The conventional wisdom that guided buyers and sellers during the real-estate boom is being challenged. Pricing is becoming crucial and relocating is trickier as the number of homes for sale nears a 10-year high.

By: Ruth Simon: The Wall Street Journal Online

As the spring selling season moves into high gear, the cooling housing market is upending the conventional wisdom that guided buyers and sellers during the housing boom.

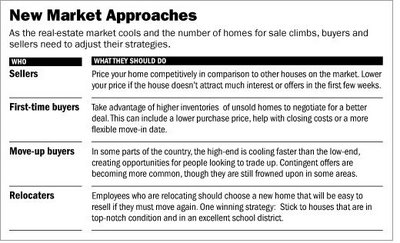

The changing dynamics have implications for a wide variety of players in the real-estate market. Some brokers are advising sellers to price their homes in the bottom 25% of comparable properties. People looking to enter the market for the first time are being told not to overly stretch their finances because rising home prices may no longer bail them out. Employees who are relocating are being advised to steer clear of new subdivisions where competition from brand new construction could make reselling soon difficult.

Such strategies aren't entirely new, but they had fallen from favor in many markets as home sales heated up early in the decade. Recently, markets have shown signs of cooling. The number of homes for sale has climbed about 30% over a 12-month period, reaching its highest level in nearly 10 years, according to the National Association of Realtors. The group recently predicted sales of existing homes would drop 5.7% this year versus a 4.4% gain in 2005.

Higher mortgage rates are making houses less affordable in many metro areas. Rates on 30-year fixed-rate mortgages now average 6.46%, up from 6.14% a year ago, according to HSH Associates, with rates on adjustable-rate mortgages moving up even faster. Another increases in interest rates by the Federal Reserve, expected today, could push mortgage rates even higher.

What this new environment means for buyers and sellers varies from market to market. To be sure, sales are strengthening in some markets, including Albuquerque, N.M., and Indianapolis. Economic growth and an influx of investors have helped to push home sales in Houston up 13% in the first two months of 2006 from a year earlier, says Steve Barnes, president of Coldwell Banker United, Realtors.

But in many parts of the country, after several years of sellers calling the shots, 2006 is shaping up to be a market in which buyers are gaining bargaining power. In New York City, where the housing market has begun to cool, some buyers are now getting condo developers to pay city transfer taxes and certain other expenses that can total 3% to 4% of the purchase price, says Jeffrey Jackson, chairman of appraisal firm Mitchell, Maxwell & Jackson.

What follows is a look at what this means for different groups of buyers and sellers.

Sellers

Say goodbye to the days when sellers could simply look at what their neighbor's house sold for and then list theirs for 10% more. Brokers are advising sellers to make sure their house comes across as a good value relative to other homes on the market.

"Pricing is absolutely critical right now," says Rosey Koberlein, chief executive of Long Realty Co. in Tucson, Ariz., where sales are off 20% so far this year.

In determining a home's value, Richard Druker, a managing broker with Baird & Warner in Chicago, considers everything from the height of the ceiling to the quality of any renovations and whether the front door creates a good first impression. "A great thing to do is to look at properties that are priced comparably to yours and ask, 'Which would you rather buy?' " he says.

Overpriced homes may never even catch the eye of their intended audience. That's because buyers and brokers increasingly rely on computers to screen listings based on price, size and other parameters when new properties come to market. Also, listings typically generate the most excitement and interest in their first few weeks on the market.

David D'Ausilio, a broker-associate with Re/Max Heritage in Westport, Conn., is counseling his clients to price their homes in the "bottom 25%" of comparable homes and to cut their asking price by 3% to 5% if the listing doesn't generate several showings or written offers within three weeks.

Brokers are also telling sellers to fix problems that buyers might have overlooked in a more heated market. Bo Menkiti, president of the Menkiti Group of Keller Williams in Washington, D.C., recently advised one couple to replace their old stove and refrigerator in their otherwise updated house. While the return on the investment was likely to be minimal, "you don't want to leave things that would be a total turnoff," he says.

First-Time Buyers

As the housing market cools, first-time buyers have the opportunity to be more thoughtful about their purchases and to negotiate for a lower price, a more flexible move-in date, or incentives such as seller-paid closing costs.

Jill Green, a Realtor with Century 21 Award in Carlsbad, Calif., a coastal community north of San Diego, has been making offers that are 1% to 5% below the low end of the seller's price range. "Sellers are entertaining the offers and are taking them," she says.

Some brokers are advising first-time buyers to leave a financial cushion instead of stretching as much as possible and counting on rising home prices to bail them out. They are also asking sellers to help with closing costs.

Elise Owen, a program manager for a nonprofit group in Washington, recently purchased a one-bedroom condo for $178,000. The seller threw in $5,000 toward closing costs. "It allowed me to feel like I was on more secure ground by keeping some of my savings available" for emergencies, Ms. Owen says.

Move-Up Buyers

Move-up buyers face the delicate task of balancing a purchase with a sale. A growing number of buyers are making offers that are contingent on selling their current home. But such offers are often frowned at, in part because these deals are more likely to fall through. "You're going to get the house for a better price if it's noncontingent," says Jane Powers, a broker with Ewing & Clark Inc. in Seattle.

In some parts of the country, such as California's Silicon Valley, cooling is most evident in the higher end of the market, good news for homeowners looking to trade up. "For an extra half-million dollars, you can get quite a bit more for your money than you did before," says Richard Calhoun, broker-owner of Creekside Realty in San Jose.

Relocaters

People who are relocating for a job often can't afford to let their home sit. Tim Popadic last summer listed his four-bedroom colonial in Monroe, Conn., for $725,000, $26,000 above his broker's initial estimate, after he accepted a position as an associate pastor with a church in Palm Beach Gardens, Fla. When no offers materialized, he delayed his move and cut his price three times, before accepting a $557,000 offer in October. "At the end of the day, [the broker] was right," he says.

Employers are looking for ways to ensure that homes don't languish on the market when an employee relocates. The number of company-ordered appraisals is growing as employers seek to get the price right before a house goes on the market, says H. Cris Collie, executive vice president of Worldwide ERC, an association of companies and professionals that relocate employees.

Going forward, Mr. Collie expects employers to more aggressively enforce policies that require transferees to price their homes close to the appraised value. He is also seeing renewed interest in "loss on sale" programs, which compensate people who are relocating for losses if they sell below the purchase price. One in three large companies now offers these policies, according to a Worldwide ERC survey, down from 42% in 2000.

Making sure the new house will be easy to resell is also crucial for people who are likely to be transferred again in a few years. "In a down market only the nicest homes sell quickly," notes Bradford Charnas, president of Charnas Appraisal in Cleveland. Mr. Charnas advises transferees to look for homes that are in top-notch condition and in an excellent school district.

Some relocation experts also advise transferees to shy away from buying a home in a brand-new development. "If you're buying in a new subdivision...you're competing with new construction" when you sell, notes Pam O'Connor, president and chief executive of Leading Real Estate Companies of the World.

Investors

As the housing market cools, investors used to seeing quick profits in once hot markets such as Phoenix, Washington, and southern Florida may be disappointed. In Tampa Bay, Fla., investors can still find buyers for one-of-a-kind homes in established neighborhoods. But in some new subdivisions, dozens of similar investor-owned homes are competing for buyers, says Craig Beggins, president of Century 21 Beggins Enterprises. "If you have any way not to sell right now, don't," Mr. Beggins tells investors. "If the neighborhood is brand new and no one is living there, my advice is to rent it if they can."

But the decision to sell or rent can be tricky, particularly if the rental income isn't enough to cover the mortgage and other carrying costs. Rental homes typically don't show well, says Bob Hamrick, broker-owner of Coldwell Banker Premier in Las Vegas, and often must be vacated and given a fresh coat of paint and new carpet before they are put back on the market.

Some investors are turning to stagers to give a vacant new home personality. Rebecca Grainger, co-owner of Staging Masters Inc. in central Florida, hangs towels in the bathrooms and rents furniture for key rooms, such as the foyer, living room, dining room and master bedroom. "We're basically making it like a model home," she says.

skip to main |

skip to sidebar

With the latest news and trends in the Real Estate Market

ABOUT

Links

ADD VF CONSULTING REAL ESTATE BLOG TO YOUR FAVORITES!

Blog Archive

-

▼

2006

(591)

-

▼

March

(52)

- Digital Home Technology More Widespread

- The Weekend Guide! March 30 - April 2, 2006

- Residences Planned for Beverly Hilton

- Unique thought process makes home ownership a reality

- The New Rules of Real Estate For a Cooling Housing...

- Foreclosure Fraud Finds a Home

- NAR Takes Issue with Good Morning America Segment

- Let the Sun Shine In: Products To Bring Light into...

- Newlyweds attempt unique real estate tax strategy

- An opening to theft

- Flipping Hotel Room Hot New Investment

- Ways You Can Lose Your Property

- The Weekend Guide! March 23 - March 26, 2006

- Existing-home sales bounce back

- NBC Universal May Develop Backlot

- At Home in Tinseltown

- Commentary: Don't Judge Housing Market By the Numbers

- Cooling real estate market presents challenge for ...

- The Right MIX

- Court Approves Sunset Millennium Project

- FHA Launches Education Initiative to Assist First ...

- Condo-hotels, now taking reservations

- Pricing as Much Art as Science

- Condos for Those Who Live to Shop?

- Art sales to benefit LGBT youth

- Real estate values need human interpretation

- Is There Still Profit to Be Made From Buying Fixer...

- The Weekend Guide! March 16 - March 19, 2006

- Commercial Real Estate Fundamentals Solid

- New tactics are in order with spring's cooler mark...

- SoCal real estate sales fall again

- Housing Market Readjusting to Normal Balance

- Making Millions through Real Estate

- Appreciating Homes Increase Owners' Net Worth

- Stevens: Internet Won't Kill Full-Service Real Estate

- Should You Move Out Or Add On To Your House?

- Home sellers say overpricing is biggest listing mi...

- Homeowners Expect Prices to Keep Rising

- The Weekend Guide! March 9 - March 12, 2006

- The hottest remodeling trends for 2011

- Home-price growth continues at robust pace

- Decline in Pending Home Sales Eases

- What work should be put into a house for sale?

- The timeline of a home sale: what to expect

- 10 most overlooked real estate tax breaks

- Stevens on Today Show: Cooling No Cause for Alarm

- How to claim double tax breaks when selling two homes

- Homeowner Equity Bigger Than You Think

- Real Estate Makeovers Booming

- The Weekend Guide! March 2 - March 5, 2006

- Most People Should Not Fear Housing Bubble

- “Soft Landing” continues in California Housing Market

-

▼

March

(52)