are based on county records data rather than MLS information. DataQuick Information Systems is a subsidiary of Vancouver-based MacDonald Dettwiler and Associates. (The top 10 lists are generated for incorporated cities with a minimum of 30 recorded sales in the month.)

Note: Large changes in local median home prices typically indicate both local home price appreciation, and often, large shifts in the composition of housing market activity. Some of the variations in median home prices may be exaggerated due to compositional changes in housing demand. The DataQuick tables listing median home prices in California cities and counties are accessible through C.A.R. Online at http://www.car.org/index.php?id=MzY0Mzc=.

. Statewide, the 10 cities and communities with the highest median home prices in California during June 2006 were: Beverly Hills, $1,877,500; Burlingame, $1,725,000; Manhattan Beach, $1,575,000; Los Altos, $1,543,500; Newport Beach, $1,347,250; Saratoga, $1,309,000; Mill Valley, $1,294,500; Palos Verdes Estates, $1,225,000; Orinda, $1,207,500; La Cañada Flintridge, $1,150,000.

. Statewide, the 10 cities and communities with the greatest median home price increases in June 2006 compared with the same period a year ago were: Delano, 94 percent; Beverly Hills, 44.9 percent; Barstow, 36.9 percent; Culver City, 35.5 percent; Porterville, 34.6 percent; Paramount, 31.7 percent; Inglewood, 31.3 percent; Laguna Hills, 30.6 percent; Arroyo Grande, 30.5 percent; California City, 28.3 percent.

Leading the way...® in California real estate for more than 100 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with more than 185,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

Read more!

Wednesday, July 26, 2006

Home Sales Dip in June as Market Stabilizes

Sellers have recognized that they need to be more competitive in their pricing given the rise in housing inventories, says NAR Chief Economist David Lereah.

NAR: REALTOR® Magazine Online

Existing-home sales declined modestly in June, while home prices were up slightly from a year ago, according to the NATIONAL ASSOCIATION OF REALTORS®.

Total existing-home sales — including single-family, townhomes, condominiums and co-ops — declined 1.3 percent to a seasonally adjusted annual rate1 of 6.62 million units in June from an upwardly revised level of 6.71 million May. Last month’s sales were 8.9 percent below the 7.27 million-unit pace in June 2005.

David Lereah, NAR’s chief economist, says the housing market is flattening-out.

“Over the last three months home sales have held in a narrow range, easing to a level that is near our annual projection, which tells us the market is stabilizing,” he said. “At the same time, sellers have recognized that they need to be more competitive in their pricing given the rise in housing inventories. Home prices are only a little higher than a year ago.”

The national median existing-home price for all housing types was $231,000 in June, up 0.9 percent from June 2005 when the median was $229,000. The median is a typical market price where half of the homes sold for more and half sold for less.

“The change in price performance is directly tied to housing inventories; a year ago we had a lean supply of homes and a sellers’ market, with monthly home sales at an all-time record high,” Lereah said.

Total housing inventory levels rose 3.8 percent at the end of June to 3.73 million existing homes available for sale, which represents a 6.8-month supply at the current sales pace. By contrast, in June 2005, there was a tight 4.4-month supply on the market.

New Opportunities for Home Buyers

NAR President Thomas M. Stevens from Vienna, Va., said opportunities have opened for home buyers. “People who were discouraged by the bidding wars that were so common over the last few years are finding more choices now,” said Stevens, senior vice president of NRT Inc. “Relative to the five-year housing boom, this year is a buyer’s market in much of the country with plentiful supply, along with interest rates which remain historically favorable, so it’s a good time to buy a home.”

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.68 percent in June, up from 6.60 percent in May; the rate was 5.58 percent in June 2005.

Single-family home sales eased 0.9 percent to a seasonally adjusted annual rate of 5.81 million in June from an upwardly revised 5.86 million in May, and were 8.2 percent below the 6.33 million-unit pace in June 2005. The median existing single-family home price was $231,500 in June, up 1.1 percent from a year ago.

Existing condominium and cooperative housing sales fell 5.5 percent to a seasonally adjusted annual rate of 805,000 units in June from a pace of 852,000 in May, and were 14.6 percent below the 943,000-unit level in June 2005. The median existing condo price3 was $226,900 in June, down 2.1 percent from a year earlier.

Regional Market Conditions

Existing-home sales in the Midwest were unchanged in June, holding at a level of 1.52 million, and were 6.2 percent lower than a year ago. The median price in the Midwest was $175,000, which is 1.7 percent below June 2005.

Existing-home sales in the West also were unchanged, at an annual pace of 1.41 million in June, and were 17.1 percent lower than June 2005. The median price in the West was $342,000, the same as a year ago.

Existing-home sales in the South eased 2.3 percent to a pace of 2.57 million in June, and were 5.5 percent below June 2005. The median existing-home price in the South was $191,000, down 0.5 percent from a year earlier.

Existing-home sales in the Northeast declined 3.5 percent to an annual sales rate of 1.11 million units in June, and were 9.8 percent below a year ago. The median price in the Northeast was $298,000, up 7.2 percent from June 2005.

Read more!

Tuesday, July 25, 2006

Hold off on that panic attack

The market's just returning to normal, experts say. Good news for buyers, but not that bad for sellers either.

By: Diane Wedner: Los Angeles Times

Although it may appear to some that the sky is falling, Chicken Little can relax for now. As Southern California's real estate boom fades and a more normal market returns, buyers and sellers can take some comfort in what lies ahead.

Industry analysts say the tumbling prices, glut of houses and 8% to 10% interest rates that marked the recession of the early 1990s are nowhere in sight now. The area's strong, diverse economy will help prevent a market freefall similar to the one the region experienced then.

"The fundamentals today are vastly different than those of the '90s," said John Karevoll, chief analyst for DataQuick Information Systems, a La Jolla-based real estate research firm.

Karevoll says that by the end of the year, he expects Southland home prices will have risen by 6% to 7% from the median price of $460,000 in 2005.

"Even in a worst-case scenario, which is not expected, economists say homeowners will lose no more than 7% of their homes' value down the line," Karevoll said. So much for a real estate crash.

Much has been made recently of the downturn in San Diego County's real estate market, considered a harbinger for the region. Alarm bells went off when the June median home price there fell 1% and the number of sales dropped 24% from the same month a year ago — a tumble experts attribute largely to conditions peculiar to that area, most pointedly the overbuilding of downtown condominiums.

That is not the case in the rest of Southern California, where in June, prices rose 7.4% from a year ago to a median of $494,000. The number of existing homes and condos sold dropped, but new-home sales, which made up 22% of the market, are showing strong gains, according to DataQuick analysis.

Taking a longer view, Los Angeles County prices rose 14.7% and sales of existing homes fell 13.8% during the first half of 2006 from the same period a year ago. In Orange County, during the same period, prices rose 10.7% and sales of existing homes remained level, while in San Diego County, prices went up 3.7% and sales dropped 12.4%.

In contrast, new-home sales in San Diego County dropped 16.9% during the first half of this year, compared with that period a year ago, while such sales, including condo conversions, soared 25.1% in L.A. County and 34.6% in Orange County.

The reason for such strong new-home sales activity is pent-up demand, a spillover from a half-decade of under-construction. Most big builders, wanting to avoid a repeat of the '90s — when they were stuck with unsold homes after the recession hit — now build houses only after preselling them.

"That is an intelligent business plan," said Carola Cherief, vice president of sales for Centex Homes. "We plan to continue that strategy. It's easier to slow down the sales pace this way and hold off on construction so we don't saturate the market."

With Southern California adding 200,000 to 300,000 new residents a year, the demand for homes won't slow anytime soon, economists say. And until the stock market takes off again — and no one knows if or when that will happen — people are expected to keep parking their investment dollars in real estate, at least for now.

So why the 13% sales decline overall? It is more a reflection of a drop from the record number of sales the region has seen in the last few years than an especially slow sales rate this year, Karevoll said. Today, the sales pace is "around the average."

Prices, meanwhile, have continued to rise. The median price of all homes in Orange County during the first half of 2006 was $624,000; in L.A. County, it was $505,000. Regionwide, however, prices in June — which rose 6% from a year ago to $493,000 — represent the smallest year-over-year increase since May 2000. The median is expected to continue to set records, but at a slower rate of appreciation than in June.

The move back to a "normal" market is resulting in unnecessary panic among some sellers, who are cutting prices too soon, industry observers say.

"Some sellers' expectations have shifted way out of whack," said Raphael Bostic, an economist and professor at USC's Lusk Center for Real Estate. "They think their homes should be on the market only for a week or two. But that's not the norm from a historical perspective."

At this midpoint in the real estate cycle, sellers who are testing the waters are planting for-sale signs in frontyards, fishing for top dollar, then taking their homes off the market months later when they don't get those prices. Anecdotally, about half the listings on the market fall into this category, industry analysts say.

The consequence of this activity is that it falsely inflates the inventory, keeps homes on the market longer and can skew the realty picture. On the other hand, serious sellers who price their homes right are enjoying more timely sales, agents say.

Because some homes are on the market longer, David Toyama, a Coldwell Banker broker in Eagle Rock, has seen a subtle shift in favor of buyers, who for several years struggled to purchase properties — especially at the entry level — and finally are getting some breaks from sellers willing to accept contingencies.

Ricardo and Eva Mendez, and their three grown children who live with them, desperately wanted to move up from their Highland Park home on a noisy, busy street, said daughter Gladys, 29. Until late last year, the family felt priced out of the market. But in November, Eva and her two daughters spotted an Eagle Rock house that had been listed for two months.

The Mendezes jumped at the chance to grab the four-bedroom "major fixer," Gladys said, for $29,000 less than the asking price of $749,000. The steep appreciation of their first home allowed them to make a hefty down payment and have money left over for renovations.

"We lucked out," Gladys said. "The timing was right."

Timing has made a difference in the mortgage market too. While buyers may be encouraged by the return to more normal home-price increases, they still face higher interest rates, said Mark Cohen, owner of Cohen Financial Group in Beverly Hills.

A year ago, a buyer with a 10-year-fixed, interest-only mortgage, for example, locked into monthly payments of about $2,448 for a $500,000 loan at 5.875%. Today, with rates at about 6.75%, that borrower would pay $2,813 per month, a 15% jump.

The psychological barrier to home buying — when interest rates reach a number that discourages buyers and pushes home prices down — is 7.8%, Karevoll said, but most economists do not expect rates to reach that level in the near future.

With interest rates still in "reasonable" territory, buyers are flocking to areas where they smell bargains, such as San Bernardino County. In June, the median price was $367,000, up 14% from a year ago. Available homes there have increased, and some sellers are giving buyers allowances for repairs and carrying their second mortgages, said Hector Castañeda. The Century 21 Town & Country agent said he's giving buyers' agents more than half of his commission as incentive to get more traffic to listings that are about to expire.

Eagle Rock agent Toyama, who has ridden out several real estate cycles, is sanguine about the current changes.

"I love this market right now," he said. "Sellers are more reasonable, buyers are getting in the market, and the flip artists are gone. We all win."

Read more!

A Cooling California Market Isn't Necessarily Bad

The Southern California real estate market is cooling, but industry analysts say signs that marked the recession of the early 1990s are nowhere in sight.

By: Diane Wedner: REALTOR® Magazine Online

The Southern California real estate market is cooling, but industry analysts say the tumbling prices, glut of houses, and 8 percent to 10 percent interest rates that marked the recession of the early 1990s are nowhere in sight.

Instead, business appears to be chugging alone, with prices up an average of 7.4 percent in the last year. The number of existing homes and condos sold has dropped as much as 13 percent in some areas, but new home sales, which make up 22 percent of the market, are showing strong gains, according to DataQuick Information Systems, a real estate research firm.

Most big builders, wanting to avoid a repeat of the '90s — when they were stuck with unsold homes after the recession hit — now build houses only after pre-selling them.

John Karevoll, chief analyst for DataQuick, says the psychological barrier to home buying — when interest rates reach a number that discourages buyers and pushes home prices down — is 7.8 percent, but economists don’t expect rates to reach that level.

So existing home sales have returned to what has been historically normal. Because some homes are on the market longer, David Toyama, a Coldwell Banker associate, has seen a subtle shift in favor of buyers, who for several years struggled to purchase properties — especially at the entry level — and finally are getting some breaks from sellers willing to accept contingencies.

"I love this market right now,” says Toyama. "Sellers are more reasonable, buyers are getting in the market, and the flip artists are gone. We all win."

Read more!

Monday, July 24, 2006

Fed Chief Says Housing Slowdown Going Smoothly

All appears to be well with the slowing housing market, Federal Reserve Chairman Ben Bernanke told members of the House Financial Services Committee yesterday.

By: Barbara Hagenbaugh: REALTOR® Magazine Online

So far, all appears to be well with the slowing housing market, Federal Reserve Chairman Ben Bernanke told members of the House Financial Services Committee yesterday.

"The downturn in the housing market so far appears orderly. The level of [housing] activity is still relatively high on a historical basis," Bernanke says.

In response to questions about the risk of rising interest rate driving more mortgage holders into foreclosure, Bernanke says the Fed estimates that 20 percent of outstanding mortgages have variable rates and half of those are set to change interest rates this year.

"So there will be some effect on variable-rate mortgages," Bernanke says. "But it should be a relatively slow process that would provide some cushion."

Bernanke's testimony came a few hours before the Fed released minutes from its latest meeting in June, when policymakers raised interest rates for the 17th time in two years. The minutes largely echoed Bernanke's testimony on the economy and suggested Fed officials are unclear about what they will do with rates in the months ahead.

When asked directly about another increase, Bernanke refused to comment.

Read more!

Sunday, July 23, 2006

Top 5 ways to buy a profitable house or condo

A little investigative reporting goes a long way

By: Robert J. Bruss: Inman News

"I can't believe the mortgage company approved me to buy a condo in such bad shape." That's what I overheard a young lady tell her breakfast date at the coffee shop I like to visit on Saturday mornings. The place is always very busy. The tables are close together so it's hard not to overhear conversations at the adjoining tables.

Burying my head in the newspaper, I then heard her say, "But my dad remodels kitchens so I know he will make it a beauty." I wanted to tell the guy, "Marry her, she's on her way to a real estate fortune." But I kept quiet and looked away.

Then she went through a list of condo fix-up work she plans to make, such as fresh paint, new carpets and several decorating ideas. At that point, the guy changed the topic. If they marry, she will obviously be the real estate tycooness in that family.

HOW TO FIND A PROFITABLE HOUSE OR CONDO. If you are a typical house or condo buyer, you probably want to purchase a new or resale residence in near-perfect, "model home," move-in condition. That's fine.

But expect to pay full retail market value. That is not the way to make a profitable home purchase.

If you want to profit from your home purchase, as that young lady will, buy a house or condo needing profitable improvements. Extreme cases are called "fixer-uppers."

To be polite, some listing agents call them "tired homes." Having bought and sold many profitable residences over 40-plus years of investing, here are my top five criteria for buying a profitable house or condo:

1. ASK HOW MUCH THE SELLER PAID. The longer I'm involved with real estate investing, the more important I think this key question is. I wish I started asking it many years ago when purchasing investment properties.

Even if you find a house or condo in excellent condition, before making a purchase offer, ask your buyer's agent, "How much did the seller pay for this home?"

Most buyers don't ask this vital question. Your buyer's agent might be shocked. Just explain the reason you need to know is to discover how much negotiation room the seller has so you can buy the property. Your agent will be thrilled to learn you plan to make a purchase offer.

For example, if you learn the seller paid $100,000 for the property many years ago, and the comparable home sales prices in the vicinity indicate it is worth $300,000 today, that seller has lots of negotiation room. However, if your buyer's agent checks the public records and discovers the seller paid $250,000 for that house last year, the seller doesn't have much negotiation room for you to buy a profitable house at a below-market purchase price.

2. ASK WHY THE SELLER IS SELLING. This is a controversial question for a home buyer to ask. Only the smartest buyers dare ask it. Knowing the seller's true motivation for selling is critical if you are to buy a profitable house or condo.

Often the listing agent doesn't know the answer. Be sure to communicate to your buyer's agent, who will then tell the listing agent, "I need to know so my buyer can make a purchase offer that meets the seller's needs."

Sometimes, you won't be told the truth. For example, if the reason for the home sale is a divorce, the listing agent might be reluctant to reveal that fact. However, I've found that to be important information so I can make a purchase offer providing cash to satisfy both sellers.

Or, if you learn the home is in foreclosure and the lender has scheduled a foreclosure sale in three weeks, you better be prepared to purchase fast before the seller loses the house.

I recall one situation several years ago where I asked the nasty listing agent why the sellers were selling a home I really wanted to buy for my personal residence. He arrogantly replied, "It's none of your business. Just bring a cash offer."

Not wanting to do business with him, I never made a purchase offer on that house. Later, I learned the sellers were very wealthy and were retiring to Palm Springs. I could have made a low-down-payment offer and they probably would have carried back a mortgage on very attractive terms.

3. LOOK FOR "THE RIGHT THINGS WRONG." This used to be my primary criteria for buying a house or condo at a bargain below-market purchase price. Although this reason is still ultra-important, it is no longer as important as the first two criteria.

That condo buyer who sat at the table next to mine a few weeks ago, understood this rule even if she didn't have it on her profitability list. By purchasing a condo needing a kitchen renovation, she was acquiring an almost instant profit opportunity, especially since her father is in the kitchen remodeling business.

"The right things wrong" mean profit opportunities. Often, all that is needed are a coat of paint and new wall-to-wall carpets. Additional profitable examples include new light fixtures, new appliances, fresh landscaping, and bathroom updating.

Examples of the "wrong things wrong" or unprofitable improvements include a new roof, foundation repairs, new plumbing or wiring, and new windows. The reason these obviously necessary updates are unprofitable is they add less market value to the home than they cost.

4. DEDUCT FROM MARKET VALUE FOR THE COST OF REPAIRS. Most sellers of houses and condos are well aware if their home needs repairs or updating to current market value standards. There are two ways for buyers to handle this.

One is to offer a low purchase price to compensate for the obviously necessary repairs. However, such an approach often upsets the seller who doesn't realize how much it will cost to bring their home up to neighborhood standards.

A better approach is to offer close to current market value, based on recent sales prices of nearby comparable houses or condos, but then list and ask for credits for necessary repairs, such as a new roof, foundation repairs, landscaping, and new plumbing or wiring. This method is often more effective because the seller then realizes all the work their "fixer-upper" needs.

5. ASK THE SELLER FOR AFFORDABLE FINANCING. Although home mortgage financing is easily available today, you might be able to do better in the right circumstances by asking the seller to carry back a mortgage for you. This can be especially valuable if the seller owns the home free and clear with no mortgage, you plan to immediately renovate the house to increase its market value, and you expect to refinance or sell the home after the improvements are completed.

To illustrate, if you offer a retiree seller a 5.5 percent interest rate on a carryback mortgage, that's better for you than is easily available at the local bank. However, be sure there is no prepayment penalty so you can refinance when you complete renovations to increase the home's market value.

As the old saying goes, "It doesn't hurt to ask." There is no easier mortgage lender than the home seller. My experience is retirees are especially anxious to finance home sales because they usually can't obtain such a high yield with the safety of a mortgage on their former residence if you fail to make the payments and they have to foreclose. By obtaining easy seller financing, you just increased your purchase profit even more.

SUMMARY: If you ask the right questions, your house or condo purchase can become a profitable investment. Whether you plan to keep your home purchase a short time or for many years, look for the "right things wrong" and the extra bonus profit opportunities, such as seller carryback mortgage financing.

Read more!

Saturday, July 22, 2006

Small defects become big turnoff for home buyers

10 must-fix areas of your home

By: Ilyce R. Glink: Inman News

One of the biggest mistakes home sellers make is listing a home with obvious, although small, problems.

Any house - even a brand-new house - needs fixing from time to time. It's just that buyers don't want to be reminded of this obvious truth when it comes time to plunk down their cash.

Most buyers would rather believe that their home is going to be fine, and for the money they're paying, they'd prefer to have a problem-free house.

As a seller, your top priority is to overcome any real or imagined obstacles buyers have. Fixing stuff that's broken and selling a home that looks like it's been impeccably maintained over the years is a good start.

Grab a pen and pad of paper and start by touring your home looking for things that need to be done. Perhaps your walls or trim need touching up with a fresh coat of paint. Or maybe you have a crack in a floor tile. Or, your wall clock needs a fresh set of batteries in order to display the correct time.

Check the bathrooms: cleaning or regrouting bathroom tile and fixtures will help make that room seem fresh and clean. Cracked window panes and ripped shades should be replaced before any agent or buyer walks through the door.

Not fixing broken items - especially those that can be easily fixed - sends a not-so-subtle message to the buyer that you don't care enough to get these things done. Also, when the home inspector comes through (which he or she inevitably will), you know these items will come up in the "need to do before I'll buy your house" list.

What should you fix? Anything that a prospective home buyer will think should be in working order on the day of sale, including: • All appliances, including air-conditioners, furnace, boiler and hot water

As you're walking around the house, remember that a prospective buyer will be opening up every drawer and door. How well these items work communicates a lot about how you've taken care of the property. Making a good impression here will go a long way toward getting your home sold quickly - and for more money.

heater. They don't have to be new, but everything should be in working order.

Clean out lint from the dryer. Make sure the ice maker is working properly.

Install new air filters in your heating and air-conditioning systems. Clean

out the air-conditioning compressors. Make sure your humidifier is working

properly.

• All faucets. If it leaks or doesn't turn on correctly, repair or replace it.

• All windows. If any window panes are cracked or don't open properly, fix or

replace. And make sure to repair all screen doors and windows.

• All doors. No creaking, no doors that open only partially, no cabinet doors

that don't open at all. If the windows are painted shut, fix them so that they

open properly.

• Any exterior problems. Replace missing roof shingles, repair your gutter if it

has come apart, and regrade landscaping away from the house if you've been

finding puddles or wet walls in your basement. Clean out your gutters and

downspouts.

• Cracked or chipped paint. A fresh coat of white or off-white paint can help

make your home seem bigger.

• Peeling wallpaper. Get some wallpaper glue and make sure to get the air

bubbles out when you press it to the wall.

• Change the light bulbs. Make sure all light bulbs are working and swap out the

burned-out bulbs. Houses are often too dark when buyers come through in the

late afternoon or evening for a showing. Make sure every light you have has

the brightest wattage possible, and that you turn on every light before a

showing - even during the day.

• Carpet. If your wall-to-wall carpet has been pulled up in places, make sure it

is tacked down firmly. And while you're at it, you might want to have your

carpets cleaned and floors waxed before you sell.

• Kitchen cabinets. Doors should open smoothly; hinges and knobs or pulls should

be tightened.

If you can't manage to get your home in selling shape yourself, check the Web for local handyman- or handywoman-type businesses to help you out. Typically, you can hire these folks for an hourly or flat fee to take care of your "to do" list.

While you may spend a couple of hundred dollars having someone install a new light fixture, fixing creaky doors or changing light bulbs, the results should make the expenditure worthwhile.

Read more!

Prepaying mortgage principal offers best bang for buck

Savvy homeowner capitalizes on investment strategy

By: Ilyce R. Glink: Inman News

Q: I'm seriously considering paying off my mortgage. I've read several articles both pro and con, including a reply you wrote to someone with the same question. My situation may be a no-brainer, but I just want to be sure.

I'm 50 years old, unmarried with no dependents. I bought my house in 1993 for $63,000. My interest rate is 6.25 percent and I have a balance of $19,500.

My annual income is under $25,000 a year. I don't see it increasing much in the future. I still manage to save. I rarely have enough deductions to itemize on my federal income tax return. Therefore, I don't benefit much from the home mortgage interest deduction.

I've been pre-paying principal $100 monthly for about the past six years. I have enough cash on hand to pay off the balance and still have some cash left over.

Still, I hesitate to just go ahead and pay off the loan. Should I use my cash to invest in more real estate, which would increase my mortgage deduction (as well as my debt burden, of course)? I know I could invest the cash in other investment vehicles, but I'm very cynical about the stock market. What's your take?

A: First, congratulations on doing such a remarkable job of saving and building a solid net worth on less than $25,000 per year.

Your question is a good one. The primary reason people tend to pay off mortgages is to preserve cash flow. In other words, they need to free up more cash each month, and paying off the mortgage is a way to do it.

Another reason to pay off your loan is that your cash will earn a whole lot more than just sitting in a bank earning 1 percent or 2 percent interest. Why? Your interest rate is 6.25 percent. When you pay off the loan, your cash will actually earn your net rate of interest. You don't itemize, so each dollar earns 6.25 percent when you prepay your mortgage.

Once you pay off your balance, you will be able to rebuild your savings quickly by banking your mortgage payment (plus the $100 extra) each month.

On the other hand, some financial advisors would advise you not to pay off your mortgage because the interest rate is pretty low. Instead, they'd advise you to invest it in either stocks or real estate. The trick is, you'll have to find an investment that is earning in excess of 8 percent per year in order to get the same post-tax bang for your buck as prepaying your mortgage.

If you decide to invest in real estate, you'll want to find someplace relatively close by for your first property. Look for something you can fix up on your own, easily rent out, and that hopefully will appreciate in the future.

Investing in real estate now is kind of tricky in many areas because of the steep appreciation over the past 15 years. That could change in some areas, which would work to your advantage. If your neighbor is having financial trouble, for example, you may be able to buy his or her house for a little cash and take over the payments.

Q: My ex-husband and I purchased a timeshare many years ago. When we divorced, the timeshare was forgotten about and was therefore never addressed in our divorce mediation. We used our timeshare one time. I thought that he was keeping up with the payments but apparently not.

I received a summons today that a lawsuit is being filed against us and that we owe an amount close to $5,000. I cannot afford a lawyer. I did try to contact the timeshare's lawyer when we were first contacted, but did not get any response. I just want to know what can happen in my situation. Thank you so much.

A: It's unfortunate that neither you nor your husband remembered the timeshare in your divorce settlement, and that you never checked to see if the annual payments were being made.

Now, you've got a much bigger problem. You do owe this money and because the timeshare company has filed suit against you, it will start to affect your credit history and credit score - if it hasn't already. (You can check your credit history for free at AnnualCreditReport.com, and purchase your credit score there for around $6.95.)

You must answer the lawsuit and contact your ex-husband to work out how you are going to pay off this debt. You must also figure out how you and he will sell (or if you can't sell, then somehow unload) this timeshare.

The summons should tell you when you need to show up at court. If it doesn't, you can call or stop by the courthouse and look up when you need to be there. If you can't afford an attorney, you might want to consult with one for an hour or so, simply to learn what you'll have to do to defend yourself.

Or, if you truly don't have a dime, you may want to contact your local legal aid society.

So many people have written to me about timeshares over the years. Caught off-guard while seeking a free lunch, they sign papers thinking they'll use the timeshare for years to come. While some vacationers do like going back to the same place year after year (or can trade their timeshare for one in other places), many people regret their moment of financial indiscretion for the next 10 years.

The best advice I can give anyone about timeshares is this: If you're invited for a "free" lunch, leave your wallet, checkbook and credit cards in the hotel room safe - and don't sign anything.

Read more!

Friday, July 21, 2006

For-Sale Signs Multiply Across U.S. As Supplies Rise and Prices Slip

The housing market continues to weaken in much of the country as inventories of unsold homes rise and many sellers cut their asking prices, a quarterly survey by The Wall Street Journal shows.

By: James R. Hagerty: The Wall Street Journal Online

There is no sign of a broad collapse of housing prices about a year after the once-hot coastal markets entered a long-anticipated cooling phase. But the general level of prices is edging down in some areas and leveling off in others, while the supply of homes for sale keeps rising.

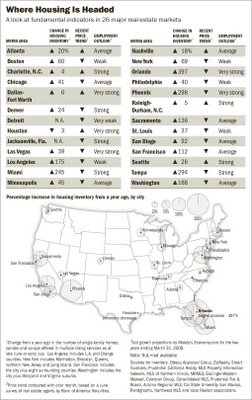

The number of homes on the market in Orlando, Fla., for example, is nearly five times the year-earlier level, while the inventory has quadrupled in Phoenix and Tampa, Fla., and nearly tripled in the Washington, D.C., area.

Use an interactive tool to search the latest data on housing inventories and price trends in 26 real-estate markets and see photos of houses on the market.

In another sign of the housing market's growing weakness, the Commerce Department said housing starts fell 5.3% last month from May, to an annual rate of 1.85 million.

One effect of the softening in many markets is that more sellers are willing to dicker. "Let's make a smoking deal," John Nichols wrote in a Craigslist.org ad for his three-bedroom ranch house in Sacramento, Calif., this week. He is seeking $315,000 but adds, "Make an offer. You won't necessarily insult me." Although the backyard is "currently a dump," Mr. Nichols says, the kitchen countertops are granite and the dual-pane windows are new.

To examine the residential real-estate prospects for 26 major metro areas, The Wall Street Journal gathered data on inventories of homes for sale at the end of the second quarter from a variety of local sources; pricing trends based on surveys of real-estate agents by Daniel Oppenheim, an analyst at Banc of America Securities in New York, a unit of Bank of America Corp.; and projections of job creation by Moody's Economy.com, a research firm in West Chester, Pa. Employment trends are among the most important factors in determining demand for housing.

Metro areas showing large increases of homes for sale and relatively weak employment growth include Boston, Los Angeles, Philadelphia and New York. Among the strongest markets overall are Houston, Dallas-Fort Worth and Seattle. All three areas are benefiting from robust job markets, and modest home prices are drawing investors and new residents to Texas.

In Massachusetts, where the job market is flagging, the median sale price for single-family detached homes in May was down 1.2% from a year earlier and nearly 6% below the peak reached in July 2005, according to the state's Association of Realtors. The supply of homes available for sale in May was enough to last 11.3 months at the current sales pace, up from 8.7 months a year earlier.

A June survey of real-estate agents by Banc of America Securities found that home prices had weakened from the prior month in 30 of the 42 metropolitan areas covered. The markets with the weakest pricing trends included Boston, Detroit, Phoenix, St. Louis and Washington, D.C.

In Miami prices have been about flat in recent months, says Ronald A. Shuffield, president of the brokerage firm Esslinger-Wooten-Maxwell Inc. Mr. Shuffield says he expects prices of condos in less-attractive parts of the Miami area to fall slightly in coming months. For condos in better parts of the area, he believes prices during the next year will range from about flat to as much as 5% higher.

So many new homes are available on the outskirts of Phoenix that it is "a total bloodbath," says Ivy Zelman, a Cleveland-based housing analyst for Credit Suisse Group. She doesn't see a recovery in most major metro areas in the near term. "It could actually get worse before it gets better," she says.

Conditions can vary considerably within a metropolitan area and among different types of housing. Sherry Chris, chief operating officer of Prudential California Realty, says condo prices in downtown San Francisco are about level with a year ago because new buildings have helped supply catch up with demand. Overall, the number of homes on the market in the Bay Area has more than doubled from a year earlier.

But in the suburb of Palo Alto, where the median home price is nearly $1.4 million, the inventory of homes has declined 2% from a year ago. Ms. Chris says she believes that reflects lots of hiring by Google Inc. and other technology firms.

Among the 26 metro areas, Orlando shows the biggest surge in inventory. But the supply was unusually lean a year ago, says Beverly Pindling, president of the Orlando Regional Realtors Association, and job growth is very strong. Ms. Pindling says prices in the Orlando area generally are down about 3% to 7% from a year ago. Home builders, eager to make sales, are "romancing the Realtors," she says; some are offering agents who bring in buyers commissions of up to 10%.

Kent Fowler, a real-estate agent and investor in Washington, is bracing for an extended period of pain. Construction was recently completed on a condo near the city's Chinatown district that he bought in 2004 for $629,000. Mr. Fowler believes the two-bedroom condo, with a view of the Washington Monument, now is worth at least $800,000. But potential buyers are scarce in today's glutted market. So he is trying to find a renter for the condo for the next year or two at around $3,500 a month, even though that rental income would fall about $900 short of his monthly loan payments, condo fees, taxes and insurance.

Some sellers are advertising prices below recently appraised values, and others are offering to help pay closing costs for buyers who are short on cash.

Many Realtors say the media have overplayed weakness in the market. Richard A. Smith, vice chairman and president of Realogy Corp., the real-estate brokerage business due to be spun off from Cendant Corp. soon, says 2006 "will be the third best year in the history of the business" in terms of total home sales, despite the cooling trend. The National Association of Realtors projects that sales of previously owned homes will fall 6.7% from last year's record.

While many investors have been scared out of the market, Mr. Smith says, plenty of other people must buy new houses because of changes in their lives, such as a new job or a divorce.

Others sound more cautious. "I do think we're going to see some tougher times ahead," says Scott Anderson, senior economist at Wells Fargo & Co. in Minneapolis. By August, he says, most cities in California will be showing modest declines from a year earlier in home prices, and prices also may decline further in parts of Florida, Nevada, Arizona and the Northeast.

Headlines about falling prices could make buyers more aggressive in negotiating and persuade some sellers to "get out with what they can," Mr. Anderson says.

Mr. Anderson expects the current downswing to last into next year; by late 2007, he thinks the market will be stabilizing. Though he doesn't expect a recession in the next couple of years, he says the housing market would be much weaker if one occurs. In the past, steep declines in home prices have tended to hit only metropolitan areas that have suffered major job losses, he says.

William Wheaton, a housing economist at the Massachusetts Institute of Technology, says the wild cards include how many investors or second-home owners will dump properties on the market and how many borrowers will default. Even if there is no surge in defaults or selling by investors, he says, some of the formerly hot local markets may be heading into five or 10 years of flat to slightly higher home prices. He believes many baby boomers on the coasts will cash out of expensive homes and move to cheaper areas; that would restrain price increases along the coasts.

Read more!

Thursday, July 20, 2006

The Weekend Guide! July 20 - July 23, 2006

The Weekend Guide for July 20 - July 23, 2006.

Full Article:

Read more!

Renting Can Cost 7 Times More Than Owning

Owning a home makes financial sense for a lot of current renters, but many are reluctant to take those first steps. Here's how to help them move forward.

NAR: REALTOR® Magazine Online

Renting can cost more than seven times more than owning per year, according to a newly revised consumer education brochure from the NATIONAL ASSOCIATION OF REALTORS®.

The brochure poses the question “Why rent when you can buy?” and challenges certain assumptions about renting versus buying. Its goal: To serve as another tool to help you work with customers to evaluate whether home ownership is the best move for them.

“Housing is a good investment, and owning a home makes sense for a lot of current renters, but many would-be home owners are reluctant to take those first steps,” says 2006 NAR President Thomas M. Stevens, senior vice president of NRT Inc., from Vienna, Va. “Given their experience with home buyer concerns and insight into local markets, REALTORS® can counsel consumers about their options and provide the information and support people need to begin their journey toward home ownership.”

Here are some key benefits of buying, as noted in the brochure: • The Federal Reserve Board estimates that home owners have a net worth nearly

“The decision to become a home owner involves financial and emotional considerations,” Stevens says. “Our REALTOR® members help millions of people into homes every year, one family at a time.”

36 times more than that of renters.

• Over the past 10 years, the cost of rental housing in the United States has

increased an average of 3 percent per year; average rents are projected to

rise 4.1 percent this year alone. With a 3 percent annual increase, a current

rental payment of $1,000 per month would increase every year and amount to

$137,567 after 10 years, with no wealth accumulation.

• By contrast, a $210,000 home purchased today with a down payment of $10,000

and a 20-year fixed rate mortgage at 6.5 percent would cost a steady $1,100

per month and yield a net worth of $138,521 after 10 years, assuming an

historic 4.5 percent annual appreciation rate.

Read more!

Wednesday, July 19, 2006

Buying a Duplex Has Clear Advantages

Besides receiving rent payments from a tenant to help pay the mortgage, there are tax benefits for duplex owner-occupants.

By: Susan E. Peterson: REALTOR® Magazine Online

Buying a duplex has long been a way for people with modest incomes to become homeowners.

Besides having rent from a tenant to help pay the mortgage, there are tax benefits for duplex owner-occupants. They can homestead the entire property, cutting the tax bill. And they can deduct the cost of repairs, improvements, and other expenses for the tenant’s half.

The price of duplexes has risen in the last several years, but the numbers still add up for many prospective duplex buyers.