Part 2: How to start investing in real estate

By: Robert J. Bruss: Inman News

There are many methods to become very wealthy, or just modestly wealthy, with your real estate investments. Although I have personally done "pretty good" investing in real estate, many of my friends, college real estate students and subscribers have done much better. I'm extremely happy for them! This four-part series will explore the question: Why do I want to invest in real estate? (See Part 1: First-timers find a place to call home.)

2 – I want to earn huge profits from appreciation in property market value. This is the primary reason many investors get started investing in real estate today. Big fortunes have been earned acquiring rental property, which is not the investor's principal residence. But in some areas, especially Las Vegas, real estate speculators have driven up property prices more than 40 percent in 2004. That rapid appreciation rate won't continue as mortgage interest rates gradually rise.

When I started investing in real estate, I thought the best type of profitable investment property to buy was apartment buildings. I read and re-read (and even outlined) William Nickerson's now-classic best-seller book "How I Turned $1,000 into $10 Million in Real Estate in My Spare Time" (now out of print, but still available at public libraries, and on e-Bay for around $100), which recommended starting with a small run-down rental property, fix it up, and then make an IRC 1031 tax-deferred exchange for a larger rental property. That became my formula! I traded up to a nine-unit apartment building in San Francisco overlooking the ocean and the old Playland at the Beach (old-timer San Franciscans will remember that classic place, near the famous Cliff House).

Although there is nothing wrong with using Nickerson's "forced inflation" to increase rental property market values, as I did with those nine units by making profitable improvements to raise the rents, including painting every apartment (because I couldn't afford to hire a professional painter at the time), I abruptly changed my "modus operandi."

On a vacation in Hawaii in the late 1970s, one morning I was sitting at the coffee shop counter of the Sheraton Princess Kaiulani Hotel across from Waikiki Beach. I was re-reading Nickerson's great book. When I put it down, the Pan Am pilot sitting next to me said, "I see you're interested in real estate." That began a conversation that changed my real estate investment direction.

The pilot said he had recently taken an excellent real estate investment course from John Schaub and Jack Miller about "Making It Big on Little Deals." Thanks to that pilot, I got in touch with Schaub and Miller, signed up for their next seminar, and at that weekend course in Reno, Nev., I learned why single-family rental houses make the best real estate investments because they are easiest to buy, finance, manage and profitably resell.

After that weekend real estate seminar, I became quickly motivated to get rid of my nine-unit apartment building because I discovered why single-family houses were better investments for many reasons. As a further inducement, one evening I started receiving frantic phone calls from my nine tenants. I had made the big mistake of giving my tenants my home phone number. Never do that! I learned my tenants had no heat. In San Francisco, no matter what time of the year, in the evening having no heat in apartments is a "big deal." The boiler in my nine-unit building had quit! It was a Friday evening. Paying a repairman would cost me double-time. I called the repair company and they fixed the problem on Saturday morning for only 1.5 times their usual outrageous hourly rate. As a result, I sold that building (at a substantial profit) and henceforth began investing in only single-family rental houses where, at worst, just one tenant at a time has a maintenance problem.

The Schaub-Miller formula of investing in single-family houses, which have the best rate of market-value appreciation, has proven to be very profitable. Yes, there were a few years when my rental houses didn't appreciate in market value. Please be aware real estate goes in cycles – the long-term trend is always up, but there will be plateaus and valleys along the way. However, over the long term (and real estate investing is a long-term investment), I don't know of any better safe investment. Do you?

Incidentally, John Schaub just wrote a great new book recently published by McGraw-Hill titled, "Building Wealth One House at a Time." In that superb book, Schaub reveals that during his more than 30 years of investing in single-family rental houses, he has never obtained a bank loan to acquire a house. Instead, he uses seller financing and other finance techniques explained in his book, such as lease-options. Schaub still teaches his excellent course, "Making It Big on Little Deals." Phone him at 800-237-9222 for information on his next classes and multispeaker conferences.

Read more!

Sunday, November 06, 2005

Single-family homes best spot to sink money

Panel revises real estate loan interest tax writeoff

Proposed cap on tax deduction for home mortgages raised to 25%

Inman News

Responding to sharp criticism of its initial proposal to slash the tax deduction for home-mortgage interest, President Bush's tax-restructuring panel offered a revised and final plan Tuesday to increase its proposed cap on the write-off by 25 percent, media accounts said.

But the new level - ranging from $227,147 to $411,704 depending on a region's housing prices - still would be far below the average mortgage in high-price markets such as the San Francisco Bay Area, New York City, Washington, D.C., and South Florida, accounts said.

Homeowners now can write off interest on up to $1.1 million in mortgage debt.

The tax panel's mortgage-interest recommendation is viewed as a long shot to become law.

Even boosting the proposed cap by 25 percent didn't stop the panel's plan from being criticized by officials ranging from California's state treasurer to leading Democrats in the House of Representatives from San Francisco, Maryland and Illinois.

The panel's report notes that fewer than 30 percent of American taxpayers benefit from the mortgage-interest deduction, and fewer than 5 percent of mortgages would be affected by reducing the $1 million cap. The panel said current policies raised the question of "whether the tax code encourages overinvestment in housing at the expense of other uses," according to media reports.

The panel proposes to replace the current mortgage-interest deduction - which can range in value depending on a homeowner's tax bracket - with a 15 percent tax credit on mortgage interest that would be available to every taxpayer. The plan would phase in over five years for existing mortgage holders.

The new cap would be linked to Federal Housing Administration mortgage limits set county-by-county each year based on the cost of a "modest" home. Those limits range from $172,632 in low-cost states to $312,895 in the most-expensive counties.

Read more!

Realty Q&A: Has the Market For Real Estate Run its Course?

Lew Sichelman on whether housing's long run is coming to a close, what might make your credit score go up or down, and other issues on people's minds.

By: Lew Sichelman: The Wall Street Journal Online

Issues on people's minds: Is housing's long run coming to a close and more on what might make your credit score go up or down.

Question: My husband and I attended a seminar featuring Suze Orman. It was definitely filled with distress as she talked about the possibility, in the near future, that we would no longer be able to declare tax credits for our mortgage payment interest, property taxes ... that interest rates will go off the wall unless you have a fixed mortgage at the lower rate (we have an ARM). My 24-year-old son lives in Miami, where he's purchased four condos, three as rentals. I'm worried about him surviving and I'm worried about us. My husband is 52 and I'm 49. I wanted to buy another home to fix up and sell, but Orman made it sound like that would be a bad idea. Can you tell me if real estate has run its course? Michele Bosca.

Answer: Real estate is probably at the top of its current cycle and destined for a slow down. But hold on just a moment. Housing's favorable tax treatment is not going to change, at least not any time soon. And mortgage rates are not projected to go any higher than 6.5% to 7% in the next two years.

The president's tax reform panel isn't due to make its formal recommendations until Nov. 1. But even it meets that deadline the White House has to put its stamp of approval on the ones it likes. Then Congress gets to have its say. So it will be a good two years, if that, before anything happens. And some lawmakers, not to mention the housing lobby, already are circling their wagons.

So far, the panel has discussed in open meetings the possibility of ratcheting down the cap on the deduction - not a credit - for interest paid on a mortgage from the current $1.1 million debt ceiling to $300,000-$350,000. Also on the table are the elimination of write-offs for property taxes, state income taxes, second homes and home-equity loans.

But it has always been expected that these deductions would be in play, or at least open to debate. And again, nothing is concrete, and nothing will be adopted without a major pitched battle.

Al Mansell, president of the National Association of Realtors, says the discussion and the media attention it has received has already had a "chilling" effect on the real estate market, particularly in high-cost areas. Whether that's just so much rhetoric or not remains to be seen, but the Salt Lake City broker told the tax reform panel in a letter that it "must understand that limiting or eliminating tax benefits will have an adverse impact on housing markets and the value of housing."

Similarly, America's Community Bankers, which speaks for small, local thrift institutions, is warning that the panel's "ill-advised proposal" to wipe out the mortgage-interest deduction could push the economy into a recession.

"Changing the interest deduction as proposed would constitute an abandonment of support for the housing aspirations of millions, and greatly diminish the net wealth of middle-class families," executive vice president Robert Davis said in another letter to the committee.

Others have weighed in as well. But you get the idea: A war is brewing.

As far as mortgage rates are concerned, they're certainly trending higher. But no one I know or hear is predicting anything outrageous. Indeed, rates just this month pushed past the 6% mark for the first time in several months. And the worst forecast I've seen to date is for 7%t. But a gradual run up in rates could be good for housing, not bad, because it will give incomes a chance to catch up to hyper-inflated house prices.

Over the last 30 years, housing costs have averaged 2.6 times disposable household incomes, according to economist David Wyss at Standard and Poor's, the Wall Street rating agency. But currently the national price-to-income ratio is 3.2 percent and two to three times that in many coastal markets, including several in Florida where your son is.

In a rising-interest-rate environment, it's always good to lock in rates with a fixed loan. But as long as rates don't go sky-high - and there is no indication they will - the garden-variety adjustable rate mortgage won't kill anyone. It's the crazy interest-only and pay-option ARMs that are dangerous and should be jettisoned as soon as possible, preferably before their initial annual adjustment.

As for house prices, I'm afraid the days of double-digit increases are behind us. Most prognosticators - even those who have no vested interest in the housing market - believe the best owners can hope for is appreciation rates of 3% to 5% over the next few years.

The most dire forecast, this one from Mark Zandi, chief economist of Economy.com, is for a "severe adjustment" in which values will not be rising at all by 2007. That's a tune he's been signing for two years, though.

At the same time, prices could take a tumble in markets where the all-important price-to-income ratio is way out of proportion - places like San Diego, where the ratio is 9.68, and Miami, where it is 6.84.

But the chances are they won't fall back by much, if they decline at all. The odds are much better that prices will simply stop rising so fast.

Clarification of FICO scoring

Craig Watts, public affairs manager at Fair Isaac Corp. writes to object to a part of my answer to a recent question about credit scores, saying it "includes and perpetuates a myth" about FICO scoring that he'd like to see dead and buried.

"A person's FICO credit score will never improve because she closes an account, unused or otherwise," he says. "In fact, closing an account can occasionally have the opposite effect on one's FICO score, depending on what else is on her credit report."

"The FICO credit score algorithm does not look at a person's available credit as an isolated factor when calculating one's score. So having a lot of unused credit will not by itself hurt one's FICO score. Fair Isaac's own research has demonstrated that the amount of available credit by itself is not nearly as predictive of future credit behavior as it's often cracked up to be. That's why we did not include it as an independent factor in the FICO scoring algorithm.

"Instead, the FICO algorithm looks at available credit in comparison to outstanding debt, from which it produces a 'credit utilization' percentage that is, in fact, used in the calculation of one's score. Maintaining low balances helps one's FICO score by keeping that credit-utilization percentage low, among other benefits."

Watts says what confuses some people in the mortgage industry is the fact that some lenders still take available credit into account as an isolated factor, separate from the applicant's FICO score. And in satisfying a lender's request to close unused accounts, he reiterates, an applicant may in fact be harming her FICO score.

Fortunately, he also reports lenders are slowly dropping this factor as an independent underwriting criteria.

By the way, the offending advice was mine, not that of Ginny Ferguson, the Pleasanton, Calif., mortgage broker on whom I rely on for help understanding credit scoring - and who may never speak to me again. Sorry, Ginny.

Email your comments to rjeditor@dowjones.com.

Read more!

Saturday, November 05, 2005

Investors say housing market overvalued

But majority still see real estate as better investment than stocks, survey finds

Inman News

Investors overwhelmingly believe the U.S. housing market is overvalued, but still see real estate as a better investment than the stock market, according to a survey released this week by financial services organization TIAA CREF.

"There is a notable disconnect between the run-up in housing market values investors are seeing as homeowners, and their desire to participate in an attractive asset class like real estate over stocks and bonds," said Tom Garbutt, TIAA-CREF managing director and head of real estate.

According to the study, conducted by Roper Public Affairs and Media for TIAA-CREF, nearly three out of four investors, or 73 percent, believe housing in the U.S. is overvalued, while just one in five, or 19 percent, believe it is valued appropriately. Middle-class investors, which comprise those with household incomes from $25,000 to $74,999, are particularly likely to see U.S. housing as overvalued.

Despite their belief that the housing market is overvalued, investors still overwhelmingly see real estate as a better investment than the stock market, according to the survey. In a head-to-head match-up, 69 percent of investors said that real estate is a better investment compared to just 24 percent who said the stock market is a better investment.

While three-quarters of investors believe that the national housing market is overvalued, just 58 percent say housing in their community is overvalued, with more than a third saying housing in their community is valued correctly.

"Investors are reluctant to believe their own housing market is overheated," said Garbutt. "I guess you could say perceptions of real estate valuations are local. "

Investors most often cite residential properties (rental properties or summer and second homes) as the source of their real estate investment with virtually none pointing to commercial real estate investments.

Unlike residential real estate, which many experts believe is overvalued in certain markets, pricing for commercial real estate has remained within appropriate levels even if the market has gotten more aggressive, according to Garbutt.

"On a relative basis, commercial real estate still appears to be priced appropriately when compared to stocks and bonds," said Garbutt. "That's why we believe commercial real estate can play an appropriate role in helping investors saving for retirement build well-diversified portfolios."

Other key findings from the study include: • Three-quarters of investors say they have no plans in the future to sell their

primary residence and use the proceeds for their retirement income, even

though they view real estate as a better investment than the stock market.

• Thirty percent of investors say they own real estate investments in addition

to their primary residence. Investors are most likely to have residential

rental properties (14 percent), second homes (13 percent) and vacation homes

(10 percent) as their real estate investments, while commercial real estate (7

percent) and REITs (3 percent) are less common.

The survey findings are based on a national telephone survey of 1,001 American investors age 30 and older who have investments in stocks, bonds, mutual funds, T-bills, a 401(k), an IRA or other investment products.

Read more!

Reducing Tax Deductions Could Hit Property Values

By: Eduardo Porter; David Leonhardt: REALTOR® Magazine Online

Housing market experts say the proposal by a White House advisory panel to reduce residential mortgage deductions and eliminate tax deductions for property taxes would have a negative impact on property values for millions of homeowners, especially those living in high-priced markets in California and the Northeast.

The Mortgage Bankers Association cautions that the plan will become "a tax increase" for many working families; while the NATIONAL ASSOCIATION OF REALTORS®, which forecasts a 15 percent decline in home prices nationwide, frets that it will be disastrous for the housing market.

"Almost any economic analysis will conclude that there will be some downward effect on prices, especially at the top of the market," concedes James Poterba, an economist at the Massachusetts Institute of Technology and a member of the president's panel. "The question is how large it will be."

A study from the Center for Economic Policy Research in Washington, D.C., shows that homeowners in expensive markets who attempt to keep their monthly house payment steady could see prices decline by more than 20 percent, and significant losses for owners of high-priced homes in cheaper markets could occur as well.

The hit that homeowners are expected to take would be somewhat softened by the panel's plan to phase in the reforms over a five-year period.

Read more!

Real estate inheritors learn value of living trusts

Time-consuming probate court raises costs, invites capital gains tax

By: Robert J. Bruss: Inman News

DEAR BOB: After our mother died in August 2003, my brother and I inherited her assets, which consisted mainly of her house plus stocks and bonds. Her will left everything to us equally. But the estate had to go through probate court proceedings. We just received title to her home recently and listed the house for sale with a local Realtor. Meanwhile, the house was vacant, costing us upkeep expenses. The only good thing resulting from the probate court delay is the house appreciated about $100,000 in market value. However, our probate attorney now tells us we will owe capital gain tax because our "stepped-up basis" was determined on the date of our mother's death. Why isn't there a law against this probate rip-off? – Cindy R.

DEAR CINDY: If you are a regular reader, you know I constantly admonish readers to arrange a revocable living trust to avoid probate costs and delays for their heirs.

Obviously, your mother didn't follow that advice. As a result, you and your brother suffered through two years of unnecessary probate court delays and costs.

I especially relate to your situation because I encountered an 18-month delay in Minnesota probate court after my mother died several years ago. Her Minnesota attorney erroneously told her not to put her condominium title into her living trust (which would have avoided probate).

When she died, the condo title had to go through probate. Most states have similar probate court costs and delays.

The only good thing about probating your mother's house was it rose in market value during the two-year delay. But the bad result is that appreciation in market value is taxed as a capital gain.

HOW LONG IS HOME BUILDER LIABLE FOR DEFECTS?

DEAR BOB: In July 2002 we bought a brand-new townhouse. We had it professionally inspected and everything appeared in good condition. But in August 2004, the slab foundation cracked. We noticed a bulge under the carpet in our living room. Immediately, we notified the builder. He said we had a one-year warranty and the concrete slab bulged or cracked after that so we are out of luck. Is this true? – Bruce N.

DEAR BRUCE: The laws of most states require home builders to warrant their homes for longer than one year. You didn't report where the townhouse is located.

I suggest you consult a local real estate attorney to determine your legal rights against that home builder. In some states, such as California, the home builder is liable up to 10 years for construction defects.

BEWARE OF A $1 QUIT CLAIM DEED

DEAR BOB: On my way driving to work every day I go by a run-down abandoned house. I have observed it for at least a year. One day I stopped to jot down the address, walk around it, and ask the neighbors. They said a "strange old lady" owned the house. I researched the title and learned the property taxes hadn't been paid for some time. I finally located a man who claims to be the old lady's son. He said the property is in bad shape and he could give me a quit claim deed for $1 since he inherited the house after his mother died. Should I get involved, knowing the house needs work? – Norman O.

DEAR NORMAN: For $1 it's hard to go wrong, unless there are recorded liabilities against the property. Before you accept that $1 quit claim deed, please consult a local title insurance company to learn if the son's quit claim deed is insurable.

If you can buy an owner's title insurance policy for that house, you may have discovered a super bargain. However, if the title insurer tells you there are lots of unpaid liens against the property, or perhaps the son doesn't really own the property, maybe you should pass on that opportunity.

Please be aware a quit claim deed conveys only whatever title the grantor owns. If that son doesn't own the property, his quit claim deed is worthless.

The new Robert Bruss special report, "How to Earn Up to $250,000 (or more) Tax-Free Profits Every 24 Months Buying and Selling Houses," is now available for $5 from Robert Bruss, 251 Park Road, Burlingame, CA 94010 or by credit card at 1-800-736-1736 or instant Internet PDF delivery at www.bobbruss.com. Questions for this column are welcome at either address.

Read more!

Friday, November 04, 2005

Pending Home Sales Index Close to Record

NAR: REALTOR® Magazine Online

Pending home sales, a leading indicator for the housing sector, eased slightly but is at the second-highest level on record, according to the NATIONAL ASSOCIATION OF REALTORS®.

The Pending Home Sales Index, based on contracts signed in September, slipped 0.3 percent to a reading of 128.8 from a record of 129.2 in August, and is 3.3 percent higher than September 2004.

The index is derived from pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed; pending home sales typically are finalized within one or two months of signing.

David Lereah, NAR’s chief economist, says the index shows a lot of momentum. “We’re still seeing a post-Hurricane Katrina boost in home sales activity, where the needs of displaced residents are supplementing a fundamentally strong market,” he says. “Aside from this temporary lift, the market is entering a period of transition in which we will see a somewhat slower but more sustainable pace of home sales—a period that is expected to be historically healthy. This will help to create a better balance between home buyer and sellers, so price appreciation should be cooler as well.”

Many post-Hurricane Katrina sales in the region surrounding the disaster zone were bulk sales by companies that were obtaining housing for employees; some of those sales closed quickly in September with others expected to be recorded in data for October and November.

An index of 100 is equal to the average level of contract activity during 2001, the first year to be examined. 2001 was the first of four consecutive record years for existing-home sales, with activity in that year being fairly close to the higher level of home sales projected for the coming decade relative to norms during the mid-1990s. A Pending Home Sales Index of 100 coincides with a historically high level of home sales.

Regionally, the highest PHSI was in the South, where the index slipped 1.6 percent in September to 139.1 from a record in August, and was 6.3 percent higher than September 2004. In the Northeast, the index rose 1.8 percent to 110.4 in September and was 0.8 percent above a year ago. The Midwest index rose 0.3 percent to 119.7 in September, and was 0.4 percent below September 2004. The index in the West held even at a level of 136.7, and was 3.6 higher than a year ago.

Read more!

Is It Time to Remodel The Homeowner Tax Break?

By: Robert Guy Matthews: The Wall Street Journal Online

One suggestion from President Bush's tax-reform advisory panel - restricting the deduction for mortgage interest - raises the question: How far should the U.S. government go in encouraging homeownership?

President Bush's tax-reform advisory panel today will urge significant changes in how American households and businesses are taxed. But one of its recommendations - restricting the deduction for mortgage interest - already is making headlines and drawing political fire.

The suggestion calls attention to a debate among academics and policy wonks: How far should the U.S. government go in encouraging homeownership? Does the U.S. tax code's tilt toward homeowners cause Americans to overinvest in housing? Would changing the tax code bring down home prices?

This is just one issue in the report that the nine-member, bipartisan commission is expected to approve today. The panel backs two alternatives to the tax code: a streamlined version of the current income tax and a revamped tax strategy designed to encourage more saving and investment. Neither is likely to become law as proposed, but they will frame a debate likely to go on for years.

Both options curtail the current tax break for homeowners that allows Americans who itemize their deductions to deduct interest on mortgages of as much as $1 million. The deduction is worth more to upper-income taxpayers: $10,000 in interest deductions cuts the tax bill by $3,333 for someone in the 33% bracket, but $1,500 in the 15% bracket.

The panel suggests turning the deduction into a tax credit equal to 15% of eligible mortgage interest, which means the tax break for interest on a $100,000 mortgage would be the same for every taxpayer, regardless of income. It suggests lowering the $1 million ceiling to the size of an average mortgage, using Federal Housing Administration regional data.

In today's real-estate market, the ceiling would range from $172,632 in rural areas to $312,895 in the urban corridors of New York City, Boston, Washington, D.C., and parts of California. The FHA says about 81% of its loans are close to the lower end and about 2.5% of loans are in the ceiling range.

The change would mostly affect only taxpayers in higher brackets with above-average mortgages. Under current interest-deduction rules, a taxpayer in the 35% income bracket with a $500,000 mortgage at 6% in the country's pricier urban corridors can reduce his or her taxes by just over $10,000. By contrast, under the new proposal, that same individual could claim a credit of roughly $2,800, according to Goldman Sachs.

The commission also recommends ending tax breaks for second homes and home-equity loans. In its proposal, current homeowners would be able to keep their original mortgage-interest deductions, which would change only if the homeowners refinanced or purchased a new home.

The panel didn't wipe out the tax deduction for housing altogether as it did the deduction for state and local taxes. President Bush, in appointing the panel, asked members to "recognize the importance of homeownership."

"We were relieved of the philosophical question of whether homeowner preferences should be in the tax code," said Charles Rossotti, a former IRS commissioner and one of the architects of the mortgage-interest proposal. The goal, he said, was to "make sure that it is still possible to own a home," but to reduce the size of the tax break for housing - giving the panel the money it needed to fix other parts of the tax code - and to restructure it so the break isn't so tilted in favor of high-income taxpayers.

Nevertheless, the housing industry was quick to criticize the proposal. "The tax deductibility of interest paid on mortgages is both a powerful incentive for homeownership and one of the simplest provisions in the tax code," said Al Mansell, president of the National Association of Realtors. "It should not be targeted for change."

The association warned that the plan would push down prices of homes, especially upper-end ones. Homebuilders and mortgage bankers sounded similar alerts, as did some think-tank economists. The proposed change "would have a negative impact on the home-building industry," says economist Adam Carasso of the Urban Institute, a think tank in Washington.

Admirers of the proposal say curtailing the tax code's tilt toward housing is in the nation's long-term economic interest because it might divert savings to other parts of the economy, and that any downward pressure on home prices caused by the tax change would be modest and manageable. Backers also say that it is wise to restructure the tax break so it doesn't benefit higher-income taxpayers as much.

Richard K. Green, a tax economist at George Washington University, calls the proposal "conceptually...really a good idea," and says the panel wisely focuses the tax break for homeownership on families who might otherwise not be able to afford to buy a house.

Other economists question the industry's assertion that watering down the housing-tax break would reduce homeownership. About 68.6% of Americans own their homes, according to the Census Bureau. Australia, Canada, New Zealand and the United Kingdom don't have such tax breaks but have similar levels of homeownership.

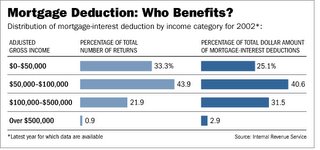

In its deliberations, the tax panel looked at who benefits from the current mortgage-interest deduction. Their answer: Mostly higher-income earners who itemize deductions on their tax returns rather than taking the standard deduction. Two-thirds of taxpayers don't itemize, the Internal Revenue Service says.

And, the IRS says, about 35% of the tax savings from the mortgage-interest deduction goes to taxpayers with gross annual incomes above $100,000. In the U.S., 9% of taxpayers earn more than $100,000.

But the politics of reducing this popular tax break, even as part of a broader tax overhaul, are tough. Sen. Max Baucus of Montana, senior Democrat on the Senate Finance Committee, said the mortgage-interest cap wouldn't get through Congress. In the 1990s, caps on mortgage interest were considered but quickly dropped because they were politically unpopular.

Even Mr. Rossotti acknowledges that the mortgage-interest cap has a slim chance of success. But he argues that Americans don't benefit as much from this deduction as they think; the tax break for mortgage interest is offset by factors that boost the taxes of those who take advantage of it.

"It is one of the great deceptions in the tax code," Mr. Rossotti said. "I defy anyone to try to figure out the interaction between what you get after phase-outs of the personal exemption, phase-outs of the itemized deductions, how much is taken back because of the alternative minimum tax and state and local taxes."

Email your comments to rjeditor@dowjones.com.

Read more!

Thursday, November 03, 2005

The Weekend Guide! November 3 - November 6, 2005

The Weekend Guide for November 3 - November 6, 2005.

Full Article:

Read more!

Shopping for a Home in Winter: A Strategy for Bargain Hunters

If you want to get the most house for the money, start your legwork now.

By: Marshall Loeb: The Wall Street Journal Online

Come spring, you'll have more competition for the best deals.

If you've been thinking about buying a new home, winter is the time to start getting serious.

Here are a few reasons to brave the cold and go on a house hunt:

The winter season has fewer units on the market, and sellers tend to need to move from their property. You can use that to your advantage to get a favorable deal.

Winter has fewer buyers in the market. Looking for a home in the winter can be inconvenient, and people are less likely to move. Families also tend to be on a September to June cycle because they are unwilling to move their children to a new town in the middle of the school year. Fewer buyers means less competition.

Lenders also usually have fewer loans to process and less paperwork to deal with (though this can change quickly if rates fluctuate). With lenders less hassled, you can expect a smoother process to get approved for a mortgage. But, as reported in Bankrate.com, there are exceptions to this rule, most notably in warmer parts of the country (especially Florida), ski towns, and in parts of the country where demand is so strong that it will not slacken during the winter months.

Finally, as all savvy shoppers know, after the holiday season comes the season of bargain opportunities. This includes houses, as well.

Email your comments to rjeditor@dowjones.com.

Read more!

C.A.R. says proposed change to deductibility of mortgage interest "DOA"

The proposed tax reform affecting the deductibility of mortgage interest will be "dead on arrival in Congress," says C.A.R. President Vince Malta.

California Association of REALTORS® (C.A.R.)

The proposal, submitted yesterday to the U.S. Treasury by the President's Advisory Panel on Federal Tax Reform, recommends converting the mortgage interest deduction to a tax credit equal to 15 percent of interest paid on mortgages, with the mortgage interest cap set to the average regional home price, ranging from $227,000 to $412,000. Currently, homeowners can deduct all the interest on mortgage loans up to $1 million on their primary residence.

"With the median price of a home in California at $543,980 and the average mortgage at least $435,180, the proposed ceiling would limit the tax break for the majority of new mortgagees in the state," said Malta.

Other changes that would negatively impact Californians are the proposed elimination of deductions for the interest paid on second home loans and home equity loans, as well as the elimination of the deduction for state and local taxes. According to NAR, second homes accounted for 36 percent of all home sales last year nationwide.

The Panel's Recommendations

Read more!

Wednesday, November 02, 2005

Times have changed for real estate

Guest perspective: Increasingly difficult to protect consumers from unintended outcomes

By: Joy Canova: Inman News

Editor's note: Joy Canova, a Realtor with Coldwell Banker Bain Associates in Seattle, wrote the following in response to an Oct. 26 article, "Times change, real estate commission stays the same," reporting on a public workshop held in Washington, D.C., on Oct. 25, to explore competition in the real estate industry.

Although the title, "Times change, real estate commission stays the same," seems to hint at a need for real estate sales commission reductions, I see another meaning.

Times have changed for the real estate market; it has become increasingly difficult to protect clients from unintended consequences of a real estate transaction. If changes to commissions are overdue, it is to increase rates, not lower them.

In real estate transactions, one needs only to look at the volume of pages in a typical purchase and sale agreement to see the changes in the industry. As greater protections are needed for clients, full-service brokerages have sought the assistance of their attorneys to design contract addendums to close risky loopholes. Full-service sales agents have the skill and knowledge to put these protections in place when and where it is appropriate.

While it is true that every real estate transaction does not require the full spectrum of abilities that full-service agents and their companies provide, the consumer will not have the expertise to determine when his or her personal situation calls for it. It is better to depend on an agent who will know when such conditions arise and employ necessary actions on the consumer's behalf.

The comparison of the real estate industry to airline competition is an interesting choice since so many airline companies are struggling to stay in business. Some may wish to blame all the woes on events after Sept. 11, but the trouble started long before that. Consumers of airlines are suffering as services and routes are cut in an effort to stay in business. A cheap ticket to nowhere is hardly a bargain.

If the federal antitrust agencies' intent is to break the real estate industry to pieces in the same manner as the airline industry, real estate consumers will suffer as well. Agent expertise will leave the industry when consumers need an advocate most desperately.

Home buyers today are faced with affordability issues and predatory lending practices. Home sellers in the marketplace are falling prey to selling-schemes that provide no assistance in negotiations and pricing suggestions that cost money as properties linger on the market.

With personal savings down and debt up for many Americans, homes are often the greatest savings a family has. To shortcut protections for consumers with this critical financial asset is unconscionable. Lowering costs without considering value is the poorest form of business in America today.

Joy Canova is a Realtor with Coldwell Banker Bain Associates in Seattle.

Read more!

Tuesday, November 01, 2005

7 Home Repairs You Can't Ignore

Homeowner procrastination can ruin a house. Don't let water, pests, faulty wiring, dirty chimneys or old appliances get the upper hand.

By: Liz Pulliam Weston: MSN

Dealing with your home's upkeep can be a pain, not to mention expensive. But if you're going to indulge in a little "deferred maintenance," make sure you at least handle these 7 crucial repairs.

Owning a house is expensive, which is why so many homeowners procrastinate on repairs. Real-estate agents have a euphemism for this condition: It's called "deferred maintenance."

Some fixes, however, should never be delayed. Ignoring these problems can result in much more expensive repairs later on—or even injury and death.

Here's what home inspectors around the country say you should be on the lookout for:

A water leak—anywhere

A stain on your ceiling. A toilet that rocks. White powdery stuff that grows on your bricks or foundation. A musty smell in your house.

Whatever the source, the culprit is water, and the damage can be severe.

"Water is probably the single most destructive force to a house," said inspector Jeff Del Guercio, owner of An Objective Inspection in Throop, Pa., and president of the local National Association of Home Inspectors chapter. "And a leak can go on for a long time without being noticed."

Left unchecked, leaks can lead to rot, dry rot, mold and termite infestations. Water can cause roofs to collapse, foundations to buckle and all manner of expensive repairs. What's more, water-related problems can get your home blackballed by insurance companies worried about the soaring number of mold-related claims nationwide. (See "Insurers keep a secret history of your home.")

The fix: Isn't it obvious? Stop the leak by any means necessary, repair the damage and take the required steps to make sure the problem doesn't reappear. Minor roof leaks, for example, can be patched with roof cement, but if your roof is aged and failing, you may need to have it replaced. That's expensive, but not as bad as replacing the trusses and underlying roof structure that can rot away if not protected.

Flickering lights

Do your lights dim when the fridge switches on or you crank up the microwave? You may have bad wiring or too many appliances hooked to one circuit. Either one can cause a fire.

"A lot of older homes have only one or two circuits in the kitchen," said inspector Jason Farrier of Elite Home Inspections in Phoenix. "People will update the kitchen but still have all the appliances running off those two circuits."

It's far safer, Farrier said, to have at least four circuits: two for countertop appliances, one to run the dishwasher and garbage disposal and another, dedicated line for the microwave.

Flickering lights also can be a sign of failing connections in aluminum wiring, a feature in homes built between 1965 and 1973.

The fix: You can try to distribute power-hungry appliances more evenly, by not running more than one at a time or by plugging some into another circuit. But the best fix is a cure: Get an electrician to upgrade your wiring, add more circuits, or both.

If you have aluminum wiring but can't afford to upgrade, the U.S. Consumer Product Safety Commission recommends making your wiring safer by using special crimp connectors rather than the usual twist-on style. For more information, see visit the commission's Web site (link at left under Related Sites) or consult a professional electrician.

Rodent incursions

If you hear the pitter patter of little rodent feet, don't turn up the stereo to drown them out. It's not just that rodents can carry disease and make a mess nesting in the tax records you've stored in the attic. Rats, mice and other vermin love to chew through insulation and wiring, Del Guercio said, and are suspects in many house fires.

The fix: Use traps and bait products or call in an exterminator. Mice droppings can carry the deadly Hantavirus, and rodents themselves can carry everything from salmonella to the plague, so professional help might be the wisest course.

Soaring fuel bills

If you're paying a lot more for gas or oil and there hasn't been a rate hike recently, Del Guercio said, the culprit could be problems with your furnace. This is more than a pocketbook issue, since poorly functioning systems can cause deadly carbon monoxide buildup in your home. The Consumer Product Safety Commission estimates about 200 people die annually from carbon monoxide exposure in the home, typically from malfunctioning heating systems.

The fix: Have your furnace professionally cleaned and inspected annually, including the flue. The cost is usually less than $100. Install UL-approved carbon monoxide detectors, which cost $25 to $50 each.

Peeling paint

Paint is like a home's skin. It's the first line of defense against incursions by water and pests. Water that seeps into wood can lead to rot. At the other extreme, unpainted wood can quickly get too dry and crack.

The fix: Scrape off the old paint, sand the surface smooth and apply a coat or two of fresh color. (Be cautious in homes built before 1978, since many still have lead paint. Dust and chips from such paint can cause irreversible brain damage in children and nerve damage in adults. Consider hiring professionals to test your home and remove any lead paint. Your local or state health department should be able to provide referrals to testing labs and contractors.)

Smoky chimney

Here's another way neglect can kill your family, since chimneys that aren't properly cleaned and maintained can catch fire. Creosote, a by-product of wood burning, can build up in the flue and ignite unless removed, said inspector Hy Naiditch of Accuspect Home Inspection Services in Chicago.

The fix: Get your chimney swept and inspected annually; the cost is about $100. (You can find certified chimney sweeps via the Chimney Safety Institute of America, link at left under Related Sites.) Use only seasoned wood, and build small, hot fires, rather than big smoky ones. Never burn trash, cardboard or wrapping paper in your fireplace.

Dirty, or missing, air conditioner filter

This is something Claude McGavic of Inspection Associates in Bradenton, Fla., sees way too often. Overloaded or missing filters allow dirt and dust to settle on the air conditioner's coils. Warm air passing over the coils causes condensation. What you get is mud—and a perfect medium for mold to grow and be blown all over the house.

Enough gunk can block air from getting into the system, McGavic said, causing it to catch fire. McGavic, president of the Home Inspectors Association of Florida, says many air conditioner failures can be traced to this simple lack of maintenance.

"With a $2 filter," McGavic says, "you can preserve a $6,000 air conditioning system."

The fix: Replace the filter once a month while the air conditioner is in use. Get your system checked annually.

Here are some other safety fixes you should consider:

Ground-fault circuit interrupters: These electrical outlets, with their distinctive red and black buttons, are designed to prevent deadly shocks. Outlets in bathrooms and those in kitchens within six feet of the sink should be replaced with GFCI outlets, said Naiditch, president of National Association of Home Inspectors Illinois chapter. "They're the best $7 you'll ever spend," Naiditch said. "They're a lifesaver." The exception: Don't put a refrigerator on a GFCI, Naiditch said. A fridge's normal on-and-off surges can trip the interrupter and leave you with an icebox full of rotting groceries.

Flexible gas connectors: Gas appliances installed more than 10 years ago may still have dangerous brass connectors that can fail, according to the safety commission, leading to fires or explosions. These should be replaced with an approved connector, typically stainless steel, Naiditch said. But don't move the appliance to inspect, since even a slight motion can cause the weak soldered connection to break. Have a professional appliance repairperson check and make any changes.

Garage door openers: Yours should have an electric eye that looks for obstructions and an automatic reverse mechanism to prevent someone from getting squashed.

Dryer vents: The lowly clothes dryer causes more than 15,000 fires every year, often caused by lint buildup in the duct that vents to the outside. Clean the ducts regularly and replace plastic ducts with metal versions.

Read more!

Realtors go to bat against expected real estate tax reform

Trade group fears widespread economic impact

Inman News

The National Association of Realtors board of directors voted this week to oppose proposals under consideration by President Bush's advisory Tax Reform Panel that the trade group's leaders say would drive down real estate values and harm the housing market and overall economy.

The value of the nation's residential property could decline 15 percent or more if the tax panel's expected recommendation to convert the mortgage interest deduction to a tax credit takes effect, according to preliminary projections by the association's Economic Research Division. The housing sector accounts for about 15 percent of the nation's gross domestic product.

Eliminating the tax deduction for second homes, another proposal under consideration, would impact at least 5 percent of the GDP, the association said in an announcement this week. Second homes accounted for 36 percent of all home sales last year.

The tax reform panel, which is expected to make its final report to the president today, is considering recommending that Congress convert the mortgage-interest deduction from a deduction to a tax credit; is also considering reducing the $1 million cap on mortgages to the local Federal Housing Administration loan limit (which can be as little as $170,000 and no more than $312,000 in high-cost areas such as Alaska, Hawaii, Guam or the Virgin Islands); repealing the deduction for property taxes, as well as other state and local taxes; and raising the amount of gain to be excluded on sale of a principal residence but reducing the frequency in which the exclusion can be taken, the trade group reported.

"Before these ill-considered proposals become official, we are raising the loudest possible alarms over their prospective economic impact. Housing, which has sustained the economy for the past five years, represents 15 percent of GDP," said Tom Stevens of Vienna, Va., who took office as the association's 2006 president on Monday.

"We are concerned not just for the housing economy but for the nation's economy as a whole. Not only do the recommendations being considered by the panel have the potential to impact the value of every home, whether it has a mortgage or not, but also they will drive down real estate values," Stevens said in a statement.

Consumers' nest eggs will be jeopardized because much of investment for retirement is tied to the equity consumers have in their home, he also stated.

Stevens said the Tax Reform Act of 1986 demonstrated that when the tax benefits associated with real estate ownership are curtailed, the value of real estate declines. The resulting loss of value in the commercial real estate sector was 30 percent following passage of that legislation.

"We urge the president not to accept these proposals. They are bad for home ownership, bad for real estate and bad for the American economy. NAR will vehemently oppose them should they be considered by Congress," Stevens said.

NAR's board on Monday voted to pay for new research to determine the economic effect of the panel's recommendation – especially their impact on the value of residential and commercial real estate, and assess their impact on home ownership.

The trade group's position is that real estate is a long-term investment, and that the tax system should reflect the stream of income and expenses associated with long-term investments. The association is urging the president and Congress to preserve the deduction for state and local taxes, including property taxes.

The board met on the final day of the 2005 Realtors Conference & Expo, held Oct. 28-31 in San Francisco. The event drew about 26,000 Realtors and guests, the association reported.

Read more!