Act today? Tomorrow? Never?

By: June Fletcher: The Wall Street Journal Online

With many consumers wondering if the decade-long housing boom is peaking, June Fletcher explores the crucial question of when is best to purchase property. Read her suggestions for gauging the effects of rates, demand and taxes.

To buy or not to buy?

That is the question facing homeowners all across the country as overall home prices reach yet another record, mortgage interest rates reach a six-year-high, and construction workers and supplies are diverted to the hurricane ravaged Gulf Coast.

As tensions mount between too much demand and too little supply, many consumers are wondering if the decade-long housing boom is peaking. Should they buy now, or wait for rising rates to depress prices? "House Poor," a new book by Wall Street Journal reporter June Fletcher, published by HarperCollins and in stores Tuesday, looks at this crucial question, and suggests strategies to survive a housing market in turmoil. Here is a condensed excerpt:

April and Adam Nichols are suffering from sticker shock. The newlywed New Yorkers would love to get out of their cramped one-bedroom rental in Manhattan, which costs them $2,325 a month, and buy a starter condo. But everything they've seen in their under-$500,000 price range is horrible, from a fifth-floor Hoboken, N.J., walk-up with a view of an ugly brick wall to a run-down building in the Bronx.

So what are the Nicholses planning to do? For now, nothing. "It's hard to throw money away on rent, but we're going to be patient," says Ms. Nichols. "Prices are bound to come down."

It's challenging to sit on the sidelines when every day, the airwaves are crammed with home fix-up shows, and bookstores push books on how to make millions as a real-estate investor. But the real trick to winning at real estate is to be contrarian and recognize just where you are in the real-estate cycle. When Doug Duncan, chief economist for the Mortgage Bankers Association, moved to Washington in 1988, the local real-estate market was sizzling and buyers got caught up in bidding wars at open houses. He decided to rent. Soon, the market took a nose dive. Five years later, he decided it would be a good time to buy. He paid about a third less than the previous owner, who'd lost his home in a foreclosure. "You have to use caution," he says.

Understandably, not many real-estate brokers share this opinion. An ad recently sent to clients by agents of the New York brokerage firm Prudential Douglas Elliman pushed ownership hard. It points out that real-estate prices, unlike stocks, adjust slowly, and that predictions that the New York market would crash after 9/11 didn't come to pass. It also told first-time home buyers that they have to "get in the elevator to ride to the penthouse," and asked: "Why do you work so hard? To live in a crummy rental for the rest of your life waiting for a bargain to emerge?"

But the real worry today isn't that you'll be stuck in a rental for the rest of your life, but that you'll buy at the peak, watch prices slide, and be stuck in the property for years, waiting for them to recover. To come out ahead as investors, consumers need to buy low and sell high, but this gets forgotten in the emotions of buying a home.

Honolulu's Bad Six Years

How often do busts occur? The Federal Deposit Insurance Corp. has identified 21 cities that experienced a housing bust over the past quarter-century. In the mid-'80s, the victims were cities in Texas, Louisiana, Oklahoma; in the early '90s, cities in the Northeast and California. Scattered throughout the country were other places that experienced price declines when they lost major employers or became overbuilt. After too many developers invaded Honolulu, for instance, the city had six straight years of price declines, ending in 2001.

How genuine is the danger of price declines today? Some economists like David Lereah, chief economist for the National Association of Realtors, argue that we're not in danger at all, because current long-term fundamentals are sound, including healthy job growth, tight supply, and continued demand.

And while nominal prices haven't fallen since the '30s, real home prices (adjusted for inflation) have tumbled from time to time, typically after a big run-up like we're seeing today. In the early '80s, real home prices fell 10%. It would take a sharp and unlikely contraction of the economy to repeat that scenario -- a doubling of current mortgage rates and a halving of home sales -- but if oil prices remain high, such a contraction is possible, according to Lawrence Yun, a forecast economist also with the National Association of Realtors.

Other factors are troubling, too. Americans are deeper in debt than ever before, many from risky interest-only and negative amortization loans they took out to take part in the all-night real-estate party. One big bump up in interest rates, coupled with a few local downturns, is another potential scenario. The effect could be serious. In 2000, when the stock market fell, the top 1% of investors controlled a third of the nation's accumulated stock wealth. Today, the top 1% of home-equity holders control only 13% of the nation's housing wealth.

So in these uncertain times, should you buy or rent? There's no one-size-fits-all answer. Generally speaking, people tend to rent when their income is the lowest, when they're young and old, and own in-between. But that's not always true, especially today, when some young people are forgoing pricey cars and weddings to make down payments, some older people are sucking the equity out of their paid-off homes through reverse-equity mortgages, and some midcareer couples are renting luxury condos rather than buying a suburban McMansion. Let's look at the cases for owning versus buying:

The Case for Owning

Uncle Sam wants you to own a house, and gives you all sorts of incentives. Though some reformers would like to see the mortgage-interest deduction phased out, it's currently one of the biggest tax breaks most homeowners have, saving $76 billion a year, according to the Office of Management and Budget.

What's more, if you sell your house after living in it for two out of the last five years, you get a tax-free gain: $250,000 for an individual, and $500,000 for a couple.

Over the past decade, 10 million new households bought homes; now seven out of 10 American households live under their own roofs. That's certainly helped increase the average family's net worth at a time of stagnant wages and a lackluster stock market. Since the boom began in 1996, homeowners nationwide have amassed more than $5.2 trillion in home equity.

The politically sanctioned push toward home-ownership, coupled with low interest rates and easy money from lenders, has caused builders to flock to for-sale housing and neglect the rental market. The supply of rental apartments is declining, as some are demolished due to age, and others are converted into condos. Construction of new rental housing fell to a 10-year low in 2004, as multifamily builders turned in droves to more lucrative condos.

Although rents are currently a bargain in some of the hottest housing markets as supply tightens, that may soon change. It's happening already in some sizzling markets like South Florida, where condos are sprouting like kudzu, but long-term rentals are becoming as rare as jungle orchids.

The Case for Renting

For those who already own a home, have built up equity, and live in the nation's hottest and most precarious housing markets, now may be a very good time to rent.

With price increases reaching the double-digits in many metro markets, housing has become increasingly unaffordable. In some markets, the flight to home ownership, spurred by low interest rates, has left units vacant, forcing landlords to make deals. In Atlanta, for instance, it's common to see giveaways of a month's rent. In Chicago, you can get two months' free rent and a $500 signing credit.

In some of the most expensive for-sale markets in the country, rents have been falling for a long time. Rents in San Francisco, for example, have fallen 19% since 2001, to $1,300. For that monthly rent, you currently can get a one-bedroom apartment on tony Nob Hill, with hardwood floors, a built-in china cabinet and a courtyard with gazebo and built-in barbecue grill. Meanwhile, buying a similar place costs about $530,000, or about $2,366 a month at a 5.34% fixed interest rate over 30 years -- and that's assuming you put down $106,000, or 20% of the purchase price.

Homeownership has other drawbacks. Because renters usually pay less, they have more money to put in the stock market, businesses and other investments. Renters also have flexibility, and can move without incurring heavy settlement costs, which typically run between 2% and 6% of the purchase price of a home.

Meanwhile, upscale owners in rising markets sometimes feel trapped in their homes by market forces. In Los Angeles, real-estate broker Anthony Marguleas says that high property taxes and limited capital-gains exclusions "severely penalize" sellers at the upper end of the market. That discourages them from listing their homes, so "inventories stay low, while demand is very high."

Buying has costs and headaches that renters don't need to think about, like homeowners' insurance, special assessments and property taxes. Even without these expenses, many families are already pushing their financial limits. A recent study by the Joint Center for Housing Studies at Harvard University found that more than one in three households spends more than 30% of its income on housing, while one in eight spends more than half.

So if you simply can't afford to buy without gambling your future, don't. "Many people are better off as lifetime renters," says Arlington, Va., housing economist John Tuccillo.

Email your comments to june.fletcher@wsj.com.

Read more!

Monday, October 31, 2005

Blueprint for Buying - or Renting: Timing for a Market in Turmoil

New "Price Bloat" Index Pinpoints Overvalued and Undervalued Home Real Estate Markets

A major mortgage insurer has unveiled for the first time its internal "valuation index" that red-flags real estate markets that are overvalued by historical norms and present greater underwriting risk of losses to the insurer.

By: Kenneth R. Harney: Realty Times

PMI Group's statistical model also pinpoints markets that are currently undervalued. Ken Harney reports.

Are some of the country's hottest, fastest-appreciating home real estate markets overvalued? Are others undervalued, and therefore relative bargains? Can anybody actually demonstrate such conclusions statistically?

A major player in the mortgage insurance industry - a firm facing millions of dollars in losses if it insures mortgages on properties that are seriously overvalued - says yes to all three questions.

PMI Group of Walnut Creek, Calif., has just unveiled for the first time the tool it uses for its own business purposes to red-flag markets where prices are significantly above where they should be, based on historical norms. Like other underwriters, PMI must compensate lender clients for the expenses they suffer when low-downpayment mortgages go into default. Those costs balloon when a house really wasn't worth as much as the lender thought, and must be resold at a big loss.

To protect against such losses, PMI economists created a statistical model they believe accurately detects price bloat -- and undervaluation -- in dozens of markets around the U.S. Dubbed the Valuation Index, the model tracks historical home price appreciation patterns over a several decades for each market, then evaluates the extent of current deviation from the historical norms.

Where are the most bloated prices -- and the most undervalued markets -- today? It probably comes as no surprise that among the most overvalued can be found in California, according to PMI's model. These include Los Angeles (33.7 percent over), San Jose (26.5 percent) and San Diego (22.3 percent). Las Vegas is 25.5 percent overvalued, and Phoenix-Scottsdale 22 percent.

On the East Coast, the most overvalued markets are northern New Jersey (25.6 percent), New York's Long Island (20.4 percent), Providence, R.I. (19.1 percent), Miami (20.5 percent), Tampa-St. Petersburg (23.2 percent), Orlando (19.6 percent), and Washington D.C. (18.2 percent.)

Where are the most undervalued home real estate markets -- where investors and insurers stand little loss of loss but a good chance of picking up relative bargains in real estate? PMI highlights a handful of underperformers: Denver, where the index puts property values at 4.2 percent below where they should be; Detroit (-10.3 percent), Charlotte, N.C. (-1 percent), Cleveland (-1.4 percent), and Memphis (-1.7 percent).

Other markets the valuation index concludes are relatively safe bets - at or just slightly above where they should be - include Pittsburgh, Kansas City, Mo., Minneapolis, Atlanta, and Ft. Worth, Tex. Austin and San Antonio are other relatively safe bets in Texas, but Dallas prices are a little riskier - 10.5 percent above where they should be, according to PMI.

Not everyone will agree with PMI's market-by-market conclusions, of course. But let's say for the sake of discussion that you do. Now what?

If you are a seller in an overvalued market, you need to take a hard look at your asking price. It's possible that you are out of sync with a slowdown that is already emerging - more houses sitting on the market taking longer to sell. Throttle back on your expectations just a little, and price below where you might had earlier this year.

What about buyers? If you are interested in purchasing a home in an area red-flagged as overvalued, exert extra caution and discipline in bidding. Be more aggressive in your initial offers. After all, you don't want to buy a house that mortgage insurers will tell you is already overvalued, and poised for a price correction.

Bargain tougher on price. And be prepared to walk away - pronto - if sellers refuse to budge.

Read more!

Sunday, October 30, 2005

Six home buyer mistakes to avoid

Why are buyer's agents, contingencies so important?

By: Robert J. Bruss: Inman News

Late October and early November are the tail end of the second-best home sales season (the most active selling season is spring when the largest numbers of buyers are in the market). Smart home buyers are realizing this may be the best time to buy before mortgage interest rates go higher.

At this season of the year, these savvy home buyers understand they can negotiate hard because home sellers and their realty agents know after Thanksgiving is the worst time of year to sell a home (but that is also the absolute best time to buy a home if you can avoid the distractions of holiday events and purchase from a highly motivated seller).

However, in the quest to purchase a house or condo, many home buyers get caught up in the thrill of acquiring a new home and they make potentially costly mistakes. Here are the top home buyer mistakes to avoid during any time of the year:

1. SHOP FOR A HOME BEFORE YOU SHOP FOR A MORTGAGE. It's normal for prospective home buyers to get excited about buying a home. According to the National Association of Realtors, more than 70 percent of today's home buyers start their quest on the Internet, usually at www.realtor.com.

But that's the wrong place to start buying a home. The first step to a successful home purchase is for buyers to check their FICO (Fair, Isaac Corp.) credit scores to be certain a mortgage can be obtained.

The best spot I've found on the Internet to check my credit is www.myfico.com. It costs about $45 to review all three credit reports there from the three national credit bureaus, Equifax, Trans Union and Experian. The last time I checked, to my surprise, my FICO scores varied about 40 points among each of the three credit bureaus.

By checking credit reports at all three bureaus, there is time to correct any errors (reportedly, about 33 percent of credit reports contain mistakes) before applying for a mortgage.

Although you can now obtain your free credit reports from all three major companies at www.AnnualCreditReport.com, or 877-322-8228, those reports are virtually worthless because they don't include FICO scores, which all major mortgage lenders now use.

Armed with your credit reports and FICO scores (anything above 700 practically assures you will get the lowest mortgage interest rate), it's time to shop for written mortgage pre-approval.

Although mortgage brokers can arrange such pre-approvals, be sure your pre-approval letter or certificate comes from a bank or mortgage broker. Disregard any "pre-qualification letter," which is worthless because it isn't a lender's written promise to grant you a home mortgage, subject to an appraisal.

2. RUSH TO BUY A HOUSE OR CONDO WITHOUT CAREFULLY RESEARCHING THE LOCAL MARKET. After you have your written mortgage pre-approval 30-day or 60-day letter or certificate from an actual lender, it's time to get serious about researching the local home market in your price range.

Although you might buy the first home you spot on the Internet, or at a weekend open house, that rarely happens. Most home buyers take several months before their purchase offer is accepted by a seller.

3. BUY A HOME WITHOUT YOUR OWN BUYER'S AGENT. Too many home buyers purchase with only the help of the seller's listing agent (called a "dual agent" when that person also represents the home buyer).

It costs home buyers no more to have their own "buyer's agent" representing the buyer's best interests.

Buyer's agents, in addition to showing listings of other agents from the local MLS (multiple listing service), can show prospective buyers the local "for sale by owner" (FSBO) homes. Smart FSBO sellers are only too happy to pay buyer's agents half of a normal sales commission, typically around 3 percent. This is a major advantage of working with a buyer's agent.

Any licensed real estate agent can be your buyer's agent to look out for your best interests (unless that agent works for the same brokerage, which also listed the property for sale; then dual agency or designated agent rules apply).

However, most home buyers find it wise not to sign an exclusive buyer's agent contract, just in case the agent turns out to be a dunce.

4. BUY A HOME WITH AN INCURABLE DEFECT. No house or condo is perfect. Each one has some defect. Even brand-new houses have problems (hopefully not significant).

After I became friends with a local building inspector a few years ago, he revealed to me some of the defects he routinely discovered in new homes. Unless the problem was dangerous or in violation of building codes, he explained he had to ignore the defects, which he knew would result in problems several years later.

Fortunately, most houses and condos don't have defects that are not tolerable. Serious problems, called "economic obsolescence" by appraisers, might include a bad floor plan, poor location (such as near high-voltage power lines or adjacent to the city dump), heavy street traffic, and lack of convenient parking.

5. DON'T INSIST ON A COMPARATIVE MARKET ANALYSIS (CMA) BEFORE MAKING A PURCHASE OFFER. This is a major mistake too many home buyers make, often resulting in overpaying for a home.

The CMA is the same document that the listing agent should have presented to the home seller before the asking price was determined. It includes recent sales prices of similar nearby homes, asking prices of comparable neighborhood homes now listed for sale, and asking prices of similar homes that didn't sell (usually because they were overpriced).

Only after reviewing the CMA, and discussing it with the buyer's agent, can a reasonable purchase price be offered.

6. FORGET TO INCLUDE THE TWO KEY CONTINGENCY CLAUSES. Especially in very competitive local home sales markets, some home buyers let their buyer's agents talk them out of protecting themselves with the two key contingency clauses.

"All cash, no contingency" is what every home seller wants to hear. But it isn't realistic or very smart for most home buyers.

Instead, smart home buyers include contingency clauses for (a) a satisfactory professional appraisal of the home for at least the purchase price, and (b) the buyer's approval of a professional inspector's report.

Additional customary local inspection contingencies might include termite (pest control) inspection, building code compliance, energy efficiency, and radon test.

SUMMARY: These six home buyer mistakes to avoid help protect buyers from making major, costly errors. Home buyers who protect themselves can feel confident of making a sound purchase, which they will enjoy for many years.

Read more!

Give Shrubs a Head Start and Save Some Cash in the Bargain

A good time to plant bushes, trees and perennial flowers is during fall.

By: Bart Ziegler: From The Wall Street Journal Online

Autumn also is a good time to shop for these plants, since garden centers and big-box stores usually have them on sale, often at ridiculously low prices.

One autumn day three years ago, I spotted two sorry-looking shrubs at the local garden center. Though they resembled a few bare sticks stuck in a pot they were only $12 each - about a third of their original price. I'm a sucker for a bargain so I decided to take a chance on them.

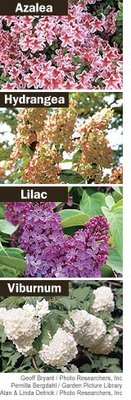

As an early November snowfall swirled around me, I chopped through the crusty surface of the soil and planted these Charlie Brown viburnums in my front yard, all the time thinking how I might have to pull out their dead carcasses six months later.

But in the spring, crinkly green leaves unfolded along their branches, then a sprinkling of white flowers. The shrubs grew and grew and by this past spring they had turned into stately beauties, each about 5 feet high and 7 feet wide. Row upon row of stunning, snowy blossoms covered their branches in June, followed by colorful berries the birds loved.

My happy experience with these viburnums wasn't a fluke. It turns out that many shrubs, trees and perennial flowers can be planted in the fall. "Fall planting is far underappreciated by folks," says Patrick Callina, vice president of horticulture at Brooklyn Botanic Garden in New York.

And as I discovered, autumn also is a good time to shop for these plants, because garden centers and big-box stores such as Wal-Mart, Home Depot and Lowe's usually have them on sale, often at ridiculously low prices, to clean out their inventory.

Mail-order supplier Wayside Gardens has cut the price of an unusual hydrangea introduced nationally this year, called "Lady in Red," by 20%, to $19.95; its frilly flowers mature from a pinkish-white to a deep crimson, while its leaves turn a reddish-purple in autumn. Lowe's stores in the mid-Atlantic region are selling three-gallon containers of low-growing parsoni juniper shrubs for just $7.98. Many local plant stores also have slashed prices; Ward's Nursery & Garden Center in Great Barrington, Mass., has marked down all its shrubs and trees by 20% to 50%. Bargains also can be found on eBay: Pase Greenhouses in North Collin, N.Y., was offering northern bayberry bushes for $2.99.

Why can shrubs and other hardy plants safely be put in the ground when nature seems to be saying that it's time to hang up your shovels for the season? The chief reason is that while the air may be nippy, the soil stays warm for many more weeks.

"Although the top of the plant may have lost its leaves, the roots can continue to grow until the soil temperature approaches freezing, which is much later than when the air temperature approaches freezing," says Marvin Pritts, chairman of the Horticultural Sciences Department at Cornell University. In warmer parts of the country where the ground doesn't freeze the roots can establish themselves all winter. Ironically, spring isn't always the optimal time to plant, because the soil typically remains much colder than the air for many weeks, in a reversal of autumn's effect. Plus, the warm days then may stress the newly transplanted shrub, flower or tree.

Autumn also tends to see more rain than the summer months, giving another boost to your fledgling plants. The cooler days are also easier on them than hot summer weather - as well as being much more comfortable for you to be outside digging holes.

Come the first mild days next year, your new plant will be ready to burst into leaf and bloom, benefiting from its head start over anything you would put into the ground in spring.

Not everything is suitable for fall planting. Some experts say that oaks, firs, willows, hemlocks, magnolias and rhododendrons are more safely planted in spring, but other authorities disagree. (Ask your local garden center for advice because this list varies by region.)

And shrubs and perennial flowers that are sold in "bare root" form - meaning the roots aren't planted in a pot but instead are soil-less and covered by plastic wrap or wax - also are better off planted in spring. They may take longer to become established in your yard than plants that were growing in soil and as a result may not grow new roots by the time the ground freezes.

Plant your new shrub or tree by digging a hole that's about twice as wide and about as deep as the container or burlap bag it came in. If the plant was in a pot, whack the sides of the container with a trowel to loosen the roots, then tip the pot on its side and gently pull out the plant by holding its trunk.

If the roots are wound around each other, loosen them by pulling them apart or, in severe cases, cutting some of them. (I roughen up the roots by running a gloved hand repeatedly over them.) Rootbound plants are common in fall, because they may have been sitting at the garden center all summer. If you don't loosen the roots, they may continue to twist around one another and stunt the plant's growth.

Add a bit of peat moss or humus (both available at garden stores) to the soil to help it retain moisture, then pack it loosely around the roots. Make sure the plant's root ball is about level with the surrounding earth, not lower. Then give your plant a good drink of water.

After planting, many experts advise spreading a layer of mulch, such as chipped wood or bark, around your new plant to help moderate the fluctuations in soil temperature, especially in areas where there's not likely to be snow cover to perform that function.

"The biggest risk from fall planting is a rapid drop in temperature," says Cornell's Mr. Pritts. "If the soil freezes before the roots become established, then plants can heave out of the ground during the freezing and thawing cycles of winter." But be careful not to let the mulch touch the plant's stem or trunk. Wet mulch can lead to growth of microorganisms that could rot the plant, warns Mr. Callina of Brooklyn Botanic Garden.

So take a chance with fall gardening. Next spring you'll be glad you did.

Email your comments to rjeditor@dowjones.com

Read more!

Saturday, October 29, 2005

Real estate sales to hold strong in 2006

Rising interest rates will help balance market, ease price gains

Inman News

With home sales holding at historically high levels, only modest cooling is expected next year, according to a forecast released today at the National Association of Realtors Conference & Expo in San Francisco.

David Lereah, NAR's chief economist, said strong demand should keep home sales at historically high levels in 2006. "We are in the process of setting a fifth consecutive annual record for both existing- and new-home sales, but the market will be coming off of a five-year boom and experience a soft landing next year," Lereah said. "An uptrend in mortgage interest rates will cause some slowing of the sales pace, but we forecast 2006 to be the second-highest year on record and housing will continue to support the overall economy."

Existing-home sales, which should increase 4.8 percent to 7.11 million this year, are projected to decline 3.5 percent in 2006 to 6.86 million. New-home sales, seen to grow by 8 percent to 1.3 million in 2005, are expected to fall 4.5 percent to 1.24 million next year. The figures for 2006 would be the second-highest year for each sector.

Total housing starts this year are forecast to be the highest since 1972, rising 5.7 percent to 2.06 million units, before declining 4.6 percent to 1.97 million in 2006.

"Baby boomers remain in their peak earning years. Their children – the 'echo boomers' – are just entering the period of life when people typically buy their first home. Immigrants, who have been arriving in strong numbers for many years, are buying in to the American Dream," Lereah said. "The market transition will result in a cooling of home-price gains, but it'll be fair to say housing activity will remain healthy for some time to come."

The 30-year fixed-rate mortgage is projected to rise slowly to 6.7 percent by the end of next year. "As interest rates rise and home sales ease, it should help to bring the market closer to equilibrium between home buyers and sellers," Lereah said. "That is expected to take pressure off of home prices and allow appreciation to settle to a more normal pace in 2006."

The national median existing-home price for all housing types, after jumping about 12.4 percent to $208,100 for all of this year, is projected to grow by 5.3 percent in 2006 to $219,200. The median new-home price is seen to increase 4.1 percent to $230,200 in 2005, and then rise more sharply next year as higher construction costs work into the market. The typical new home price is forecast to rise 7.3 percent in 2006 to $247,000.

Historically, home prices grow 1 to 2 percentage points faster than the rate of inflation. The Consumer Price Index is likely to rise 3.4 percent this year, and then ease to an increase of 2.7 percent in 2006. Inflation-adjusted disposable personal income is expected to rise by 1.5 percent in 2005 and 4.1 percent next year.

The U.S. gross domestic product is forecast to grow 3.5 percent for all of this year and 3.8 percent in 2006. The unemployment rate should average 5.1 percent through the first quarter of next year, and then decline to 4.9 percent by second half of 2006.

Read more!

Gas heater a great addition for garage or shop

What to consider when shopping for a heater

By: Paul Bianchina: Inman News

Frozen fingers and numb toes don't make for the most pleasant experience while you're in your shop hand-crafting that cherry bookcase, or in the garage rebuilding a carburetor. It might be time to consider adding some heat to those spaces, and making life a little more comfortable.

Natural gas and propane heaters can offer clean and safe heat for your garage, woodshop, barn, or other work areas. Portable and permanently installed models are available, both vented and non-vented.

SHOPPING FOR A HEATER

The first decision is what type of fuel to use. If natural gas is already available at the property, it makes sense to power your shop heater with gas as well. If not, propane models are available that are supplied by a propane tank that is placed above or below-ground on your property. DO NOT try to operate a natural gas heater with propane, or vice-versa.

Fuel-fired shop heaters are rated in BTUs of heat output. To decide on the right heater for your shop, the ideal way to do it is to perform a heat-loss calculation first. Heat-loss calculations take insulation, weather-stripping, windows, and several other factors into consideration, with the end result of all the calculations telling you how many BTUs the heater would need to put out to heat that space. If you have a large shop, barn, or other space, it makes sense to talk with your local natural gas or propane supplier or with a heating contractor to have the necessary calculations done.

For the average garage or small shop, however, the manufacturers of most shop heaters will tell you that a particular heater is capable of heating a space of a particular square footage. Those numbers tend to be a little optimistic and assume fairly ideal circumstances, so it's best to use them only as a rough guide. If your shop has tall ceilings, lots of air leakage, poor insulation, or other factors that make it harder to heat, you need to decrease the recommended square footage accordingly (and also take some steps to plug the leaks and beef up the insulation).

Permanently mounted heaters are available for mounting on both the wall and the ceiling, and typically come with all of the necessary hardware for installation. Each heater will have manufacturer-specified clearances that must be maintained between the heater and any combustible surface or material, so be sure you read and understand all of the heater's clearance specifications, and be sure the unit is installed properly.

Heaters are also available in both vented and non-vented models. Vented heaters utilize a specific type of double-wall flue pipe, and here again specific clearances need to be maintained between the pipe and combustible materials. Also, remember that the vent needs to be taken all the way to the outside of the building -- not into an attic or crawlspace – and needs to have the proper termination cap on top.

SAFETY FIRST

Burning natural gas or propane requires oxygen, and during the combustion process, air is drawn from the room for use in the heater. This air needs to be replaced or the room will become dangerously depleted of oxygen, so makeup air is a consideration with the installation of any fuel-fired heater.

Makeup air can come from many difference sources. If the shop is large enough, a sufficient amount of air is present to fuel the combustion process without causing any safety concerns. In smaller shops, it may be necessary to install a small outside air intake vent in the wall or floor to provide the needed air. If makeup air specifications are not included with the heater's installation instructions, check with the manufacturer, dealer, or your local building officials for recommendations.

To ensure safe operation, some heaters now come equipped with a low-oxygen shutoff valve. The valve senses how much oxygen is present in the air, and should that oxygen level fall below a certain point, the valve will shut the fuel off to the heater.

Another safety precaution is the installation of a carbon monoxide detector. Carbon monoxide is a byproduct of the combustion process, and a detector installed in the same room as the heater will warn you if the levels of this potentially deadly gas exceed certain preset safe limits.

Shop heaters are available through many larger home centers, utility companies, farm and garden suppliers, greenhouse and nursery suppliers, and on the web through manufacturers such as Mr. Heater (www.mrheater.com).

Remodeling and repair questions? E-mail Paul at paul2887@direcway.com.

Read more!

Friday, October 28, 2005

More people In Their 20s Seek Homeownership

Record-low interest rates and sweet-deal loans making it easier than ever.

RISMedia

At 20 years old, Patricia Introini figured she didn’t have a shot at buying a house, especially in today’s market.

That didn’t stop the Bakersfield native from trying.

It took three attempts before Introini and her husband, Mike, found a real estate agent who took them seriously.

The couple soon moved into a three-bedroom home in the southwest last May. They paid a little more than $200,000.

“We were tired of renting and not having something of our own,” she said.

Like Introini, more and more people in their 20s are choosing to buy rather than rent. And in a time of record-low interest rates and a new wave of sweet-deal loans, it’s easier than ever to do.

Nationally, the percentage of homeowners younger than 25 has jumped 69 percent—from 14.9 percent in 1994 to 25.2 percent in 2004 -- according to U.S. Census Bureau data.

Bakersfield has had a strong market for young buyers, even with its soaring appreciation rates in recent years, said local real estate agent Susan Ferguson.

“You can’t do that in some parts of California,” Ferguson said. “We can still do that here.”

They’re not buying their dream houses, but it’s a start, she said.

And it’s affordable.

With a variety of new loan offers out there, buying a house doesn’t require as much saving as it used to, said real estate agent Jeanne Radsick.

People can buy now without putting any money down and snag lower mortgage payments through adjustable-rate and interest-only loans.

“We’ve made it real easy for people to get in,” Radsick said.

Around 40 percent of first-time home buyers purchased with no money down last year, said National Association of Realtors spokesman Walter Molony. That’s up from 28 percent in 2003.

Roughly 24 percent also get a financial boost from family or friends.

People ages 25 to 34 make up the biggest concentration of owners at around 34 percent, Molony said.

The “echo” generation—children of baby boomers born in the mid-1970s to mid-1990s—are expected to be a big factor in house sales in the next 10 years, he said.

Now in his late 20s, Lyle Gartenlaub bought a house in the Panorama Drive area four years ago for just less than $130,000. Gartenlaub doubts that it would be possible now.

“We couldn’t even afford this house today,” he said. “The economy and the market today is a lot harder and a lot tougher than it was four years ago.”

Introini, who works as a receptionist at a law firm, said rising house prices made buying a place more urgent. Now she’s settled with her husband and son in a 1,200-square-foot house on a corner lot near White Lane.

Owning a home makes her feel more mature.

“I have a bigger responsibility than my friends,” she said. “I can’t stop working because then I’ll lose the house, but it’s worth it. Now I know I have something that’s mine.”

RISMedia welcomes your questions and comments. Send your e-mail to: editorial@rismedia.com.

Read more!

Buyers Need Real Estate Professionals in the Internet Marketplace

Some three out of every four buyers use the Internet to search for homes.

RISMedia

The Internet has changed but not diminished the role real estate brokers play in helping buyers close real estate transactions successfully, a former president of the National Association of Realtors® told a workshop on competition in the real estate industry sponsored by the Federal Trade Commission and the Department of Justice’s Antitrust Division.

“About three out of four buyers today use the Internet to search for homes, and those using the Internet are more likely to work with a professional than those who do not,” said Cathy Whatley, a Realtor from Jacksonville, Fla. who served as NAR president in 2003. One reason Internet buyers use professionals may be that the hardest task in today’s market is not to locate the property but to negotiate a successful purchase agreement with sellers who frequently receive multiple offers often exceeding list price and then bring the transaction to a successful close, she suggested.

“Providing buyers with information about the properties that are for sale, usually by consulting one of the nation’s 900 multiple listing services, is just one of the services real estate professionals provide. Once buyers identify the house they want to buy, they must be able to successfully negotiate a contract. If they are successful in getting their offer accepted, many other services are required in order to close the transaction. These include arranging inspections, mortgage application and approval, escrow, title insurance, coordination and scheduling of closing, ordering utilities, planning the move, etc. In most cases, participation of a broker/agent to assist the buyer throughout the process is very helpful, if not essential,” Whatley said.

Whatley also discussed the importance that the MLS plays in helping brokers serve buyers. “Without the MLS, it would be far less efficient--and therefore more time-consuming and costly—for buyers to be able to learn about all the properties available for sale in a given market,” she said. She appeared on a panel on real estate buyers.

Addressing another panel at the workshop, Lawrence Yun, a senior economist at NAR, said that real estate customers are free to choose from nearly 80,000 real estate brokerages and more than 2 million real estate licensees, about 1.2 million of whom are Realtors, who abide by the strict Realtor Code of Ethics, and are members of NAR.

“America’s real estate industry is one of the most competitive business environments in the world, characterized by low barriers to entry, intense personal client service and a results-based compensation structure,” Yun said.

“Competition is fierce. Today’s consumer is bombarded with choices on television, radio, newspapers, and the Internet. They are enticed by offers of flat fees, rebates, and other incentives. In fact, discount brokerages and many innovative business models are doing very well in today’s real estate marketplace,” he said. He said that average real estate commission, as computed by Real Trends, have dropped from 5.5% in 1998 to 5.1% in 2003.

Yun cited a recent study by researchers at Pennsylvania State University that found that consumers in 12 residential real estate markets have more information, demand more services, and have more agents and business models to choose from than ever before. The study, undertaken by Professor Steve Sawyer, suggested that increased consumer access to real estate information online is redefining how consumers engage real estate services and may be contributing to the growth of real estate markets and a high level of competition. Potential sellers are more knowledgeable about property values, alternatives and service options.

Access to multiple listing service data may be creating better consumers who demand more of their real estate agents and other value-adding service providers.

RISMedia welcomes your questions and comments. Send your e-mail to: editorial@rismedia.com.

Read more!

Thursday, October 27, 2005

The Weekend Guide! October 27 - October 31, 2005

The Weekend Guide for October 27 - October 31, 2005.

Full Article:

Read more!

Economic future bright through 2007, bankers' group says

'Robust' growth in the forecast

Inman News

A major national mortgage bankers' group projects "robust" economic growth through 2007 and says 2005 will be the third-biggest year ever, trailing 2003 and 2002, the group said today.

The Mortgage Bankers Association today released its three-year economic forecast update, projecting robust economic growth of around 3.5 percent through 2007.

Total residential mortgage production in 2005 will be $2.78 trillion, the third-biggest year behind 2003 and 2002, the MBA said.

"At about 3.5 percent, economic growth will be solid this year despite a drag from sharply higher energy prices, hurricane-related impacts, and a widening trade deficit," said Doug Duncan, MBA chief economist, in a statement.

"Housing will continue to be a major contributor to economic growth, and we expect the string of record-high home sales to continue for the fifth consecutive year in 2005," Duncan said.

During a panel discussion at MBA's 92nd Annual Convention & Expo in Orlando, Duncan said that the labor market will remain strong nationally, even with the devastating impacts on labor markets in the Gulf areas.

According to Duncan, core inflation should edge higher this year and next year as rising and elevated energy prices are expected to pass though to underlying inflation. The Fed is expected to continue its tightening through next year to ensure that inflation remains under control, the chief economist said.

"Long-term rates, albeit rising, will remain relatively low, supporting residential and commercial real estate finance activity," continued Duncan. "Long-term rates have risen by about 40-50 basis points from their lows immediately after Hurricane Katrina."

Duncan said the markets perceive that the Fed is now more concerned about inflation and will be more aggressive in raising rates than previously expected. The economist expects further increases in long-term yields of 20 to 30 basis points by the end of 2005, and another 40 to 50 basis points during 2006.

"The 30-year fixed-rate mortgage yield should reach 6.8 percent by the end of 2007. Even with this moderate increase from the current level, interest rates will still be quite low by historical standards," said Duncan.

Read more!

Younger Buyers Flood the Home Market

By: Ylan Q Mui; Michael Rosenwald: REALTOR® Magazine Online

Younger buyers are jumping into the real estate market, despite their large student-loan debts, minimal credit histories, and lack of savings. Like many Americans, this younger set is afraid that waiting will push them out of the market for good.

Thirty-nine percent of homebuyers in 2004 were 18- to 34-year-olds, and 12 percent of first-timers were under the age of 25, according to the NATIONAL ASSOCIATION OF REALTORS®

Some young buyers are resorting to interest-only mortgages or co-buying with friends to make the purchase. Real estate practitioners say they've noticed more young buyers get emotionally attached to a particular home.

They also report these buyers tend to be less experienced when it comes to negotiations, often accepting terms that leave them vulnerable to future financial turmoil.

Read more!

C.A.R. reports median home price increased 17.3 percent in September

Median price of a home in California at $543,980 in Sept., up 17.3 percent from year ago; sales increase 3.9 percent

California Association of REALTORS®

The median price of an existing home in California increased 17.3 percent in September and sales increased 3.9 percent compared with the same period a year ago, the California Association of REALTORS® (C.A.R.) reported today.

Closed escrow sales of existing, single-family detached homes in California totaled 650,780 in September at a seasonally adjusted annualized rate, according to information collected by C.A.R. from more than 90 local REALTOR® associations statewide. Statewide home resale activity increased 3.9 percent from the 626,210 sales pace recorded in September 2004.

The statewide sales figure represents what the total number of homes sold during 2005 would be if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

The median price of an existing, single-family detached home in California during September 2005 was $543,980, a 17.3 percent increase over the revised $463,630 median for September 2004, C.A.R. reported. The September 2005 median price decreased 4.4 percent compared with August’s revised $568,730 median price.

“The September median home price compared with August has fallen every year since 1993, and in 20 of the last 26 years,” said C.A.R. President Jim Hamilton. “This year is no exception and is part of the seasonal shift to an off-peak period in the real estate market as we approach year’s end.

“Despite the seasonal slow down for the market as a whole, the median price in the High Desert, Riverside/San Bernardino, Santa Barbara South Coast and San Luis Obispo regions hit record highs last month,” he said.

“Year-to-date sales are on track with our expectation that the market in 2005 will set new records for both statewide sales and median price,” said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. “Entry level and mid-range homes are showing more strength in year-over-year price gains compared with the high end of the market. But all tiers of the market are appreciating more slowly than they did a year ago.”

Highlights of C.A.R.’s resale housing figures for September 2005:

. C.A.R.’s Unsold Inventory Index for existing, single-family detached homes in September 2005 was 3.3 months, compared with 3 months (revised) for the same period a year ago. The index indicates the number of months needed to deplete the supply of homes on the market at the current sales rate.

. Thirty-year fixed mortgage interest rates averaged 5.77 percent during September 2005, compared with 5.75 percent in September 2004, according to Freddie Mac. Adjustable mortgage interest rates averaged 4.51 percent in September 2005 compared with 3.99 percent in September 2004.

. The median number of days it took to sell a single-family home was 32 days in September 2005, compared with 29 days (revised) for the same period a year ago.

Regional MLS sales and price information is contained in the tables that accompany this press release. Regional sales data are not adjusted to account for seasonal factors that can influence home sales. The MLS median price and sales data for detached homes are generated from a survey of more than 90 associations of REALTORSâ throughout the state. MLS median price and sales data for condominiums are based on a survey of more than 60 associations. The median price for both detached homes and condominiums represents closed escrow sales.

In a separate report covering more localized statistics generated by C.A.R. and DataQuick Information Systems, 95.2 percent or 394 of 414 cities and communities showed an increase in their respective median home prices from a year ago. DataQuick statistics are based on county records data rather than MLS information. DataQuick Information Systems is a subsidiary of Vancouver-based MacDonald Dettwiler and Associates. (The top 10 lists are generated for incorporated cities with a minimum of 30 recorded sales in the month.)

Note: Large changes in local median home prices typically indicate both local home price appreciation, and often, large shifts in the composition of housing market activity. Some of the variations in median home prices may be exaggerated due to compositional changes in housing demand. The DataQuick tables listing median home prices in California cities and counties are accessible through C.A.R. Online at http://www.car.org/index.php?id=MzU2MTI=.

. Statewide, the 10 cities and communities with the highest median home prices in California during September 2005 were: Palos Verdes Estate, $1,600,000; Manhattan Beach, $1,578,000; Burlingame, $1,419,000; Los Altos, $1,410,500; Newport Beach, $1,399,000; Coronado, $1,350,000; Saratoga, $1,314,000; Calabasas, $1,218,000; Carmel, $1,200,000; Hermosa Beach, $1,200,000.

. Statewide, the 10 cities and communities with the greatest median home price increases in September 2005 compared with the same period a year ago were: Reedley, 89 percent; Twentynine Palms, 81 percent; Sanger, 79 percent; Laguna Hills, 60 percent; Barstow, 57 percent; Upland, 53 percent; Adelanto, 52 percent; Ripon, 52 percent; Merced, 50 percent; Taft, 48 percent.

Leading the Way...® in California real estate for 100 years, the California Association of REALTORS® (www.car.org) is one of the largest state trade organizations in the United States, with more than 180,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

Read more!

Wednesday, October 26, 2005

California real estate values don't disappoint

Median price up $80K from a year ago

Inman News

The median home price along Santa Barbara County's 45-mile-long South Coast jumped to approximately $1.48 million in September.

The median price of an existing California home in September increased 17.3 percent from a year ago, while sales grew 3.9 percent, the California Association of Realtors reported today.

The median price of an existing, single-family detached home in California was $543,980, a 17.3 percent increase over the revised $463,630 median for September 2004, C.A.R. reported. The September 2005 median price decreased 4.4 percent compared with August's revised $568,730 median price.

"The September median home price compared with August has fallen every year since 1993, and in 20 of the last 26 years," said C.A.R. President Jim Hamilton. "This year is no exception and is part of the seasonal shift to an off-peak period in the real estate market as we approach year's end.

"Despite the seasonal slowdown for the market as a whole, the median price in the High Desert, Riverside/San Bernardino, Santa Barbara South Coast and San Luis Obispo regions hit record highs last month," he said.

Closed escrow sales of existing, single-family detached homes in California totaled 650,780 in September at a seasonally adjusted annualized rate, according to information collected by C.A.R. Statewide home resale activity increased 3.9 percent from the 626,210 sales pace recorded in September 2004.

The statewide sales figure represents what the total number of homes sold during 2005 would be if sales maintained the September pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

"Year-to-date sales are on track with our expectation that the market in 2005 will set new records for both statewide sales and median price," said C.A.R. Vice President and Chief Economist Leslie Appleton-Young. "Entry-level and mid-range homes are showing more strength in year-over-year price gains compared with the high end of the market. But all tiers of the market are appreciating more slowly than they did a year ago."

The median number of days it took to sell a single-family home was 32 days in September 2005, compared with 29 days (revised) for the same period a year ago.

Statewide, the 10 cities and communities with the highest median home prices in California during September 2005 were: Palos Verdes Estate, $1,600,000; Manhattan Beach, $1,578,000; Burlingame, $1,419,000; Los Altos, $1,410,500; Newport Beach, $1,399,000; Coronado, $1,350,000; Saratoga, $1,314,000; Calabasas, $1,218,000; Carmel, $1,200,000; Hermosa Beach, $1,200,000.

Statewide, the 10 cities and communities with the greatest median home price increases in September 2005 compared with the same period a year ago were: Reedley, 89 percent; Twentynine Palms, 81 percent; Sanger, 79 percent; Laguna Hills, 60 percent; Barstow, 57 percent; Upland, 53 percent; Adelanto, 52 percent; Ripon, 52 percent; Merced, 50 percent; and Taft, 48 percent.

Los Angeles-based C.A.R. is a state trade organization with more than 180,000 members.

Read more!

Homeowners Keep First Homes, Buy Second

By: June Arney: REALTOR® Magazine Online

Many homeowners are using equity in their current residence to trade up; but instead of selling their existing property, they are renting out their first home to generate income in the hopes of selling and turning a big profit in the future.

The trend is evident in the Baltimore area; and an increase in cash-out refinancings not only in the Northeast but also the Mid-Atlantic, California, and Florida suggests that homeowners elsewhere are doing the same.

According to a 2004 survey by the NATIONAL ASSOCIATION OF REALTORS®, 9.4 percent of buyers expected to purchase a second home and retain their current residences. However, there are concerns about the risks of "leveraging up," as doing so can make the housing market more volatile.

"If there are a lot of people speculating in the same way at the same time, it may push prices above where they can stay," says Patrick Lawler, chief economist for t he Office of Federal Housing Enterprise Oversight.

Other problems can occur if borrowers hold interest-only loans and rates significantly rise; or if they fail to take the costs of both mortgages, property taxes, maintenance, and vacancy periods, among other factors, into account.

Read more!

Tuesday, October 25, 2005

Home Sellers Remain Optimistic

Fewer new-construction houses listed for sale.

RISMedia

The number of houses for sale in the Omaha, Neb., area grew slightly in September, but there were fewer new-construction houses listed for sale and more new-house sales pending than a month earlier.

New detached, single-family houses on the market totaled 1,143 in September, down from 1,148 in the peak month of August and up from 787 in September 2004, according to Trendgraphix data provided to NP Dodge Real Estate.

The number of existing homes listed for sale continued to grow in September, with 3,295 on the market -- 21 more than in the previous month and 1,479 more than a year ago, Trendgraphix said, based on information from the two multiple-listing services in the Omaha-Council Bluffs area.

A national housing economist said some sales may be driven by “fence jumping” from people getting into the market before interest rates get higher. One local Realtor blamed “speculatory selling,” or people who list their houses to see what they can get for them.

Contracted sales in September for existing homes were down from the previous month but were 12.5 percent ahead of sales that month in 2004, Trendgraphix reported. New-home sales were up 28 percent from September 2004.

The continued sales and leveling off of inventory in the new-home market were viewed as positive signs by people in the home-selling business.

“Buyers are still buying, which means we’ll work through this inventory,” CBSHome President Larry Melichar said.

Signs of optimism about the local housing market are evident from one end of the metro to the other:

--Celebrity Homes has announced the opening of Stone Ridge at 162nd and Fort Streets with 500 lots for homes priced from about $190,000 to more than $200,000. The company also is advertising three others coming this fall: Harrison Park, 190th and Harrison Streets; Brook Park, two blocks south of Cornhusker Road on 25th Street; and Williamsburg, Fairview Road and the Kennedy Freeway.

--Benchmark Homes has new models under construction at Ashford Hollow, northwest of 42nd Street and Nebraska Highway 370 in Bellevue.

--NP Dodge next week will hold a “lot draw” for builders of a new subdivision, Sagewood, at 174th and Fort Streets. Eight models are planned.

--Rogers Development Co. is grading 160 acres at 72nd Street and Cornhusker Road for the Settlers Creek subdivision.

--CBSHome agent Mark Ciochon advertised last weekend that he would sell a home within 90 days “or I make your payment.” He said that if a home is priced right and in good condition, he can sell it, usually in about 60 days.

The local optimism has been bolstered by a series of national reports that push a predicted housing slowdown into 2006.

The National Association of Realtors, which originally thought 2005 would be the second-best sales year for both new- and existing-home sales, now says another record is in the works, partly because of the demand created by Hurricane Katrina and partly because of people rushing to buy before interest rates go higher.

Mortgage interest rates increased this week for the sixth week in a row, with a 30-year fixed rate averaging 6.1 percent.

The PMI Group Inc., a mortgage insurer, this week said half of the nation’s 50 largest housing markets, most of them in California and the Northeast, are at risk of price declines over the next two years.

The company’s “risk index,” which places Boston, San Diego and Long Island at a greater than 50 percent chance of experiencing price declines, put Omaha-Council Bluffs at the other end of the spectrum at 6.5 percent. Des Moines was 6.1 percent; Lincoln was 5.7 percent.

The chief economist for the National Association of Home Builders, in a construction forecast conference Thursday, said the housing market “is seeking out a peak,” but it was too early to conclude that it has found one.

The economist, David Seiders, predicted a rise in long-term mortgage rates to about 6.6 percent by the third quarter of 2006 and declines in total housing starts from an estimated 2.032 million this year to 1.94 million in 2006 and to 1.883 million in 2007. After that, he said, annual production should settle around 2 million.

“We’ve been running a tad above that,” he said, “but the comedown shouldn’t be all that dramatic.”

Mike Riedmann, president of the Metro Omaha Builders Association and president for residential sales at NP Dodge, said the new subdivisions opening this fall in the Omaha area represent projects that have been in the works for nine months to two years.

He said that in order to be ready for the biggest sales months -- March, April and May -- developers and builders work in the fall before the first hard frost to get subdivisions to a point where power is installed.

Riedmann and Melichar said the current inventory of houses for sale seems big because of a string of hot sales years that have kept inventories low. “This is more like normal times,” Riedmann said.

Existing home listings may be up, he said, because some owners, hearing about others’ sales, are testing to see how high values have gone.

“We’re seeing homeowners who have said, ‘Gosh, it’s been a hot market, let’s see what we can get for our house,’“ Riedmann said. If they sell, they buy another house; if they don’t get a high enough price, they stay put.

“Those who need to get out adjust their prices so they get it sold,” he said.

But others say they see some evidence of homeowners getting caught making two house payments because of slower sales. “Sixty to 70 percent of the homes I show are vacant, and that’s a really high number,” Ciochon said.

RISMedia welcomes your questions and comments. Send your e-mail to: editorial@rismedia.com.

Read more!

Monday, October 24, 2005

Housing Poised to Recede from Peak Levels

Federal Reserve to continue tightening in early 2006.

RISMedia

Frustrated that steadily increasing the federal funds rate in quarter-percentage-point increments hasn’t driven up the low long-term mortgage rates that have helped fire up the housing market in recent years, the Federal Reserve will continue tightening into early 2006, when housing activity should start flattening out below this year’s torrid levels, NAHB Chief Economist David Seiders told the NAHB Construction Forecast Conference in Washington, D.C.

“The housing market is seeking out a peak,” said NAHB Chief Economist David Seiders, and while it is still too early to conclude that it has found one -- with housing starts increasing 3.4% in September and third-quarter performance exceeding expectations – there is growing evidence that the Fed has started to hit its mark and housing will begin losing some of its exuberance in the period ahead.

“The power of long-term interest rates for housing is incredible,” said Seiders, and key to the housing outlook is where those rates are headed. The rates on 30-year fixed-rate mortgages reported weekly by Freddie Mac have been moving up over the past month, he pointed out, and are now above 6%.

In his housing forecast, Seiders is predicting that long-term mortgage rates will rise by another 60 basis points by the third quarter of next year, bringing them to about 6.6%.

The Federal Reserve will decide to boost its federal funds rate by one-quarter of a percentage point at each of its next three meetings, he predicted, bringing it to 4.5% at the end of January when Fed Chairman Alan Greenspan’s term runs out. Most likely, that will be the rate at which the central bank decides that its policies have reached neutrality, neither stimulating nor slowing down the economy.

Greenspan has discovered that it’s no longer as easy to slow down housing as it used to be, and the Fed has run into difficulty in taking some of the steam out of a boom that it believes has been running too hot and cannot be sustained.

The proliferation of “exotic” adjustable rate mortgages (ARMs) such as interest-only and payment-option loans, along with a rise in speculative buying that has been boosting home purchases and prices in hot markets, has strengthened the Fed’s determination to gain control over the housing sector, he said.

Monetary policy may already be starting to work. The Mortgage Bankers Association’s weekly index of mortgage applications to buy homes has for the past 10 weeks shown “fundamental flatness hovering around a high level,” Seiders said. However, initial interest rates on ARMs have remained at attractive levels despite increases in short-term market rates because lenders are discounting the initial ARM rates, “bringing the actual rate to 2% below what could be charged.”

NAHB is forecasting a decline in total housing starts from 2.032 million this year to 1.94 million in 2006 and a further drop to 1.883 million in 2007. After that, the annual production of new housing units (including manufactured homes) should settle around 2 million units, which is within the 1.9 million to 2.1 million rate that is sustainable on average for the 2003-2013 period, he said.

“We have been running a tad above that,” Seiders said, “but the comedown shouldn’t be all that dramatic.”

Single-family construction is projected by NAHB to decline from 1.683 million starts this year to 1.590 million in 2006 and 1.533 million in 2007. Multifamily output, however, should remain close to the 349,000 level expected for this year through 2007.

With vacancy rates falling and condominiums becoming oversupplied in some markets, the composition of the multifamily market should shift a bit away from condos and back to market-rate rentals, he said.

RISMedia welcomes your questions and comments. Send your e-mail to: editorial@rismedia.com.

Read more!

Tax Reform Panel Makes it Official: No More Home Equity Interest Write-offs, No Property Tax Deductions

By: Kenneth R. Harney: Realty Times

At its final meeting last week, the President's federal tax reform advisory panel intensified its assault on real estate, with new proposals to effectively eliminate most home equity-related write-offs replacing them with a 15 percent tax credit on mortgage amounts up to local FHA limits, plus a $100,000 increase in the home sale capital gains exclusion. Ken Harney reports.

If you could pocket an extra $100,000 on your home sale profits tax-free, would you give up your mortgage interest deductions and your ability to write off local real estate taxes and your state income taxes?

That's the crux of the real estate bargain proposed last week (October 18) by President Bush's tax reform advisory panel. The bipartisan, blue-ribbon group called for a 15 percent tax credit on mortgage interest, but only up to a strictly-capped loan limit, along with an end to all write-offs for state and local taxes. Only mortgage debt up to the FHA maximum loan ceiling for your area would count toward the 15 percent credit. In other words, if you had a $550,000 first mortgage and a $150,000 home equity credit line and you lived in an area where the FHA loan limit is $172,000, you would qualify for a 15 percent credit on mortgage interest paid only on the first $172,000 of your $700,000 mortgage debt. Under current tax rules, you can write it all off.

The only bone the tax reform panel threw to real estate owners last week was a proposed $100,000 increase in the current $500,000 capital gains exclusion limit for married, joint-filing sellers and a $50,000 increase for single sellers. On top of that, the panel recommended the capital gains exclusion for home sale profits be indexed to inflation. A $600,000 cap next year, for instance, would become a $618,000 cap the year after that, assuming a 3 percent jump in the Consumer Price Index (CPI).

The reform panel's plans, scheduled for formal presentation to the White House Nov. 1, called for an extensive list of other tax code changes, including an end to the alternative minimum tax (AMT) that has begun affecting large numbers of upper-middle income households, plus a cut in the capital gains rate from 15 percent to one-quarter of each taxpayer's ordinary income tax rate - a maximum rate of 8 .25 percent.

The possible elimination of mortgage interest deductions was hinted at by the panel earlier in October, and raised a predictable firestorm of protest from real estate and mortgage groups. But the recommendation to end all deductions for state income taxes and local property taxes, unveiled for the first time last week, would constitute a double-whammy for hundreds of thousands of homeowners in high-cost, high-tax states if enacted.

In an interview with Realty Times, Doug Duncan, the chief economist for the Mortgage Bankers Association of America, called the tax reform proposals "a disaster" for homeowners in states such as California, New York, Massachusetts and much of the East Coast.

"Would people continue to be able to buy houses at prices like they are paying today?" asked Duncan. "Of course not - home prices would have to decline" if tax benefits such as interest deductions and property tax write-offs were stripped out of the equation.

How serious should real estate owners and advocates take the advisory panel's recommendations? Didn't the president himself say he didn't want tax reform at the cost of homeownership? Yes, but panel members argue that a 15 percent credit for a moderate amount of mortgage interest would actually benefit far more homeowners - especially the vast numbers of people who do not itemize - than the current system, which skews benefits heavily toward upper-income owners and those who live in high-cost areas. Property tax write-offs also do not benefit moderate income and first time buyers, according to panelists, but instead subsidize upper income families overwhelmingly. The panelists point to studies conducted by the Congressional Joint Committee on Taxation and the Treasury Dept. that buttress these conclusions.

The President is highly likely to include at least some of the recommendations from the advisory panel in his budget proposals to Congress in 2006. What Congress does with those proposals is a completely different issue, especially in an election year.

Bottom line: Don't look for any drastic real estate tax changes in 2006, but do not dismiss the panel's recommendations out of hand. Revenue-raising ideas - even those that would negatively affect real estate - have ways of getting on Congress's agenda when Congress needs to raise money to restrain budget deficits. That time of reckoning - paying for costly wars and massive disaster relief and reconstruction, along with scrapping of the unpopular revenue gusher known as the AMT - may not be as far in the future as some homeowners assume.

Read more!

Sunday, October 23, 2005

Risk of home-price declines rise

Prices overvalued by 10% or more in half of large metros.

Inman News

A number of the nation's largest housing markets remain at risk of price declines, according to the PMI U.S. Market Risk Index, released this week, and prices in many markets are overvalued.

The median risk index value increased 11.6 percent, from 120 to 134. Topping the risk index list with a greater than 50 percent chance of experiencing price declines are Boston; San Diego, Long Island (Nassau-Suffolk), N.Y.; Santa Ana, Calif.; and Oakland, Calif.

Nationwide, there is a 21.8 percent probability of an overall house price decline, as measured within the next two years and across the 50 largest housing markets, up slightly from 21.3 percent last quarter. At the top of the valuation index, a new feature this quarter, were Los Angeles, where home prices are estimated to be overvalued by 33.7 percent; Sacramento, by 31.3 percent; and Riverside, by 30.7 percent.

The fall report is based on second-quarter data, so excludes the impact of Hurricanes Katrina and Rita.

"House prices are sticky, so moving to another phase in the real estate cycle can be a slow process," explained Mark Milner, chief risk officer with PMI Mortgage Insurance Co. "But we believe that over the medium to long term, prices will move into better alignment with local economic factors, in particular income."

Marco van Akkeren, an economist with PMI Mortgage Insurance Co., explained, "In the riskier markets affordability has weakened over the past several quarters as house price appreciation diverged from economic fundamentals. With this quarter's report we are seeing a continuation of that trend."

The PMI US Market Risk Index is published quarterly by PMI Mortgage Insurance Co., a subsidiary of The PMI Group, as part of its Economic and Real Estate Trends report. The risk index indicates the probability that home prices will decline in two years.

The new valuation index indicates whether prices are over- or undervalued compared to their long-term trend, and by how much.

The valuation index found that half of the nation's 50 largest housing markets are overvalued by 10 percent or more. Three are overvalued by 30 percent or more and another 11 are overvalued by 20 percent or more.

Eleven markets are undervalued. Van Akkeren explained, "This is another way of looking at the markets, and the results reveal a strong association between PMI's market risk index values and deviations from long-term home-price trends, shown in the valuation index. Taking a historical view, we also see that markets are more overvalued today than they were in the past."

Market risk index trends include: • Boston, San Diego, and Long Island (Nassau-Suffolk), N.Y., continue to top the

index with scores of 551, 536, and 532, respectively, although San Diego has

jumped over Long Island to second place.

• The MSAs that experienced the biggest change in market risk index score since

last quarter are Fort Lauderdale, Fla., and Las Vegas. Fort Lauderdale's score

increased 69 points to 288, moving it from the 18th spot to the 16th; Las

Vegas also moved up two spots, from 24th to 22nd, as its score increased 67

points to 201.

• Other big gainers were in California and Florida. In Florida, Miami added 40

points for a score of 206, while Tampa gained 35 points, taking it to 201. In

California, Riverside increased 44 points to 466, Los Angeles was up 39 points

to 460, and Sacramento gained 37 points for a score of 456. San Jose made the

biggest move in the other direction, dropping 41 points to 472, below the 50

percent mark and out of the top five.

• The five least risky areas are Columbus, Ohio; Cincinnati, Ohio; Memphis,

Tenn.; Indianapolis, Ind.; and Pittsburgh, Pa., last on the list with a score

of 54, down a point from last quarter.

Findings of PMI's new valuation index include: • Of the 14 markets overvalued by 20 percent or more, seven are in California

(Los Angeles, Sacramento, Riverside, San Diego, Santa Ana, Oakland, and San

Jose), three are in the Northeast (Edison, N.J., Newark, N.J., and Nassau-

Suffolk, N.Y.), and two are in Florida (Tampa and Miami). The other two are

Las Vegas and Phoenix.

• Detroit leads the list of undervalued markets at -10.3 percent, followed by

three Ohio markets: Cleveland (-6.9 percent), Cincinnati (-3.4 percent), and

Columbus (-3.2 percent).

The PMI U.S. Market Risk Index is based on the House Price Index from the Office of Federal Housing Enterprise Oversight, labor market statistics from the Bureau of Labor Statistics, and the PMI affordability index, which uses local median household income, home price appreciation, and the price of a conventional mortgage to calculate the local share of mortgage payment to income relative to its baseline year of 1995.

Read more!

How real estate can save on your income taxes

Tips for 2005 tax season

By: Robert J. Bruss: Inman News

Although the end of 2005 is several weeks away, it's not too early to plan for year-end tax savings. Real estate can play a major role in saving your tax dollars.

As always, before using these tax saving techniques, please consult your personal tax adviser for details. Even if you use just one or two of these methods, the result can save hundreds or even thousands of tax dollars:

1. BUY A PRINCIPAL RESIDENCE BY YEAR-END. This is the best time of the year to buy a home. As the holiday season approaches, each week there are fewer competitive home buyers in the market. Home sellers who have their residences listed for sale at this slow home sales time of the year are usually highly motivated to sell.

The loan fee you pay to obtain a home acquisition mortgage is fully tax-deductible as itemized interest. Also, mortgage interest you pay in 2005 is also tax-deductible. However, your home purchase must close by Dec. 31, 2005, to qualify.

2. SELL YOUR PRINCIPAL RESIDENCE BY YEAR-END. If you enjoy tax-free cash, selling your home can produce up to $250,000 (up to $500,000 for a qualified married couple filing jointly) tax-free capital gains. To qualify, Internal Revenue Code requires you to have owned and occupied your principal residence at least 24 of the 60 months before its sale.

3. USE A HOME EQUITY LOAN TO CONVERT NON-DEDUCTIBLE LOANS INTO TAX-DEDUCTIBLE INTEREST. If you pay non-deductible interest on a car loan, credit cards, student loan, or personal loan up to $100,000 total, obtaining a Home Equity Line of Credit (known as a HELOC) can convert that non-deductible loan interest into tax-deductible home equity interest when you pay off those loans.

Banks, credit unions and other lenders are eager to make you a home equity loan. For some unexplained reason, the default on home equity loans is virtually zero. Interest on such loans, up to $100,000, is tax-deductible as itemized interest.

However, if the purpose of your home equity loan is to use the funds for home improvements or in your business, there is no limit to the interest deductibility on your business tax returns.

4. REFINANCE YOUR HOME LOAN; DEDUCT ANY UNDEDUCTED LOAN FEE. If you hurry, you can refinance your home mortgage by year-end. Although loan fees paid on refinanced mortgages are not fully deductible in the year paid, they can be deducted (amortized) over the life of the mortgage.

When you refinance an existing mortgage, on which you are deducting amortized loan fees, in the year of the old loan's payoff you can deduct the entire undeducted loan fee.