By: Brian Deagon: REALTOR® Magazine Online

As home technology becomes more affordable, reliable, and user friendly, more consumers will become more open to incorporating "smart" features into their properties, experts say.

Smart homes feature computer networks that control appliances, security systems, and heating and air-conditioning systems, usually through the Web. Wireless broadband is helping to fuel the trend.

Rather than base smart homes on "cool technology," the Internet Home Alliance says the focus needs to be on instituting products for the home's three ecosystems: family, work, and entertainment. Products that serve the family ecosystem concentrate on security and energy-efficiency, among other things; while those that serve the work ecosystem include cell phones and telecommuting tools.

Joe Dada, founder of SmartLabs and Smarthome.com, says he expects word-of-mouth advertising to boost the popularity of smart homes, but he and other experts believe home builders need to do more to promote the technology.

Bill Ablondi of the Parks Associates research firm says builders are not widely aware of the smart-home products that are presently available, which is why most do not include such products in their inventory.

Read more!

Friday, March 31, 2006

Digital Home Technology More Widespread

Thursday, March 30, 2006

The Weekend Guide! March 30 - April 2, 2006

The Weekend Guide for March 30 - April 2, 2006.

Full Article:

Read more!

Residences Planned for Beverly Hilton

Owner Beny Alagem would bulldoze parts of the famed hotel to make way for about 200 for-sale residences as part of a $200 million redevelopment project.

By: ANDY FIXMER: Los Angeles Business Journal

The owner of the Beverly Hilton is planning to bulldoze parts the famed hotel to make way for luxury residences, according to a report obtained by the Business Journal.

Packard Bell co-founder Beny Alagem, who paid $130 million for the 569-room hotel two years ago from entertainment mogul Merv Griffin, wants to knock-down Trader Vic’s Restaurant and Bar, the executive conference center, the Oasis Court and the hotel’s 514-space parking garage.

On those sites Alagem would build two 13-story buildings containing 96 condominiums, a 104-unit, 15-story condo hotel and 96 hotel rooms in two 3-story structures. The hotel’s parking would be put underground and increased to 1,422 spaces, to meet Beverly Hills’ codes.

A price tag for the project – which also includes a remodeled pool and traffic improvements – wasn’t included in the report, but sources said the final cost could be in the $200 million range.

The hotel, and its ballroom in particular, has gained international prominence as the home of the Golden Globe Awards and other entertainment industry events.

Though the main 353-room, 8-story tower designed by noted architect Welton Beckett would remain, the plans would result in a net reduction of 96 hotel rooms.

Alagem’s investment firm, Oasis West Realty LLC, is expected to announce its plans at a joint meeting of Beverly Hills’ planning commission and city council on Tuesday afternoon.

Sources involved in the project provided the Business Journal with a copy of a master plan that Oasis West Realty distributed to city officials this month.

Oasis West Realty declined to elaborate on specifics of its plans until its Tuesday meeting. Hilton Hotels Corp. executives didn’t return calls seeking comment.

Bruce Baltin, a senior vice president at PKF Consulting, said the firm is working on the Beverly Hilton redevelopment plans, but he declined to comment on specifics.

“As projects go, this makes all the sense in the world,” he said. “It keeps the best elements of the hotel and replaces those elements that no longer work.”

Hotel owners across the country are considering similar projects that subtract rooms and add residences, said hospitality attorney Jim Butler, a partner at Jeffer Mangels Butler & Marmaro LLP.

“This has become a major national trend for any full-service property,” he said. “There are a lot of people who want to live in condos that have the amenities and security of a hotel. For that reason, most (hotel owners) are considering a residential component to increase the economics of the property.”

The massive redevelopment plan for the Beverly Hilton’s 9-acre property comes on the heels of an $80 million renovation of the hotel that Oasis West Realty recently completed. The project is not expected to compromise that work.

As Oasis West Realty was finishing the renovations, the firm announced in December that it hired New York-based architecture firm Gwathmey Siegel & Associates LLC to design residential additions to the hotel.

Read more!

Wednesday, March 29, 2006

Unique thought process makes home ownership a reality

How to eliminate obstacles to financial goals

By: Ilyce R. Glink: Inman News

When you're broke, and spend your free time dreaming the American Dream of home ownership, the idea of closing on a house seems about as real as an oasis in the desert.

So you continue to daydream about the future while wasting money decorating your rental, buying nice clothes and eating out several times a week. You feel better about where and how you're living today, because you've created a nice-looking home for yourself.

But if your real goal is to become part of the "ownership society," and buy a place of your own, your ship is turned in the wrong direction. You're actually moving further away from home ownership.

Feathering someone else's nest is often misplaced money management. And it happens so quickly, and so silently, that most wannabe home buyers aren't even aware that they're moving backward instead of forward.

How do you right the ship and turn yourself around? You have to bring the "future to the present."

Bringing the "future to the present" is a phrase my friend, Michael Alter, likes to use when working on closing a sale in business. Alter, who is president of a fast-growing online payroll company called SurePayroll (www.surepayroll.com), likes to lay out the path so he knows what steps have to be taken to get the deal done, which hurdles have to be overcome, and who the real decision maker is in any business deal.

The methodology involves asking a lot of pointed questions that begin with, "If this happens..." and end with "…then what?"

Buying a house requires home buyers to ask a lot of these kinds of "If...then what?" questions. For example, let's say you have a $15,000 car loan and $2,000 of credit card debt, and you apply to get pre-approved for a mortgage. The lender says that your debt-to-income ratios are a bit out-of-whack. In other words, the monthly debt service on what you want to buy is more than you can afford-a common obstacle for first-time home buyers.

If you're using "future to the present" logic, you might say to a mortgage lender, "If I can pay off the $2,000 of debt, then what will you need to approve me for the loan?"

The lender might say nothing more is needed, or he or she might suggest that you beef up your cash reserves. At which point you would say, "And if I bring up my cash reserves, then will you be ready to approve me for the loan?" And so on, until the lender says there's nothing left to do and the loan is approved.

Bringing the future to the present allows home buyers to eliminate potential obstacles to a deal and get it done. It allows pre-buyers, those who are still in the dreaming stage, to organize their thinking and figure out what kinds of steps they need to take to achieve their goal of home ownership.

Which is what Sandra, 26, needs to do. Sandra works full-time in Portland, Ore., and wants to buy her first house. Housing prices in the metro area are affordable, but she wasn't sure how to begin thinking about buying a house when even modest two-bedroom bungalows seemed out of her price range.

So instead of taking actual steps toward achieving her goal, Sandra started sending friends and family links to various homes for sale in different neighborhoods.

In bringing the future to the present, Sandra has to think about how she can translate her rent payment into a mortgage/taxes/insurance payment. She also has to work out how she is going to reduce her credit card debt enough so that she can take on as large a mortgage as possible.

She also has to think about maintenance and upkeep, which neighborhoods are going to provide good price appreciation but allow her to feel safe at night, and whether her next career move (either up the ladder or off to graduate school) will allow her to keep afloat financially.

Where should she, or any first-time buyer, start? If you have debts that you cannot pay off today, you should probably sit with a credit counselor for a free budgeting session. The counselor will go over your monthly expenses, and show you places you may be able to cut back. Then, you should start paying down your revolving debts with the savings.

Once your debt load is under control, find an honest mortgage lender who can work with you to maximize your earning power. Work with the lender step-by-step in order to resolve each issue before it becomes overwhelming.

The next step is finding the right house, resolving all of those issues that come up, building the best home-buying team and ultimately closing on the property.

Bringing the future to the present isn't a magic answer. You won't buy your dream house overnight. It may take weeks, months or even a year, depending on how complicated your life is today.

But focusing on the step you're standing on and what has to be done to get you to the next step will get you turned in the right direction.

And that's the first step toward achieving your dreams.

Read more!

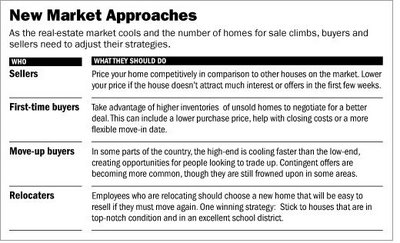

The New Rules of Real Estate For a Cooling Housing Market

The conventional wisdom that guided buyers and sellers during the real-estate boom is being challenged. Pricing is becoming crucial and relocating is trickier as the number of homes for sale nears a 10-year high.

By: Ruth Simon: The Wall Street Journal Online

As the spring selling season moves into high gear, the cooling housing market is upending the conventional wisdom that guided buyers and sellers during the housing boom.

The changing dynamics have implications for a wide variety of players in the real-estate market. Some brokers are advising sellers to price their homes in the bottom 25% of comparable properties. People looking to enter the market for the first time are being told not to overly stretch their finances because rising home prices may no longer bail them out. Employees who are relocating are being advised to steer clear of new subdivisions where competition from brand new construction could make reselling soon difficult.

Such strategies aren't entirely new, but they had fallen from favor in many markets as home sales heated up early in the decade. Recently, markets have shown signs of cooling. The number of homes for sale has climbed about 30% over a 12-month period, reaching its highest level in nearly 10 years, according to the National Association of Realtors. The group recently predicted sales of existing homes would drop 5.7% this year versus a 4.4% gain in 2005.

Higher mortgage rates are making houses less affordable in many metro areas. Rates on 30-year fixed-rate mortgages now average 6.46%, up from 6.14% a year ago, according to HSH Associates, with rates on adjustable-rate mortgages moving up even faster. Another increases in interest rates by the Federal Reserve, expected today, could push mortgage rates even higher.

What this new environment means for buyers and sellers varies from market to market. To be sure, sales are strengthening in some markets, including Albuquerque, N.M., and Indianapolis. Economic growth and an influx of investors have helped to push home sales in Houston up 13% in the first two months of 2006 from a year earlier, says Steve Barnes, president of Coldwell Banker United, Realtors.

But in many parts of the country, after several years of sellers calling the shots, 2006 is shaping up to be a market in which buyers are gaining bargaining power. In New York City, where the housing market has begun to cool, some buyers are now getting condo developers to pay city transfer taxes and certain other expenses that can total 3% to 4% of the purchase price, says Jeffrey Jackson, chairman of appraisal firm Mitchell, Maxwell & Jackson.

What follows is a look at what this means for different groups of buyers and sellers.

Sellers

Say goodbye to the days when sellers could simply look at what their neighbor's house sold for and then list theirs for 10% more. Brokers are advising sellers to make sure their house comes across as a good value relative to other homes on the market.

"Pricing is absolutely critical right now," says Rosey Koberlein, chief executive of Long Realty Co. in Tucson, Ariz., where sales are off 20% so far this year.

In determining a home's value, Richard Druker, a managing broker with Baird & Warner in Chicago, considers everything from the height of the ceiling to the quality of any renovations and whether the front door creates a good first impression. "A great thing to do is to look at properties that are priced comparably to yours and ask, 'Which would you rather buy?' " he says.

Overpriced homes may never even catch the eye of their intended audience. That's because buyers and brokers increasingly rely on computers to screen listings based on price, size and other parameters when new properties come to market. Also, listings typically generate the most excitement and interest in their first few weeks on the market.

David D'Ausilio, a broker-associate with Re/Max Heritage in Westport, Conn., is counseling his clients to price their homes in the "bottom 25%" of comparable homes and to cut their asking price by 3% to 5% if the listing doesn't generate several showings or written offers within three weeks.

Brokers are also telling sellers to fix problems that buyers might have overlooked in a more heated market. Bo Menkiti, president of the Menkiti Group of Keller Williams in Washington, D.C., recently advised one couple to replace their old stove and refrigerator in their otherwise updated house. While the return on the investment was likely to be minimal, "you don't want to leave things that would be a total turnoff," he says.

First-Time Buyers

As the housing market cools, first-time buyers have the opportunity to be more thoughtful about their purchases and to negotiate for a lower price, a more flexible move-in date, or incentives such as seller-paid closing costs.

Jill Green, a Realtor with Century 21 Award in Carlsbad, Calif., a coastal community north of San Diego, has been making offers that are 1% to 5% below the low end of the seller's price range. "Sellers are entertaining the offers and are taking them," she says.

Some brokers are advising first-time buyers to leave a financial cushion instead of stretching as much as possible and counting on rising home prices to bail them out. They are also asking sellers to help with closing costs.

Elise Owen, a program manager for a nonprofit group in Washington, recently purchased a one-bedroom condo for $178,000. The seller threw in $5,000 toward closing costs. "It allowed me to feel like I was on more secure ground by keeping some of my savings available" for emergencies, Ms. Owen says.

Move-Up Buyers

Move-up buyers face the delicate task of balancing a purchase with a sale. A growing number of buyers are making offers that are contingent on selling their current home. But such offers are often frowned at, in part because these deals are more likely to fall through. "You're going to get the house for a better price if it's noncontingent," says Jane Powers, a broker with Ewing & Clark Inc. in Seattle.

In some parts of the country, such as California's Silicon Valley, cooling is most evident in the higher end of the market, good news for homeowners looking to trade up. "For an extra half-million dollars, you can get quite a bit more for your money than you did before," says Richard Calhoun, broker-owner of Creekside Realty in San Jose.

Relocaters

People who are relocating for a job often can't afford to let their home sit. Tim Popadic last summer listed his four-bedroom colonial in Monroe, Conn., for $725,000, $26,000 above his broker's initial estimate, after he accepted a position as an associate pastor with a church in Palm Beach Gardens, Fla. When no offers materialized, he delayed his move and cut his price three times, before accepting a $557,000 offer in October. "At the end of the day, [the broker] was right," he says.

Employers are looking for ways to ensure that homes don't languish on the market when an employee relocates. The number of company-ordered appraisals is growing as employers seek to get the price right before a house goes on the market, says H. Cris Collie, executive vice president of Worldwide ERC, an association of companies and professionals that relocate employees.

Going forward, Mr. Collie expects employers to more aggressively enforce policies that require transferees to price their homes close to the appraised value. He is also seeing renewed interest in "loss on sale" programs, which compensate people who are relocating for losses if they sell below the purchase price. One in three large companies now offers these policies, according to a Worldwide ERC survey, down from 42% in 2000.

Making sure the new house will be easy to resell is also crucial for people who are likely to be transferred again in a few years. "In a down market only the nicest homes sell quickly," notes Bradford Charnas, president of Charnas Appraisal in Cleveland. Mr. Charnas advises transferees to look for homes that are in top-notch condition and in an excellent school district.

Some relocation experts also advise transferees to shy away from buying a home in a brand-new development. "If you're buying in a new subdivision...you're competing with new construction" when you sell, notes Pam O'Connor, president and chief executive of Leading Real Estate Companies of the World.

Investors

As the housing market cools, investors used to seeing quick profits in once hot markets such as Phoenix, Washington, and southern Florida may be disappointed. In Tampa Bay, Fla., investors can still find buyers for one-of-a-kind homes in established neighborhoods. But in some new subdivisions, dozens of similar investor-owned homes are competing for buyers, says Craig Beggins, president of Century 21 Beggins Enterprises. "If you have any way not to sell right now, don't," Mr. Beggins tells investors. "If the neighborhood is brand new and no one is living there, my advice is to rent it if they can."

But the decision to sell or rent can be tricky, particularly if the rental income isn't enough to cover the mortgage and other carrying costs. Rental homes typically don't show well, says Bob Hamrick, broker-owner of Coldwell Banker Premier in Las Vegas, and often must be vacated and given a fresh coat of paint and new carpet before they are put back on the market.

Some investors are turning to stagers to give a vacant new home personality. Rebecca Grainger, co-owner of Staging Masters Inc. in central Florida, hangs towels in the bathrooms and rents furniture for key rooms, such as the foyer, living room, dining room and master bedroom. "We're basically making it like a model home," she says.

Read more!

Tuesday, March 28, 2006

Foreclosure Fraud Finds a Home

The crime that preys on strapped mortgage holders is on the rise in the Southland and elsewhere.

By: Jessica Garrison, Times Staff Writer: LA Times

Howard Brown and his family felt panicked and desperate. They were behind on their mortgage payments, and they had just learned that their three-bedroom house in Wilmington was being foreclosed on. They did not know where to turn.

Then, a nice young man appeared in the driveway. Well-dressed and pleasant, he told Brown he was a Christian. He said he could help save Brown's home.

All Brown had to do was sign documents that would allow Brown to arrange for someone to temporarily "share" title to his property. With someone else's name on the title along with his, Brown could refinance and also improve his credit. Then, once his credit was repaired, he would get sole title back.

Brown signed. "He seemed like he was honest," the legally blind Korean War veteran said.

And that's when his real troubles began. With mounting horror, he and his family came to realize that they had signed over title to their home to a man they had never heard of. It also became clear that they were now on the hook not only for their original loan of about $160,000 but also for about $150,000 in new debt borrowed against the house without their knowledge.

Then the family began getting notices that the property was going to be put up for auction.

--------------------------------------------------------------------------------

Foreclosure fraud is a relatively simple crime. Once a property owner misses two or three monthly payments, a lender routinely files a notice of default with the county recorder's office. That public document is a precursor to formal foreclosure, and all a scam artist has to do to find victims is read the notices, descend on the homeowners and trick them into signing over title to their homes.

It is a crime that consumer advocates fear could become increasingly common — especially in Southern California, where many homeowners have stretched themselves to their financial limits to afford the region's record high housing prices.

"The scammers don't create the foreclosure rates, but they swoop in at the time that someone is in distress," said Elizabeth Renuart, a staff attorney with the National Consumer Law Center in Boston and the author of "Dreams Foreclosed: The Rampant Theft of Americans' Homes Through Equity-Stripping Foreclosure 'Rescue' Scams."

While still considered low, indications are that the nation's foreclosure rate is on the rise, meaning the pool of potential victims is growing. Overall, the foreclosure rate in the Los Angeles region has doubled since October, according to RealtyTrac Inc., an Irvine-based company that monitors foreclosures. As of February, the rate was one foreclosure for every 1,223 households.

At the same time, the steep rise in housing prices over the last few years has created a massive amount of equity in many properties — a tempting target for swindlers.

The average value of a house in Wilmington, where the Browns live, has more than doubled over the last five years, rising from $155,000 in 2000 to $395,000 last year, according to DataQuick Information Systems, a real estate research firm in La Jolla. Similar jumps were recorded across Los Angeles County.

"There's so much equity in houses, if you're going to do white-collar crime, you only have to rip off 10 people to become a millionaire," said Debra Zimmerman, an attorney at Los Angeles' Bet Tzedek legal services who specializes in real estate fraud and elder abuse. She said she has seen a "dramatic" rise in victims of foreclosure fraud in Los Angeles County in the last few months.

"I am getting three cases a week," she said. "I used to get none." Attorneys at the Legal Aid Foundation of Los Angeles also report jumps.

Across the country, law enforcement officials also are grappling with the crime. Colorado's attorney general, John Suthers, is pushing a law that would tighten rules for brokers after a rash of scams in that state. Minnesota passed new rules in 2004, Maryland in 2005.

California actually has some of the nation's strictest regulations, but advocates say that does not stop all scam artists. And homeowners in the state could be particularly vulnerable because so many have nontraditional loans such as adjustable rate mortgages that send payments spiraling upward with rising interest rates after a fixed period. Real estate experts said many of those payments are set to begin rising this year.

Already, advocates say they are seeing a corresponding rise in fraud victims.

"We are just seeing more and more of it," said Dan Grunfeld, president and chief executive of Public Counsel, a Los Angeles pro bono law office that tries to help victims — including the Brown family — reclaim title to their houses or at least escape the crushing debt that many are left with after scam artists have drained the properties' equity.

--------------------------------------------------------------------------------

Brown bought his Wilmington house in 2000 for $185,000. Built over an oil well that no longer produced, it was brand-new, with three bedrooms and two bathrooms. When it's sunny, light streams through the living room windows. There is space out front for Brown, who is retired from an auto body shop, to work on his VW Bugs.

But by the spring of 2004, Brown and his girlfriend, Dana Timmons, said, they were struggling with their monthly mortgage payment of about $1,700.

To help afford the payments, Brown and Timmons rented out some rooms.

Amy Salyer, the girlfriend of Timmons' son, lived with the family for a time.

"They were going to lose the house," she recalled of that period. She later played a key role in discovering what had happened when the family was allegedly defrauded.

In addition to renting out rooms, the family also began trying to refinance. But Brown's credit was less than stellar, and things were not looking good.

Then, according to both Brown and a federal grand jury indictment filed last year, a man named Edward Seung Ok showed up one day while Brown was working on his cars in the frontyard.

Ok said his parents owned a business in Wilmington, Brown said, and that they had once been at risk of foreclosure too. Ok said he was dedicated to helping people like Brown save their homes, Brown added.

"He made everything really easy," Timmons said.

Ok took Brown and Timmons to his office and introduced them to a woman he described as his colleague, Martha Rodriguez. The two explained that they were going to give Brown a new loan. They said he would temporarily share title to his home with someone else while his credit was being repaired, the grand jury said. They also said he would get $10,000 in cash, according to the indictment.

For their trouble, Rodriguez and Ok would receive a commission, Brown and his family said.

"It was good for everybody, right? That's what it seemed," Salyer said.

In September of 2004, Brown said, he signed the paperwork that Ok and Rodriguez put before him.

Within weeks, the family said, they began receiving mail for a man named Luis Pineda. They assumed it was a mistake and sent it back.

They continued to receive late notices on their loan, which they had thought had been taken care of.

Calls to Ok and Rodriguez went unreturned, Salyer said, but after days of trying, she finally reached Rodriguez. The woman assured her everything was fine, made one payment and then vanished. Salyer said they could never get her on the phone again.

Meanwhile, the Browns kept getting solicitations from people offering to help them out of foreclosure. Unbeknownst to them, they were still in default on their loan.

Salyer got on the Internet and began doing research. Slowly, the puzzle pieces came together: The house was now in Pineda's name. And he, or someone using his name and Social Security number, had taken out a second loan on it.

What's more, no one was making those payments either; creditors and solicitors were showing up at Brown's door, asking for Luis Pineda and saying they could help him too.

Pineda was identified by the initials L.P. in the indictment, which described him as "a strawbuyer," someone whose name is used on a loan application even though that person does not intend to live in the home or make any payments.

"We were frantic," Salyer said. "We couldn't sleep. It was sickening."

Fearful that they would be evicted at any moment, Timmons said she began packing the family's possessions and preparing to move.

Salyer, meanwhile, launched a campaign to try to save the family's home. "I contacted talk shows … Oprah, Montel," she said. She also called officials with the county and the state. At some point, someone put her in touch with the FBI. Investigators, it turned out, were already on the trail of Ok and Rodriguez.

Last year, the U.S. attorney's office charged the two with 10 counts of mail fraud for a scheme authorities say cheated dozens of Los Angeles and Orange County homeowners and lenders, including Brown, out of $8 million.

Rodriguez and Ok have pleaded not guilty. Their case could go to trial this year.

Ok's lawyer, Roger Rosen, said the Brown family should not blame his client for their troubles.

"They were not tricked," he said of Brown and the other alleged victims. "It was all above board. It was all on the table."

Rosen said that what Ok did "was offer an opportunity to individuals that they would not otherwise have had…. So if things did not work out for some of these folks, it may be for reasons other than what they'd like to do, and that is blame Mr. Ok and Ms. Rodriguez."

Rodriguez's lawyer was unavailable for comment.

Legal aid lawyers contend that upward of 100 families around Los Angeles who entered into financial transactions with Ok and Rodriguez are now in danger of losing their homes.

Later this spring, attorneys plan to file lawsuits seeking to restore titles to many of the victims.

The Brown family is represented by Public Counsel and a private attorney working pro bono, Lou Schoch, of the firm Gibson Dunn & Crutcher.

Schoch said he plans a series of legal actions. One will try to get title to Brown's home back in Brown's name.

Now it is listed as belonging to Luis Pineda.

"Does he exist? We don't know," Schoch said.

Schoch said he also planned to sue Ok, Rodriguez and a number of title, realty and loan companies that may have been involved in the transactions that drained the equity from Brown's home.

Brown and his family are hopeful. But they are also braced for the worst. Along the wall in the living room, boxes of the family's possessions are still stacked, in case the family has to move.

Brown said he is under so much stress that his doctor recently increased Brown's blood pressure medications.

Just last week, he said, more creditors came to the house asking for Luis Pineda.

"I said, 'I never saw him. It's all illegal,' " he said, his voice growing agitated. "I don't sleep hardly at all anymore."

*

(INFOBOX BELOW)

Avoiding scams

Here are some things consumers can do to prevent foreclosure fraud:

• Never sign a contract under pressure.

• Never sign away ownership of your property to anyone without advice from your lawyer.

• Don't make mortgage payments to someone other than your lender.

• Beware of any home sale contract in which you aren't formally released from liability for your mortgage.

• Never make an oral agreement; get all promises in writing.

• If you're not English-speaking, use your own translator; do not depend on translation offered by others.

*

Source: National Consumer Law Center

Los Angeles Times

Read more!

NAR Takes Issue with Good Morning America Segment

NAR: REALTOR® Magazine Online

NAR President Thomas M. Stevens is asking the producers of ABC TV'S Good Morning America for equal time after the show ran a misleading and misinformed consumer-advice segment about real estate practitioners.

The segment, which aired March 24 under the title, "Tricks of the Trade: Confessions of a REALTOR®," claims consumers shouldn't trust everything practitioners say.

The segment "gave a very inaccurate, grossly misleading and unfair depiction of the nation's REALTORS®," says Stevens. "Several of the allegations made by the guest described practices that violate the REALTOR® Code of Ethics, such as intentionally misrepresenting a property and could be grounds for suspension of membership. Because of the Code, all REALTORS® know such behavior is wrong."

Stevens called upon the producers to balance the show's coverage by giving REALTORS® the chance to respond.

Read advice on what your broker won't tell you from the show and view NAR's Code of Ethics online.

Read more!

Monday, March 27, 2006

Let the Sun Shine In: Products To Bring Light into the Home

For the homeowner who has everything - except enough sunshine - a growing industry of boutique firms and architects is collecting, hoarding and taming the daylight that streams into your house.

By: Christina S.N. Lewis: The Wall Street Journal Online

Gary Lauder's spread in Aspen, Colo., has all the fancy trappings you'd expect to find in a venture capitalist's second home. It's full of folk art and antiques, and sports a gym, guest rooms, a media room and a mud room. But to take it all in, you might need to get out your Ray-Bans.

Once the sun comes up, light doesn't simply stream in through the windows, it invades from every angle. Sunlight bounces up into the kitchen, reflected by skylight shafts and mirrored cabinet tops. A set of automated windows and shades open the moment the outside temperature hits 74 degrees. Once installed, four platter-sized reflectors will funnel sunshine down a stairway and into the basement. "It will look like the sun is directly overhead for eight hours a day," says Mr. Lauder.

Here's an illuminating development. For the homeowner who has everything - except enough sunshine - a growing industry of boutique firms and architects is collecting, hoarding and taming the daylight that shines into your home. Called "daylighting," the practice involves gizmos from melon-shaped "skylights" that capture and funnel sun through roofs to software programs that command shades to retract depending on the time of year.

In January, Velux America, a skylight company in Greenwood, S.C., introduced technology that electrifies glass panels, clouding them up to block the sun. Each 2-foot by 4-foot panel costs $2,000. In the past two years, business has been so strong at one Seattle lighting lab that the backers launched three satellite offices in the region. MechoShade in New York has a new $25,000 software program for the home that adjusts lighting and shades depending on each room's location and exposures. The tagline: "Integrate the sun."

Dogged by a flood of cheap imported shades and curtains from China, the U.S. lighting and window-coverings industries are looking for some bright ideas to boost business. Not only have window-coverings sales been flat -- they rose 1.8% last year -- residential-lighting sales rose 1.3% annually between 1998 and 2003, according to Business Trend Analysts, a market-research firm in Commack, N.Y. But the growth in daylighting services and products also reflects a broader societal trend toward products that are perceived to be energy-friendly or environmentally conscientious. Companies like Lutron Electronics in Coopersburg, Pa., are promoting their systems as a way to cut down on energy use.

Lights Off at Night

But environmentalists say the pitch is slightly misleading. Lighting makes up just a small percentage of energy consumption in a home - about 5%, according to the U.S. Green Building Council, a nonprofit group in Washington, D.C. - and the high-tech daylighting systems don't significantly reduce energy costs. Furthermore, homeowners mainly use their lights at night when there's no sun anyway, says Jay Hall, a manager with the Building Council. The energy savings of something like an automated shading system rarely cover the initial cost of the system. "I don't think that there's a huge opportunity for lighting energy savings," says Mr. Hall.

Some architects are also critics, saying that a mechanized approach to daylight is unnecessarily complicated. A cheaper, more efficient way to get more sun in the house would be to orient rooms around the compass, placing morning areas like bedrooms and kitchens in the east, and living and dining rooms in the south or west. "They'd do much better to just design the building properly in the first place," says Lisa Heschong, a commercial architect who has written about the effect of lighting on students and workers. She calls the high-tech solutions "Band-Aids and repair jobs to bad design."

John Heily simply knew he wanted more sun in his Seattle home than its floor-to-ceiling windows could capture. The food-company chief executive discussed the issue with his architect, who had a solution: installing high windows, hidden by reflective white shelves, to boost the reflection factor. Now, Mr. Heily has a domed living-room ceiling that cost $60,000 -- twice the price of a normal ceiling, according to the architect -- with the soft, infinite look of the sky. The only drawback is that the hard-to-reach windows need to be cleaned twice a year. (He hires a window-washer with a really tall ladder.) "Dust collects up there," he says.

Technology to help manage daylight originated about 30 years ago as a way to reduce energy costs for office buildings. The practice has gained traction in recent years as studies showed that exposure to natural light brings benefits that range from lower job stress to faster healing times for hospital patients. Now, new software programs are allowing architects and lighting experts to manage light better, and are helping popularize the concept with residential projects.

At Washington's Seattle Daylighting Lab, the past three decades' transition is like night and day. Started in 1975 at the University of Washington, the nonprofit lab was created to help commercial buildings save energy and is now funded by regional utilities. Today, its technicians often offer their services to residential architects hired by private clients. (The lab charges architects about $5,000 a project to develop high-end residences.) Since 2004, the utilities that sponsor the lab have opened sites in Boise, Idaho; Spokane, Wash.; and Bozeman, Mont.

The lab's big draw is an 8-by-8-foot mirrored box, lit by rows of fluorescent bulbs that simulate the sky. To start a job, the architect clamps a microwave-oven-sized model of the home to a table inside the box. The home is tilted according to the site's latitude, then rotated while Joel Loveland, the lab's director, films the interior. A colored spotlight shines overhead, standing in for the sun. Since the fake sun isn't as strong as the real sun, sometimes Mr. Loveland's team takes the table out to the parking lot for a dose of real rays.

For one recent job, Mr. Loveland teamed up with architect Jim Olson on behalf of an art-collecting homeowner. The challenge was to build an 11,000-square-foot home with plentiful light -- but not so much it would damage paintings by Georgia O'Keeffe, Andy Warhol and Edward Hopper. The duo installed postage-stamp-sized duplicates of the art inside a 1/24th-scale cardboard model of the home, glued photo sensors to the walls, and then tweaked the model for several months until they were sure that direct sunlight would never hit the artworks. It's a typical job, says Mr. Loveland. "The art wants to be living in a black box and the client wants to live with it."

More Light, Less Stress

In the most experimental cases, light-harvesting techniques are moving outdoors. In Austria, lighting-design company Bartenbach LichtLabor plans to mount large mirrors on nearby hillsides to beam sunlight into the 1,000-year-old town of Rattenberg, population 500, which is shaded by one large hill in the winter. The reflected beams will light up the town's main drag, Sudtiroler Strasse, and create the impression of a sunny city, says Helmar Zangerl, president of Bartenbach. The hope is that the project will lighten the local mood and help retain citizens.

Of course, there can be too much of a good thing. Pat Trowbridge recently paid $450 for a tubular skylight that bounces sun into his San Diego kitchen. But the 8-foot-long pipe floods in so much light, the retiree says he has to look away. "I feel like I could get a suntan," says Mr. Trowbridge. His solution: Maybe buying a shade to cover the skylight.

Read more!

Sunday, March 26, 2006

Newlyweds attempt unique real estate tax strategy

Situation complicated when both spouses own homes

By: Robert J. Bruss: Inman News

DEAR BOB: I will be getting married soon. My fiancé and I will be buying a home together and selling our current residences for capital gains exceeding the $250,000 exemptions for each. If we put ourselves on each other's title, and file a joint tax return, can we take advantage of the $500,000 married exemption per property and avoid capital gains tax? If so, can we use the $500,000 exemption twice in the same tax year since both properties will be sold in 2006? -Wilamena P.

DEAR WILAMENA: Adding your name to the residence title owned by your fiancé, or vice versa, won't change anything.

The reason is, to increase the principal residence sale tax exemption from $250,000 for a single owner to $500,000 for a married couple filing a joint tax return, both spouses must occupy the home at least 24 of the 60 months before its sale.

You can each sell your principal residences in the same tax year and claim up to $250,000 tax-free home-sale profit on each sale, thanks to Internal Revenue Code 121.

That's presuming you each owned and occupied your home at least 24 of the 60 months before its sale. But you will owe capital gains tax, currently at the 15 percent maximum federal tax rate, plus state tax, on the capital gain exceeding $250,000. For full details, please consult your tax adviser.

UPSTAIRS CONDO OWNER'S NOISE IS A PRIVATE NUISANCE

DEAR BOB: I own a ground-floor condo, which I rent to a tenant. The resident owners of the unit above replaced their flooring with hardwood floors. My new tenant says the noise from the floors is intolerable and he wants to move out. With this noise problem, I am about to lose my tenant and I doubt I can even sell the condo if I disclose this noise problem to a buyer. I talked with the homeowner's association. They advised that this is a problem between my neighbor and me. If I can't work things out with my neighbor, do I have any recourse? This noisy floor is ruining my rental property. -Matthew D.

DEAR MATTHEW: The situation you describe is legally known as a "private nuisance" because it only affects one property owner. If it affected many owners, it would be a "public nuisance."

If you can't resolve the noise problem on a friendly basis with the inconsiderate upstairs neighbor, you may need to retain a real estate attorney to bring a private nuisance abatement lawsuit and sue for monetary damages.

NEIGHBOR LIABLE FOR DIVERTING WATER ONTO LOWER PROPERTY

DEAR BOB: About two years ago, my neighbor and I built a common cinderblock fence on our property line. She made additional improvements to her driveway on her side of the fence. Then she discovered her garage flooded with heavy rains. She rectified the problem by having the fence contractor punch a hole in the bottom of our fence to let the water drain into my yard. Now that part of my yard becomes a swamp when it rains. When I approached her about this problem she created, she said that is the natural way the water would run. She refuses to do anything. Is she right? Is her flooding my problem to fix? I am tempted to have the contractor come back to plug up that hole. -Katalin S.

DEAR KATALIN: The general rule is a lower property owner must accept the natural flow of water from an upper property owner. However, the upper owner cannot divert or channel water unto the lower property without liability.

Because you and your neighbor jointly built the cinderblock fence, it appears the rules of natural water flow no longer apply to your situation. Now your upper neighbor appears to be illegally directing or channeling the water onto your property.

Please consult a local real estate attorney to determine if "self-help" is appropriate by blocking that fence hole that directs water toward your property. Or perhaps you should file a lawsuit against your uncooperative neighbor to abate the private nuisance that she has created.

HOW LONG BEFORE OWNER-OCCUPANT CAN CLAIM $250,000 TAX BREAK?

DEAR BOB: After my rental property is converted to my principal residence, how long must I live in my house to qualify for the $250,000 tax-free from the sale? Some friends say two years, but others say five years. -Kimberly T.

DEAR KIMBERLY: If you acquired the rental residence in an Internal Revenue Code 1031 tax-deferred exchange, you must own the property at least 60 months before you can sell it and qualify for the Internal Revenue Code 121 principal residence sale tax exemption up to $250,000 (up to $500,000 for a qualified married couple filing a joint tax return.

Whether you acquired the rental house in a tax-deferred exchange or as a purchase, you must own and occupy it at least 24 of the 60 months before its sale to qualify for the IRC 121 exemption. For full details, please consult your tax adviser.

IS "BED-AND-BREAKFAST INN" A GOOD REALTY INVESTMENT?

DEAR BOB: My wife and I are thinking about selling our home, taking that $500,000 principal-residence-sale exemption you often discuss, and buying a small "bed and breakfast inn" where we have stayed many times. It has five bedrooms, plus an owner's cottage in the back. Is this type of property a good investment? -Dan W.

DEAR DAN: A bed-and-breakfast inn is both a business and a real estate investment. Do you realize you will also be buying yourselves seven-day-a-week jobs? Please consider yourself fortunate if you earn much profit and if you eventually profitably resell.

I have some friends who owned a nice bed-and-breakfast inn in a resort area. The wife talked her husband into buying it. Only after moving in did they realize it was a full-time job (although they were able to hire outside help to give them a day off each week).

Due to a family situation a few years later they decided to sell. After the sale closed, the husband told me that was the happiest day of his life.

WHAT IF CO-SIGNER DEFAULTS ON HOME MORTGAGE?

DEAR BOB: A few years ago, my husband's brother talked him into co-signing on a mortgage so the brother could buy a condominium. My husband had good credit and his brother did not. Since then, his brother has been in and out of jail, doesn't work steadily, and my husband often has to pay all or part of the mortgage payments to prevent it from going into default. My husband wants his brother to sell the condo (which can be sold at a net profit of at least $75,000) but he refuses to sell. What can my husband do to get out of this mess? -Vivian R.

DEAR VIVIAN: Presuming he is a title co-owner, your husband can bring a partition lawsuit to force the sale of the property with the sales proceeds divided between the co-owners. He will need a real estate attorney to handle the legal details.

But before filing a partition lawsuit, if I were your husband I would sit down with the brother, explain the facts, and suggest they voluntarily agree to sell the condo without the costs of a partition lawsuit.

IS A "YIELD SPREAD PREMIUM" LEGAL?

DEAR BOB: I recently refinanced my home mortgage. I had to pay the mortgage broker a two-point loan fee. But at the closing settlement, the statement I received said there was a "yield spread premium" to the mortgage broker of $1,785. When I asked what this was for, I was told the lender paid my mortgage broker $1,785 on top of my two-point loan fee. Is this legal? -Miriam A.

DEAR MIRIAM: Yes. A "yield spread premium" fee is a legal kickback from the mortgage lender to your mortgage broker for producing a home loan with an interest rate higher than the lender requires.

For example, suppose the lender requires a 6 percent mortgage interest rate but you agreed with the mortgage broker to pay 6.25 percent interest. In addition to saying "thank you" to the mortgage broker, the lender paid a "yield spread premium" kickback fee to the mortgage broker.

When this occurs, often due to a decline in the mortgage market, many mortgage brokers will decrease the loan fee paid by the borrower. If you ask, perhaps your mortgage broker will refund part of the loan fee you paid him.

Read more!

An opening to theft

An open house leaves valuables at risk - even the contents of your medicine cabinet.

By: Chip Jacobs, Special to The Times: LA Times

DANELL ADAMS felt confident she had locked away temptation as she readied her ocean-view Laguna Beach home last year for an open house.

Knowing that thieves sometimes posed as potential home buyers, she locked her jewelry in a safe and hid her keepsakes and electronics. Adams' mistake was she didn't think cynically enough — and she's a 33-year veteran of the city's police force.

Sometime during the open house, three prescription medications — a painkiller, a muscle relaxant and a sleep aid — were taken from her master bathroom. Adams had left the vials beside the sink to remind herself to take the pills she needed after back surgery.

"It was a little thing you don't think about," said Adams, a supervising detective. "It was like, 'How easy was that?' Then it alarmed me. That was some pretty heavy-duty medication."

Other home sellers also have discovered that public showings of their properties lightened their medicine cabinets.

Although prescription-drug thefts may not come to mind as owners prep their homes for an open house, they occur frequently enough that agents routinely advise clients to stash away pharmaceuticals along with heirloom brooches, iPods and Rolexes. Websites run by brokerages and government agencies across the nation post similar warnings.

When someone attending an open house or a yard sale lingers in the bathroom, they actually may be "pharming" — cadging pills for resale or their own addiction, according to Tom Riley, a spokesman for the White House Office of Drug Control Policy.

"It's a much more common phenomenon than people realize," Riley said. "We hear anecdotes about it all the time, and it's probably underreported because people consider the content of their medicine cabinet private. Plus, they don't want to seem stupid" for having left medications in easy reach.

Criminals' favorite targets appear to be multimillion-dollar homes swarming with visitors during Sunday open houses, when owners are often away. No statistics are kept on the most commonly swiped prescriptions, but real estate agents and local police report that painkillers such as Vicodin and Oxycotin and tranquilizers have gone missing. One broker reported migraine medicine stolen from a Bel-Air client.

Crooks frequently work in pairs using a distract-and-conquer scheme, in which one asks the agent questions while the other hunts for loot. The ploy is a reason why many agents work in pairs. If a house is split-level, an agent stays on the ground floor to welcome attendees while the other goes upstairs, watching visitors for suspicious behavior.

"If we have 10, 20, 30 people in an open house, it's hard to control them all the time," said Vince Malta, president of the California Assn. of Realtors.

Coldwell Banker agent Mary Lu Tuthill once had a Brentwood client who discovered her Ritalin missing following an open house. In another incident, Tuthill's partner observed a woman rummaging through a homeowner's master-bathroom medicine cabinet. Before they kicked her out, the two agents persuaded the woman to empty her pockets. She had not stolen anything — yet.

Of course, thieves have snatched more than pills. A ring operating on the Westside a few years ago grabbed rings, watches and laptops.

Concerns about theft and personal safety are why Tuthill today only hosts open houses with off-duty police officers on the premises. Like many of her peers, she requires prospects to furnish identification, address, broker's name and related information before entering. "We live in desperate times," Tuthill said. "Some people are willing to take advantage."

Visitors at public open houses sometimes hesitate when asked to give out contact information, Tuthill said, because they fear agents will use it to hound them with follow-ups.

"They don't like to give out their phone number," Tuthill added. "I say the owner just likes to know who comes in their house."

Calculating how much security open houses require is tricky. Agents estimate that thefts occur less than 1% of the time, partly because veteran Realtors can sniff out fishy visitors. Still, nobody knows the true rate, because some sellers are reluctant to disclose sensitive medical issues to police that could later be made public in a crime report.

Stolen pharmaceuticals fuel a profitable trade. A $1 pill under subsidized healthcare can fetch multiple times that amount on the black market, according to Adams and other police. Riley, of the White House's drug-control office, said stolen prescription drugs are the "one segment of the drug trade" that is still growing.

John Aaroe, president of Prudential California Reality, which represents properties from Santa Barbara to the Coachella Valley, said he's noticed that trend reflected at open houses during the last five years.

"The most obvious problem we have is with prescription drugs being taken," Aaroe said. "People are surprised. We all think our house could be burglarized or damaged. We don't think our prescription drugs are of interest to anybody else."

Agents and brokerages are typically not liable for stolen property.

The local Bonnie and Clyde of open-house thievery was a polished young couple who over the course of a year hit more than 50 upscale homes as far north as Beverly Hills and as far south as Laguna Niguel. They rolled up in a black Jaguar and chic garb to create the impression that they were serious buyers.

Los Angeles Police Det. Steve Bucher, who tracked the couple before arresting them in South Pasadena in September 2003, said the pair mainly took jewelry — including a $35,000 watch — but did take a few pill containers. Quick with a turnaround, the couple could rob an open house in the morning and have the best items in a pawnshop or jewelry store by the afternoon. If need be, they impersonated brokers and broke into jewelry boxes, stealing goods in excess of $200,000.

Dewey West and Kathy Engelhardt pleaded guilty to numerous counts of residential burglary, Bucher said. A Superior Court judge sentenced West to 16 years under California's "three-strikes" law. He escaped from the Pitchess Detention Center in Castaic, but police soon re-apprehended him.

Engelhardt never appeared to begin her four-year sentence; there are outstanding warrants for her.

"Real estate agents were very aware of the ring," Bucher added. "It got through their whole network."

Adams, for her part, remains in disbelief that somebody took medicine from her home.

She said her Realtor followed up by alerting the agents representing prospective buyers who had been there that a crime had taken place.

"But there were so many people who came through," Adams said. "It's a lesson learned."

*

(INFOBOX BELOW)

Before you roll out the welcome mat

If you are planning an open house:

• Talk to your agent about how to safeguard your possessions.

• Store your jewelry, electronics and other valuables in a safe place, preferably locked.

• Go through your medicine cabinets to remove and hide all prescription drugs.

• As you scan your house before the public showing, consider removing anything you do not want a stranger to see, whether it be family pictures, calendars or mementos.

• If your Realtor is considering allowing prospects to view your house through a virtual tour, discuss what you are comfortable with showing. If a prospect is using a Web tour to study your floor plan, so might a thief.

Read more!

Saturday, March 25, 2006

Flipping Hotel Room Hot New Investment

By: Elizabeth Esfahani: REALTOR® Magazine Online

The hottest business for real estate flippers these days isn’t starter homes — it’s hotel rooms.

Investors buy individual hotel rooms with a relatively modest capital outlays. The least expensive opportunities are in yet-to-be-built hotels. There’s no upkeep for the finished unit. In addition to being able to stay in their rooms whenever they want, investors make money by leasing out the units to others.

Most hotel operators run services that will match rooms with customers and send a healthy fee to the room owner. James Dubois, a hotel-condo investor in London, says he made a solid 6.7 percent return in the past year on his $410,000 purchase of a room by renting it out through the building's developer, GuestInvest.

The larger payoff can come by investing in rooms in hot locations and hoping they rise in value. Joel Greene, president of Condo Hotel Center, says the big bet is that condo-hotel rooms can be resold to affluent buyers looking for prestigious, no-hassle second or even third residences.

Read more!

Friday, March 24, 2006

Ways You Can Lose Your Property

Foreclosure proceedings are becoming more common. How do all of these homeowners lose their homes?

By: M. Anthony Carr: Realty Times

There are times and ways that people lose their homes through foreclosure or possession. The way many rags-to-riches seekers pursue the quick buck is through the foreclosure sales. Nevertheless, there are several other ways homeowners or investors can lose property. Below are at least six ways a homeowner can lose their property to the auction block.

• Don't pay your mortgage. Generally, quit paying your mortgage and you'll end up getting past due notices, followed by foreclosure proceedings notices and then a visit from the sheriff's office to "assist" you in removing all your property from the household.

While there may appear to be a lot of foreclosures out there, the Mortgage Bankers Association reports that less than 1 percent of mortgages in 2005 went into foreclosure (down 12 basis points from the year before.) However, the number of mortgagees in default rose the last reporting quarter to 4.70 percent.

The increase comes as no surprise to the group's chief economist, Doug Duncan. "We have been expecting an up-tick in delinquencies due to a number of factors: the seasoning of the loan portfolio, the increased shares of the portfolio that are ARMs and subprime mortgages, as well as the elevated level of energy prices and rising interest rates," he said on the group's website.

• Don't pay your taxes. For homeowners who pay their own taxes, (not paid through a mortgage service provider), a tax sale could be in their future if they fail to pay taxes on the property. Though most tax sales are through local governments, both state and federal revenue agencies can confiscate real estate for not paying taxes.

If this happens, it's not as simple as just paying the back taxes and getting your property back. For some, it includes also paying penalties and interest, which many times can bypass the actual amount of the back taxes balance.

If your local taxing jurisdiction is anything like mine here in good old Fairfax County, Virginia, then the confiscation of your home is a last resort - first they will have tried various other methods of tax collection, such as garnishing wages, confiscated money from your bank, booting and towing your car, then of course, selling your house on the auction block.

• File bankruptcy. In the past, filing bankruptcy usually gave the homeowner some protection from losing his home to creditors. With the revamped bankruptcy laws passed last year, creditors may now have the upper hand in bankruptcy situations, according to Herbert Addison, co-author of "How to Save Your Home" and a certified housing counselor. He contends on ezinearticles.com that while the new law allows for 180 days for the consumer to work out payment plans with the creditor, it does not stop the foreclosure process, which could be a shorter period of time than the payment workout plan.

• Surety for other debts besides mortgage. Creditors are in business for one thing - to make money off consumers through interest and fees collected during payback of loans. If the consumer fails to pay off those loans, the creditors can go after assets to satisfy the debts. Your house could be one of those assets.

• Failure to pay homeowners dues. If you get into an argument with your homeowners association, withholding the homeowners dues paid each month should not be one of your strategies. HOAs can also auction your house to satisfy past due homeowners HOA fees.

• Illegal activity. The American Civil Liberties Union contends that 80 percent of homeowners who have had property forfeited by the federal, state or local government have never been convicted of a crime, rather law enforcement officials only need to prove probable cause that the homeowner either used the property in committing a crime or purchased the house through funds created through illicit behavior.

Read more!

Thursday, March 23, 2006

The Weekend Guide! March 23 - March 26, 2006

The Weekend Guide for March 23- March 26, 2006.

Full Article:

Read more!

Existing-home sales bounce back

Northeast, Midwest gains outpace rest of nation

Inman News

Existing-home rose in February following five months of decline, indicating a stabilization is taking place in the market, according to the National Association of Realtors.

Total existing-home sales - including single-family, townhomes, condominiums and co-ops - increased 5.2 percent to a seasonally adjusted annual rate of 6.91 million units in February from an upwardly revised pace of 6.57 million in January, but were 0.3 percent below a 6.93 million-unit level in February 2005.

David Lereah, NAR's chief economist, said mild weather appears to be responsible for some of the gain. "Weather conditions across much of the country were unseasonably mild in January and likely were a factor in higher levels of buyer activity, which boosted sales that closed in February," he said. "Higher interest rates had been tapping the breaks, notably in higher-cost housing markets since mortgage interest rates trended up last fall, but we're seeing signs of stabilization in the market now with the sales rebound. Home sales should level out in the months ahead."

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.25 percent in February, up from 6.15 percent in January; the rate was 5.63 percent in February 2005.

NAR President Thomas M. Stevens from Vienna, Va., said comparisons with market performance over the last five years distort what people should expect from housing as an investment. "Housing is simply returning to a normal market, where annual home prices will rise a little faster than the overall rate of inflation," said Stevens, senior vice president of NRT Inc. "However, in looking at total returns, you need to consider that the typical buyer is making only a modest down payment but enjoys a return on the full value of the home, which is many times the actual cash investment. In other words, normal is pretty good for the typical homeowner, and that's what we expect for the foreseeable future."

Stevens noted that price appreciation has yet to cool significantly. "We're still seeing double-digit annual price gains, but we should get down to single-digit appreciation fairly soon," he said.

The national median existing-home price for all housing types was $209,000 in February, up 10.6 percent from February 2005 when the median was $189,000. The median is a typical market price where half of the homes sold for more and half sold for less.

Total housing inventory levels rose 5.2 percent at the end of February to 3.03 million existing homes available for sale, which represents a 5.3-month supply at the current sales pace - the same as in January.

Single-family home sales increased 4.7 percent to a seasonally adjusted annual rate of 6.06 million in February from 5.79 million in January, and were 0.2 percent below the 6.07 million-unit pace in February 2005. The median existing single-family home price was $208,500 in February, up 11.6 percent from a year ago.

Existing condominium and cooperative housing sales rose 8.8 percent to a seasonally adjusted annual rate of 850,000 units in February from a level of 781,000 in January. Last month's sales pace was 1.5 percent below the 863,000-unit pace a year ago. The median existing condo price was $214,300 in February, up 3.5 percent from February 2005.

Regionally, existing-home sales in the Northeast jumped 19.2 percent to an annual sales rate of 1.18 million units in February, and were 2.6 percent higher than February 2005. The median price in the Northeast was $263,000, which is 5.2 percent higher than a year ago.

Total existing-home sales in the Midwest rose 11.1 percent to a pace of 1.6 million in February, and were 1.9 percent above a year earlier. The median existing-home price in the Midwest was $160,000, up 3.9 percent from February 2005.

In the West, existing-home sales increased 5.1 percent to an annual pace of 1.44 million in February, but were 10.6 percent below February 2005. The median price in the West was $306,000, up 12.1 percent from a year ago.

Existing-home sales in the South fell 2.5 percent in February to a level of 2.69 million, but were 3.1 percent higher than a year ago. The median price in the South was $182,000, up 11.7 percent from February 2005.

Read more!

NBC Universal May Develop Backlot

NBC Universal said Wednesday that it is considering redeveloping a large portion of its backlot into a mix of residences and shops. The film studio hired Thomas Properties Group Inc. and Rios Clementi Hale Studios to assist in the effort.

By: ANDY FIXMER: Los Angeles Business Journal Staff

NBC Universal announced Wednesday that the film studio is considering redeveloping a large portion of its backlot into a mix of residences and shops.

NBC Universal has hired Thomas Properties Group Inc., an L.A.-based real estate investment trust, and Rios Clementi Hale Studios to assist the company with defining the project and ultimately getting entitlements from city and county authorities.

Jim Thomas, chief executive of Thomas Properties Group, said his firm has been hired as a consultant but that he hopes to be involved in any future project.

“Our involvement in any project would come at a later stage depending on what comes out of this process,” Thomas said, “but obviously, should there be a development opportunity, it would be something we would be very interested in.”

The announcement was included in a statement outlining the studio’s desire to create a long-term vision for its 400-acre property, which includes Universal Studios, outdoor entertainment district CityWalk and theme park Universal Studios Hollywood.

The Business Journal first reported the studio’s intentions to develop its backlot in January.

Universal Studios president Ron Meyer said in the announcement that the studio wants to create a “city within a city” on its property. The process will consider the needs of the studio, the theme park, the entertainment district and the office and hotel buildings.

Still, building residential, retail and production facilities on NBC Universal’s backlot will likely be the most controversial aspect of the studio’s proposal. A more detailed plan will be made public in four to six months.

In its announcement, the studio pledged to work with neighbors, elected officials and the larger community on a “Vision Plan” for Universal City that would guide development.

NBC Universal’s announcement had been expected.

Last summer, the studio hired brokerage Jones Lang LaSalle to recruit developers for a 150-acre section of its backlot. Sources close to the process had said studio executives believed the site could support up to 1,000 condominiums and apartments.

In addition, the studio says it needs to expand its facilities to better accommodate its 6,000 workers and add production and sound studio space. Its current facilities are more than 90-percent occupied.

“It’s very important that this business be able to meet its needs and thrive and prosper and employ all of these people,” Thomas said. “The question is: What can you do with the land that makes sense for the business and the surrounding community?”

Read more!

Wednesday, March 22, 2006

At Home in Tinseltown

A flurry of projects in the area around Hollywood and Vine are designed to restore the famous intersection's luster and make it an 'in place' to live and play.

By: Roger Vincent, Times Staff Writer: LA Times

Hollywood and Vine, the once-storied intersection that had degenerated into a home to panhandlers, prostitutes and drug dealers, soon could become home to an entirely different crowd: some of Los Angeles' most well-heeled glitterati.

Developers hope their planned $1.2-billion construction of more than 2,000 upscale condominiums and apartments, along with a new ritzy W Hotel and other attractions, will make the spot a Los Angeles rarity — a neighborhood like parts of Manhattan, with residents and nightlife.

The condos already are enjoying strong buyer demand. But the proposed transformation has its naysayers. Some existing business owners and neighbors worry about increased traffic congestion and say new residents may get turned off by the bustling nightlife the development is intended to enhance.

Los Angeles city officials have been plotting Hollywood and Vine's comeback for more than a decade, but didn't foresee the rush for high-end living in an area that had seen better days.

"We are a little bit surprised that Vine is becoming a premier residential address," said Helmi Hisserich, the Community Redevelopment Agency's regional administrator for Hollywood. "It just sort of emerged. Vine is going to become an extraordinarily wonderful street for Los Angeles."

The momentum is so strong that developers are trying to buy the cylindrical Capitol Records Tower north of the intersection in the hope of converting it to condos. Early buyer reaction bodes well for builders at Hollywood and Vine, where construction at all four corners is underway or close to starting.

Nearly all 96 units in the former Broadway department store at the southwest corner of the intersection were sold as soon at they went on the market. Prices ranged from more than $500,000 to $2.8 million for some penthouses.

Developer Kor Group said there were hundreds of registrants for a chance to purchase a unit, but declined to identify any buyers. One of them, though, was real estate broker John Tronson, who described "a feeding frenzy" among "mostly high-profile L.A. people or celebrities who want an L.A. base. They think it will be hottest place in town."

Part of the appeal for the glitterati is the reputation of Kor Group as a purveyor of Old Hollywood style. Chief Executive Brad Korzen and his wife, interior designer Kelly Wearstler, build for the chic set and made a splash with their lavishly decorated boutique hotels such as the Avalon in Beverly Hills and the Viceroy in Santa Monica.

Hollywood's rebirth is a bit ahead of the comeback going on in downtown Los Angeles, where Kor is also building condos, Korzen said.

"Hollywood and Vine is surrounded by dozens and dozens of clubs, bars and restaurants," Korzen said. "It's got a robust nightlife in an urban setting. You don't have that anywhere else in L.A."

Korzen is transforming two adjoining buildings that date to the 1920s and 1930s and served as the now-defunct Broadway chain's high-end Hollywood outpost for decades before closing in the 1980s. To revive the glamour factor, he is adding a roof garden with pool, cabanas, an exercise room and a spa.

The Broadway, the former Equitable office building across the street at the northeast corner and the Taft office building at the southeast corner are links to the era when Hollywood Boulevard and Vine Street was one of the city's great crossroads in the 1920s, when it was the second-busiest intersection after Wilshire Boulevard and Western Avenue.

It was a gateway to the San Fernando Valley in pre-freeway Los Angeles and had been a draw for the movie industry from the very beginning. Cecil B. DeMille shot "The Squaw Man," Hollywood's first feature film, at the nearby corner of Selma Avenue and Vine in 1914.

Later, radio and then television stations set up operations in the neighborhood and KFWB announcers chirped often that they were broadcasting "from Hollywood and Vine," according to historian Marc Wanamaker. "It was considered the downtown of Hollywood."

Such mass appeal was a distant memory by the 1980s, when the neighborhood fell prey to such activities as drug dealing, prostitution and panhandling.

By the early 1990s, the Community Redevelopment Agency had come up with a plan for improving Hollywood that called for commercial and residential development at the intersection. Changing political administrations, subway construction and real estate downturns kept builders at bay, however.

Finally, a city ordinance that simplified conversion of commercial buildings to residential use, along with the Hollywood and Highland development and the recent housing boom, spurred developers to action. The area's grittiness even holds appeal for some.

"Hollywood has just become what the Meatpacking District was five years ago in New York," said developer Avi Brosh, who builds for the single, hip and affluent and who is also spearheading the effort at Hollywood and Vine. "It's the emerging epicenter of nightlife and culture."

Brosh's Palisades Development Group is currently converting the Equitable building to condominiums. He also got city approval in January to build a five-story condominium building on the intersection's northwest corner. It will replace a parking lot situated between a nightclub and a theater built in 1927 that was home to the "Hollywood Palace" television vaudeville show in the 1960s.

He plans to provide furnished units for rent and for sale, all with a concierge, housekeeping staff and room service from the street-level restaurant.

"We want people who might have stayed in an Oakwood but don't feel in tune with their design," said Brosh, referring to the West Los Angeles-based company that specializes in renting furnished apartments.

The next major addition will spring up around the Taft building and a subway entrance at the intersection's southeast corner.

Gatehouse Capital Corp. received approval from the city Planning Commission last month to build a 300-room W Hotel along with 150 condominiums served by the hotel's staff. The project will include a restaurant, spa, fitness facility and rooftop bar.

The opportunity to build at Hollywood and Vine was worth the five years of effort it will have taken to get underway, said Marty Collins, Gatehouse's president.

"It is one of those iconic intersections in the world," Collins said. "From Africa to Nepal to China, you can say the word 'Hollywood' and they have an image of it that is largely good."

Another developer, Legacy Partners, will contribute 375 apartments and retail space on the ground floor including a convenience grocery store, said Dennis Cavallari, senior vice president.

Plans for the development call for eliminating some old buildings along Vine, including a cocktail lounge, juice bar and a luggage store, which were condemned earlier this month by the Community Redevelopment Agency through eminent domain.

Luggage store operator Robert Blue said he would mount a court challenge to keep possession of his 78-year-old building in part because he hopes to be in business when new residents arrive. "All these people will need luggage and repairs."

Some longtime locals wonder if the neighborhood's transformation will go smoothly.

The trouble with Hollywood's current appeal, said puppet maker Greg Williams, is that "it's all alcohol-based" around trendy nightclubs. New residents may not care for the noise the clubs generate, he said.

Williams, who said he grew up in Hollywood and later ran his Puppet Studio at Hollywood and Vine, said a lack of city leadership following damages from the 1994 Northridge earthquake and following subway construction disruptions ruptured the fabric of the business community by driving out longtime small-business owners.

Like many neighbors in the path of development, Nancy Omeara, who keeps an office in the Taft building, worries whether all the new residents and their cars will be too much of a good thing.

"It's great people are going to be coming," said Omeara, vice president of the Foundation for Religious Freedom. "It's all a positive story except for the traffic. Maybe we'll actually have a city here."

Former New Yorker Raymond Urgo, also a Taft building tenant, said he was worried about the heavy focus on housing development instead of office or retail.

"Everybody is trying to get in on residential, but I'm not sure the mix is right," said Urgo, a management consultant. "The people coming in are going to be paying too much for what they are getting."

Without other uses besides housing, "it will be 10 or 20 years before it becomes a true hot spot," Urgo said.

Perhaps not surprisingly, developer Brosh predicts success will come a lot sooner: "What you are going to see is probably the most dynamic corner in the city. If you're an urban person, this will be as good as it gets."

*

(INFOBOX BELOW)

Boom town

Here are some of the projects underway or being planned for the neighborhood surrounding Hollywood Boulevard and Vine Street, the developer and the estimated cost.

*

1. Project :Palihouse Hollywood

Developer: Palisades Development

Size: New; five stories, 57 condos and apartments over a restaurant

Cost: $50 million

2. Project: Equitable office building

Developer: Palisades Development