Find out what lenders have to say

By: Ilyce R. Glink: Inman News

Q: How should I get a loan to purchase a residential piece of property? The house is located next to my house. I wouldn't buy it to flip it and resell. Instead, I would like to purchase the house to use as my office. In essence, the whole property would be an investment.

I am hoping that I could use cash from the business I start to pay the mortgage, and use it as a write-off. Should I get a business loan? Is there another way to do this? What do you suggest?

A: There are mortgage lenders who will help you finance the property for your business. It will cost more, and you won't be able to get 100 percent financing. In fact, you may be limited to 75 percent if you choose to finance the property as investment real estate.

If you get a loan of up to 75 percent of the purchase price, you can either take out a home equity loan on your current property and use that as the down payment, or see if the seller will carry back the second note.

If you use a commercial mortgage lender, you need to know that you'll pay a higher interest rate and more in points and fees. That's why so many people try to use a residential mortgage lender to buy a second home-even if it is ultimately for investment or commercial use.

Since the property is located next door to your current residence, and since you plan to use the house as your office, it's possible to find a residential lender to give you the loan to purchase the house. The rate may be a little higher, but may be quite a bit less than with a commercial lender. Talk to several mortgage lenders to make sure that you qualify for a residential loan.

One thing to check-some communities frown on homeowners who operate businesses from residential neighborhoods. You should check to make sure that your neighborhood or community does not have such restrictions. You may also need a business license for your entrepreneurial endeavor.

Q: I live in a community that is very expensive. The rent I pay is cheap, but it costs too much to buy a home here, near where I work.

However, I have saved up enough cash for a 5 percent down payment on a property that is in another state. I would use this property as an investment and try to rent it out.

Since I don't live near where the property would be located, I am wondering if I should hire a management company to take care of everything for me.

A: While I don't know if you live in Manhattan, but many New York City dwellers (and those in other expensive metropolitan areas) are doing what you're considering-renting a primary residence and purchasing a second or investment home elsewhere.

Since this isn't going to be a vacation home for you-where you might want to take advantage of mountain, lake, or simply wide-open view-you need to spend some time working out the details of your investment property purchase.

I do wonder why you'd want to buy an investment property so far from where you live. Isn't there anything you can afford that is more easily accessible? While you can hire a management company, it's a far better idea to buy in a place where you visit frequently, so you can keep an eye on your investment.

A management company may take a sizeable portion of the rent you receive to manage and, perhaps, rent the property for you. And, you'll still have to check up on the management company to be sure that all monies are accounted for.

If you decide to go this route, please interview several companies thoroughly before handing over the keys to the house.

Here's another way to do it: If you buy an apartment building that either has a "caretaker's cottage" or "engineer's apartment" consider renting out one of the units to someone who is particularly handy and trustworthy to take care of the property and keep an eye on it for you. You can trade some or all of the rent cost for the physical management of the property.

I wouldn't have that person collect rent, but those can be sent to you or your bank directly, or you can arrange an electronic transfer into your business account.

If your plan to buy a property is in a vacation community, you may want to look for a condominium or vacation home that is in a large development.

Frequently, these large developments take care of the exterior maintenance of the buildings and offer rental property management and services. You can take advantage of the rental office, place your property with them and allow them to rent it for you. But be prepared to pay as much as half of the rent you receive for these services.

Finally, if your choice is to buy a single-family home in a different city, make sure you have friends or relatives near buy to keep an eye on the property for you.

While you'll still need to check on the property from time-to-time, this should help.

Read more!

Wednesday, May 31, 2006

Can buying house for business constitute a write-off?

Tuesday, May 30, 2006

Las Vegas real estate prices dampen merger talk

Taking a gamble on Las Vegas is getting expensive these days.

By: Paritosh Bansal: Reuters

Several casino companies are looking for ways to enter the largest U.S. gambling market, but doing so has become too costly after some pricey deals for Las Vegas properties.

"We were very interested in Las Vegas until the price got so high," Trump Entertainment Resorts Inc. Chief Executive James Perry told Reuters in a recent interview. "We don't see ... having an opportunity there in the short term."

Deals such as the buyout of Aztar Corp. by closely held Columbia Sussex Corp. for more than $1.9 billion and the acquisition of Hard Rock Hotel & Casino by Morgans Hotel Group Co. for $770 million sent shivers down the spines of other companies hoping to enter Las Vegas.

Aztar, which owns 34 acres of land on the Las Vegas Strip, saw a fierce two-month bidding war that involved as many as four suitors.

Columbia won. But it could be paying more than $30 million an acre just for the land, the highest price ever for a parcel of that size in Las Vegas, according to Deutsche Bank analyst Marc Falcone.

"The costs are getting to be prohibitive," Penn National Gaming Inc. Chief Executive Peter Carlino said in a recent interview.

"The numbers are out of control over there," Carlino said, referring to the Hard Rock deal. "They are paying way too much for that for our taste."

REAL ESTATE BOOM

A limited amount of available real estate on the Strip, coupled with the ever increasing popularity of the gambling mecca, is helping boost prices.

"Land is not available in that area," said Peter Dunay, chief investment strategist at Leeb Group. "So it is very competitive and very tough."

Things have gotten worse as private companies with deep pockets turn to the gaming industry, which offers stable cash flows and high returns.

"There's a lot of money around right now ... looking for a place to land, and gaming seems to be one of the places they want to go," Perry said.

When shareholders in companies that own casinos in Las Vegas see other deals, they too want more.

Last month, when casino operator Riviera Holdings Corp. agreed to go private in a $211.5 million buyout, one large shareholder opposed the deal, saying it undervalued the company's land on the Las Vegas Strip.

But there is a limit to how much public companies are willing to pay for a piece of the action.

Pinnacle Entertainment Inc., which started the bidding war over Aztar with an initial offer of $38 per share, bowed out of the contest when Columbia bid $54 per share. Ameristar Casinos Inc., another bidder, quit when offers started pushing $50 per share.

VEGAS BECKONS

Still, the lure of Las Vegas is too powerful for companies to completely ignore.

The city offers a stable regulatory environment and its fame as an entertainment destination is so widespread that it affects competition even in regional markets, Calyon Securities analyst Smedes Rose said.

Harrah's Entertainment Inc., the world's largest gaming operator by revenue, promotes its casinos in smaller markets through offers such as discounts at its Las Vegas properties -- a competitive edge that companies such as Pinnacle want.

Having a casino in Las Vegas also boosts the value of a company's brand, Dunay said. "It's a prestige thing to say that I own a casino on the Strip."

Pinnacle, Trump and Penn National all continue to look for ways to get into Las Vegas.

Trump's Perry said he would be open to talking with Morgans Hotel, which would like a partner to run the casino, as well as any other opportunity that may arise.

Penn's Carlino said his company would also continue to look for a point of entry, such as a joint venture.

But he added, "That's going to be tough."

Read more!

How to get the best appraisal for your house or condo

Technology improves but lacks human touch

By: Robert J. Bruss: Inman News

A few weeks ago I enjoyed lunch with one of my favorite Realtors. During our conversation, she told me about a home sale she recently closed in an upscale neighborhood for thousands of dollars above any previous sale price in that area.

As I drove home from our lunch, I couldn't help but think, "I wonder how that house appraised for a much higher sales price than any recent comparable home sales price in the vicinity?" I sure wouldn't want to be the appraiser who got that assignment.

When a home buyer makes a small or zero down payment, the appraisal is vital to obtaining a high loan-to-value ratio mortgage. However, if a home buyer makes a large down payment, then the appraised valuation to confirm the sales price is not so critical.

WHAT IS AN APPRAISAL? A state-licensed appraiser makes professional real estate appraisals. Any other evaluation, such as a real estate agent's estimate of market value, is not an appraisal, but rather an opinion of market value.

An appraisal of real estate market value is an estimate by a trained appraiser of the most likely price at which a property will change ownership, with neither the buyer nor seller being under pressure to buy or sell.

But the real world is much different. There are different types of appraisals, such as a "quick sale value," "as-is condition," "future renovated valuation," and others. The skill and experience of the licensed appraiser play a key role in the accuracy of the appraisal.

Until there is an actual property sale, an appraisal is just an estimate of probable market value. However, even when there is a sale, the buyer might have overpaid or a desperate seller might have accepted a below-market purchase offer.

IS APPRAISAL AN ART OR A SCIENCE? During the last 10 years, there have been many attempts to make real estate appraisals more accurate, especially with automated valuation models (AVMs). Mortgage lenders would be thrilled to be able to verify the exact market value of a house by pressing a few buttons on a computer. Although that day might be coming, it has not yet arrived.

The latest attempt to eliminate the need for appraisers is the free Web site www.Zillow.com, which claims to have 60 million U.S. homes profiled. For several of my properties I checked, I found the results amazingly accurate. I especially like the aerial views with the lot boundaries superimposed.

Then I checked the house where I grew up in Edina, Minn. Zillow reports a one-bedroom, one-bathroom house worth $1.2 million. That house description sounds like a shack. If the valuation is correct, I wish my parents hadn't sold that house. The reality is it is a very nice three-bedroom, two-bathroom house. Zillow isn't always correct.

However, when houses and condos are relatively similar to nearby houses, AVMs can be very valuable to help estimate market values. But appraisers will always be needed to verify valuations, especially in neighborhoods of unique one-of-a-kind homes.

Although computers have changed real estate appraisals, there is no substitute for the experience of a realty appraiser to interpret the recent sales prices of comparable nearby houses and condos, which determine the market value of a specific home. Equally important, an expert appraiser is needed to evaluate if the local home sales prices are rising, falling, or "normal." So far, computers haven't been able to replace this judgment test.

HOW TO GET AN ACCURATE APPRAISAL OF YOUR HOUSE OR CONDO. The Internet can be used to research approximate market values of houses and condos, based on recent sales prices of similar neighborhood homes within the last six months.

But that is just a starting point because each residence is unique. Market value depends on many variables. However, there are still a few basic rules to assure an accurate appraisal:

1.) GET THE HOME INTO TIP-TOP CONDITION. If you are buying a house or condo, the seller has presumably made the residence look its best. However, if you own the home and need an appraisal for mortgage refinancing or other purpose, aim to put the home into its best "model home" condition before the appraiser arrives.

Because appraisers often inspect three or more houses each day, and can't possibly remember each home's special features, it is best to hand the appraiser a list of the residence's special features, especially those that add market value. Also, if you know of recent nearby home sales prices, be sure to hand that information to the appraiser.

A Realtor friend of mine, who never has problems getting an appraisal to match the home's sales price, tells me, "I practically do the entire appraisal to be sure the house appraises for the sales price."

2.) ALWAYS ACCOMPANY THE APPRAISER. Either the real estate agent or the homeowner should always accompany the appraiser to facilitate the inspection and answer the appraiser's questions. Be sure to point out the home's special features and benefits that the appraiser might miss during the inspection.

3.) INSIST THE LENDER WILL PROMPTLY PROVIDE THE BORROWER WITH A COPY OF THE APPRAISAL. Technically, the appraisal belongs to the mortgage lender who hired the appraiser, even when the homeowner or home buyer is paying for the appraisal.

Borrowers should insist their lender agrees to promptly provide the borrower with a copy of the appraisal. If the appraisal comes in low, the home buyer, realty agent, and homeowner should have immediate access to that appraisal to correct any errors.

For example, when I refinanced my home last year with Wells Fargo Mortgage, I was very impressed when the lender sent me an overnight FedEx copy of the appraisal.

If the appraisal comes in low, and you see the appraiser made an error evaluating your house or condo, don't hesitate to promptly request a correction or a "review appraisal" by another appraiser (to be paid for by the lender).

CONCLUSION: Although appraisal is still very much an art, rather than an exact science, computers continue to help make residence value estimates more accurate. However, licensed appraisers will always be needed to verify the facts and use them to arrive at expert valuations. More details are in my new special report, "How to Get the Best Appraisal of Your House or Condo," available for $5 from Robert Bruss, 251 Park Road, Burlingame, CA 94010 or by credit card at 1-800-736-1736 or instant Internet delivery at www.BobBruss.com.

Read more!

Monday, May 29, 2006

Pricey Parking Is a Lot of Trouble

As L.A.’s real estate market has exploded during the last three years, the price of workplace parking has spiked 10 to 12 percent.

By: ANDY FIXMER: Los Angeles Business Journal

At STA Travel Ltd.’s corporate headquarters at 5900 Wilshire Blvd., most of the staff learned the hard way that their office building had been sold:

The parking rates increased 50 percent, from $70 to $105 a month.

“We don’t really have a choice but to pay it,” said Jarrett Klein, STA Travel’s vice president of operations. “Our landlord is undoubtedly taking advantage of the situation.”

STA, which specializes in the student travel industry, is far from alone. As L.A.’s real estate market has exploded during the last three years, so too has the price of workplace parking.

The average rate landlords charged for parking in L.A. County office buildings last July was $185 for a monthly unreserved space, according to a Colliers International survey. But since then, rates have spiked 10 to 12 percent, with most unreserved spaces now fetching more than $200 a month, parking operators in Los Angeles County say.

“The parking market and the office leasing market move in sync,” said Ross Moore, Colliers’ director of market and economic research. “We had a great year on the office leasing side, and as buildings fill up, parking garages fill up. And as parking garages fill up, you can imagine what happens to rates.”

In Los Angeles County, office vacancy rates dropped by 7 percent during the last three years – and 4 percent in the last year, according to Grubb & Ellis Co. The average L.A. County office building is now nearly 90 percent occupied.

“Once office buildings get up around 90 percent occupancy, landlords aren’t worried about losing tenants because there are three more waiting for the space,” said William Francis, a vice president at Walker Parking Consultants Inc. “In a strong market, office building owners are not bashful about raising prices.”

Moreover, during the last three years, there has also been a tremendous boost in the number of office buildings trading hands in the L.A. region. Since 2003, roughly one in every four L.A. County office buildings have switched owners. When a deal closes, new owners commonly look to parking as a quick way to raise a building’s revenue stream.

“You can’t arbitrarily raise income from office rents because those rates are set under a lease – naturally you look at parking,” acknowledged developer and landlord Wayne Ratkovich, who last year purchased 5900 Wilshire Blvd., where STA Travel is located, for close to $105 million.

Supply and demand

There are other factors at play too

Garages at L.A. County’s office buildings are filling up at an even more accelerated rate due to the region’s sizzling housing market; developers are building condo projects on top of former surface parking lots, which have historically served as a source of cheap monthly parking for commuters.

With surface lots disappearing, more and more commuters are being forced to park at their office building. “We’ve lost quite a bit of our surface lots,” Moore said. “Every time a lot is taken off the market, there’s a couple hundred cars displaced and a lot of them end up in the parking structure.”

But even with parking rates on the rise, Los Angeles commuters fare better than counterparts in New York, Boston, Washington, D.C. and San Francisco, where the cost is nearly double.

That’s mainly because L.A. grew-up in the automobile age and planned better to meet its parking needs. However, there are signs that L.A. could be heading toward a parking shortage.

For example, the city has cut in half the parking requirement for office buildings on downtown’s Bunker Hill, where developers now have to provide one space for every 1,000 square feet of office space within 1,500 feet of the building. For much of the rest of Los Angeles, developers are required to provide two parking spots per 1,000 square feet of office space within 750 feet of the building.

“In downtown, land costs are so high that you can’t afford to park every person,” said Francis, who has been studying parking issues in the L.A. region for nearly 30 years and has seen rates rise and fall dramatically at times, especially downtown.

From the late 1970s through the late ’80s, a time of heavy office construction activity, developers would include 400 spots in office properties with demand for 800 spaces, Francis said. And because the developments increased the demand for parking but limited the supply, a parking shortage occurred before the end of the decade. It wasn’t until the economic recession of the early 1990s and the opening of new parking garages that the imbalance leveled off.

“In 1989 you needed to spend $240 a month and know somebody to get a parking space,” Francis said. “Three years later you could walk into almost any garage in downtown with three friends, get a group discount and pay only $80 a month.”

‘Scarce commodity’

While today’s increasing parking rates may seem steep, Francis said it’s been bad before, even prior to the late 1980s. For example, from 1979 through 1984 parking rates increased 15 percent a year compounded annually.

“Parking is probably one of the few commodities that is a great example of the relationship between supply and demand,” Francis said. “When there’s lots of supply and not so much demand, rates get soft.”

In Los Angeles, parking rates historically soften when occupancy falls below 75 percent, he said.

For Ratkovich, 5900 Wilshire Blvd. was close to 90 percent full at the time of his purchase and included one tenant – L.A. Fitness – that has a heavy parking requirement. And unlike years past, tenants can’t rent a parking space at the Los Angeles County Museum of Art, which is across the street.

Late last year, LACMA demolished its 1,200-space garage, which typically soaked-up overflow parking from the office building, to make way for the museum’s expansion project. With the garage out of commission, demand for parking in the area spiked and Ratkovich said he was forced to raise rates.

“We have a scarce commodity. How do you allocate a scarce resource? The best way to do that is by price,” he said. “The only way to increase the supply of parking is to raise parking rates until they justify new construction.”

Read more!

Sunday, May 28, 2006

NAR: FHA Reforms Would Open Doors to Homeownership for Millions of Hard-Working Families

Bill would raise FHA loan limits and extend possible terms from 30 to 40 years

RISMedia

The National Association of Realtors(R) strongly supports the passage of the Federal Housing Administration reform package approved yesterday in a mark-up vote by the House Financial Services Committee led by Congressman Bob Ney (R- Ohio) and Congresswoman Maxine Waters (D-Calif.).

H.R. 5121, the Expanding American Homeownership Act of 2006, would raise FHA loan limits, eliminate restrictive down payment requirements, provide risk based mortgage insurance premium flexibility, and extend the possible terms of FHA loans from 30 years to 40 years. All of these changes will help make homeownership more attainable.

"The Expanding American Homeownership Act will make FHA a more viable tool for first-time home buyers and lower and moderate income families and many others pursuing the dream of homeownership. It is also the most substantive FHA reform legislation undertaken by Congress in over 15 years. Not only will hundreds of thousands of additional families have the opportunity to own their own home, but this legislation will improve FHA's relevance and competitiveness in the housing market," said Congressman Ney following today's successful committee mark-up.

"On a typical loan, these changes will save many families hundreds of dollars per month -- opening the door to the American Dream for thousands," said NAR President Thomas M. Stevens. "We commend the House Financial Services Committee for taking this important step to make FHA once again competitive in the home mortgage arena. With interest rates climbing and housing prices at all time highs, it is imperative to have a modernized, effective FHA product."

NAR also announced the formation of a coalition designed to help move this legislation ahead in Congress. The Coalition for a Strong FHA, led by NAR, is made up housing industry leaders including the National Association of Home Builders, National Council of State Housing Agencies, National Alliance of Independent Mortgage Bankers/Lenders One, National Association of Hispanic Real Estate Professionals, National Association of Real Estate Brokers, National Association of Local Housing Finance Agencies, Asian Real Estate Association of America, and the Strategic Alliance for Mortgage Subsidiaries.

The coalition is expected to become an advocacy force for the housing market. The coalition's mission is to ensure FHA reform is enacted and that it becomes a competitive option. Additional information regarding the coalition is available at www.strongfha.org.

"For over 70 years, the Federal Housing Administration has made homeownership possible for millions of Americans at no cost to taxpayers. With the proposed reform legislation, FHA will continue to make homeownership available for millions," said Stevens.

NAR and its Coalition for a Strong FHA partners urge House Members to cosponsor this legislation and urge the House leadership to schedule time for House floor consideration as quickly as possible following the Memorial Day recess.

The National Association of Realtors(R), "The Voice for Real Estate," is America's largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

Information about NAR is available at www.realtor.org. This and other news releases are posted in the Web site's "News Media" section in the NAR Media Center.

Read more!

Don't confuse 'stepped-up basis' with property tax basis

'Stepped-up' refers to adjusted-cost basis for inherited property

By: Robert J. Bruss: Inman News

DEAR BOB: I read your recent item about property "stepped-up basis" with great interest, but I wish you had taken it further. Suppose an owner deeds you a house purchased for $100,000, which is now worth $300,000, and you live in it the rest of your life. Won't you be paying taxes on $100,000 and be way ahead of the game? -Martin A.

DEAR MARTIN: You seem to be confusing apples with oranges. "Stepped-up basis" to market value refers only to the adjusted-cost basis for inherited property. In other words, the owner died and you inherited the property. Stepped-up basis is very important when the heir decides to sell the inherited property.

For example, if your basis for a property is $100,000, but it is worth $300,000 on the date of your death, your heir's stepped-up basis is $300,000. When the heir sells that property, his taxable capital gain is only the amount exceeding $300,000.

This is a huge tax savings over a lifetime gift. Instead, if you give the same property to someone before you die, that person takes over your low $100,000 adjusted-cost basis in this example. If the donee then sells that property for $300,000, there is a $200,000 taxable capital gain.

Depending on local property tax assessment laws where the real estate is located, and the relationship of the person receiving the property, that person might be able to take over your current below-market property tax assessment. However, that has nothing to do with "stepped-up basis" for inherited property.

HOW TO TRANSFER YOUR HOME LISTING TO A BETTER AGENT

DEAR BOB: We are not happy with our listing agent, but we have a signed listing contract. How can we change agents or sell for sale by owner (FSBO)? -Leah M.

DEAR LEAH: I hope you didn't sign a long-term listing beyond 90 days.

If you are unhappy with your listing agent, your best recourse is to contact the agent's brokerage owner or manager. Explain the situation and ask that your listing be transferred to the firm's top sales agent for your area to complete the listing term.

Transferring a listing means the original listing agent will get a referral commission when your home sells, typically 10 percent of the office's gross commission. A listing transfer keeps everybody happy at that brokerage so the firm will actively promote your listing, especially your new listing agent.

In today's slowing real estate home sales market, you definitely don't want to risk become a FSBO. If you want to receive top dollar, don't even consider selling FSBO because you need all the professional help you can get.

LIVING TRUST AVOIDS PROBATE COURT COSTS AND DELAYS

DEAR BOB: I have a living trust. After I die, what does the final beneficiary have to do, such as filing court papers? I have followed your column for many years and have done very well investing in real estate. -Gloria T.

DEAR GLORIA: Congratulations on your successful real estate investments.

When your revocable living trust "matures" after you pass on, your successor trustee (such as a surviving spouse, trusted friend or relative, or bank trust department) will distribute your living trust assets according to the terms of your living trust.

No probate court action is required. It is that simple. More details are in my special report, "24 Key Questions Answered: Living Trust Secrets Reveal How to Avoid Probate Costs and Delays," available for $5 from Robert Bruss, 251 Park Road, Burlingame, CA 94010 or by credit card at 1-800-736-1736 or instant Internet delivery at www.BobBruss.com. Questions for this column are welcome at either address.

Read more!

Saturday, May 27, 2006

Seller learns difference between appraised and market value

Stream of low offers confuses home seller

By: Ilyce R. Glink: Inman News

Q: I tried to sell a house for the appraised price and was unable to sell at that price. I understand that property will not sell when it is priced too high but the offers I received were $5,000 to $8,000 less than the appraisal.

I was under the impression that if I advertised the property for the appraised price, it would move quickly. I told one real estate agent when she made me an offer from a client that I was going to have the house appraised again and that I would provide the appraised price to the potential buyer so he could adjust his bid.

The agent didn't go for that at all. Can you give me some suggestions as to what I did wrong? When I couldn't sell the house, I finally rented it.

A: I think you made a few basic mistakes. First, the appraised value is not necessarily the same thing as the market value.

The appraised value of the home is what an appraiser thinks the home is worth based on the sales of other similar homes in the area. The market value is what someone will actually pay for the house.

In your case, either because of the condition or location of the home, the market is telling you that your home isn't worth what the appraiser thinks it should be worth-it's worth $5,000 to $8,000 less.

Getting a new appraisal doesn't change what someone will pay for the home. You'd be better off buying some cans of white paint and repainting the interior of the property. Then, you might get more money for it.

Renting the house is fine. Eventually, prices will rise in your neighborhood and you'll get your price, but not today. And only you can decide if waiting for prices to rise in order to get the extra $5,000 to $8,000 is worthwhile.

Q: My father died late last year and left a piece of property to my two sisters and me. Ownership is to be divided equally. The property is a house on Lake Michigan on the eastern shore, about due east of Chicago.

Local real estate agents have told us the property is worth $1.2 to $1.5 million. We all live too far away to use or manage the property and have decided to sell. However, one sister insists on doing nothing this year and waiting until next spring to sell. She says she heard one should wait at least a year to sell inherited property and that it "feels right" to wait.

Can you give me some reasons why we should either wait or sell immediately? My own feeling is that the taxes for this property are going to be very high once my father's "grandfathered" tax rate lapses.

A: First, I'd like to offer my condolences on the loss of your father.

Although I'm sure you and your sisters are missing your dad, I can't think of any reason why you wouldn't want to put your dad's house on the market now-when vacation homes are selling like hotcakes. The carrying costs (taxes and maintenance) on a house that expensive could be costly, especially if none of you are near enough to use it regularly and make sure that small problems don't turn into big issues.

I think the advice your sister is remembering refers to individuals who have experienced a huge trauma, like the death of a spouse or partner. In those cases, if the individual can afford to wait, it is a good idea to let a year go by while he or she adapts to the new circumstances of a new life.

In your case, you won't gain anything by waiting a year to sell this property. You have inherited the property at the current market value (which may even be able to be adjusted to whatever price you sell it for this spring). That means you would pay no capital gains tax on your inheritance when you sell.

And after the expense of selling it (broker's commission, transfer taxes, etc.), you would each pocket a significant amount of cash.

I think that you should sell now, especially since interest rates might rise significantly in the next year, which could dampen interest in an expensive vacation property. But it doesn't really matter what I think.

You and your siblings need to talk this out so everyone is comfortable with the plan. If you're having trouble agreeing, ask an estate attorney to mediate.

Read more!

Ways to Save Money This Summer By Cutting Your Energy Bills

Technology is making it easier (and cheaper) to conserve power in your home, thanks to everything from using more efficient appliances to installing solar panels on your roof.

By: Marshall Loeb: The Wall Street Journal Online

Saving energy on hot-weather days is cool. And the good news is that technology is making it easier (and cheaper) to conserve power in your home by means that range from using more efficient appliances to installing solar panels on your roof.

Mike Gordon, president of ConsumerPowerline, a New York company that helps businesses cut their energy bills, has tips that are quick and easy - and some that are more involved - for saving money this summer.

When it comes to simple things, Gordon says, drawing your shades goes a along way.

Meanwhile, running a dehumidifier will boost your air conditioner's efficiency. The more humid the air inside, the harder your air conditioner will have to work. Lower humidity in your home means you'll be comfortable at higher temperatures, so you can turn the thermostat up a few degrees, saving even more money.

Gordon also recommends buying motion sensors that will turn your lights off once you've left the room. If you've ever been in a business meeting where the lights went out because everyone was sitting still, you're already familiar with the minor inconveniences of sensors. But the savings can be substantial.

Some homeowners can now earn money from their power company by "shedding" electrical capacity at peak times, like hot summer days. Many utilities already have such programs for condo owners and multifamily buildings.

Here's how it works: the power company will install controls that shut down your power use when you expect to be out and when the power grid needs more electricity, like at midday. In return, says Gordon, the utility pays you for the power you're not using. And the controls should come with an override so that if you unexpectedly return home you'll be able to use the dishwasher.

Another source of savings: the energy bill Congress passed last year. It includes tax credits for everything from energy-efficient windows to solar-power water heaters and other home improvements.

"If it's energy-efficient and certified as such it will likely make you eligible for credits," Gordon says. But check with your tax adviser before you go on a shopping spree.

Read more!

Friday, May 26, 2006

L.A. Home Median Hits $567,480

The median price of an existing home in Los Angeles increased 17 percent to $567,480 in April compared to a year ago, and sales decreased nearly 13 percent, the California Association of Realtors said Thursday.

Los Angeles Business Journal Online

The California median rose more than 10 percent to $562,380, with sales down 21.4 percent, said the industry group, which collects data from more than 90 local Realtor associations around the state. Closed escrow sales of existing, single-family detached homes statewide totaled 516,960 in April at a seasonally adjusted annualized rate.

“Concerns about the likelihood of future interest rate increases continue to influence the market,” said C.A.R. President Vince Malta in a statement. “While still near their historic lows, mortgage interest rates are at their highest level since June 2002 for fixed-rate mortgages, and August 2001 for adjustable-rate mortgages.”

In a separate report covering more localized statistics generated by C.A.R. and DataQuick Information Systems, 84.5 percent, or 339 out of 401 cities and communities showed an increase in their respective median home prices from a year ago.

Statewide, the 10 cities and communities with the highest median home prices in California during April were: Manhattan Beach, $1,685,000; Burlingame, $1,600,000; Los Altos, $1,557,500; Newport Beach, $1,445,000; Saratoga, $1,407,500; Santa Barbara, $1,250,000; Lafayette, $1,112,500; Mill Valley, $1,068,750; Santa Monica, $1,020,000; Danville, $1,019,500.

Read more!

On Heels of Rebound, Existing-Home Sales Ease

Pressure has come off of home prices and most owners can expect steadier gains in home values for the foreseeable future, says NAR President Thomas M. Stevens.

NAR: REALTOR® Magazine Online

Existing-home sales eased in April on the heels of a two-month rebound, according to the NATIONAL ASSOCIATION OF REALTORS®.

Total existing-home sales — including single-family, townhomes, condominiums and co-ops — slipped 2 percent to a seasonally adjusted annual rate of 6.76 million units in April from a downwardly revised level of 6.9 million in March. Sales were 5.7 percent below the 7.17 million-unit pace in April 2005.

The decline was expected, says NAR Chief Economist David Lereah. “Our leading indicator for pending home sales was trending lower, and our forecast model is showing a modest decline for the second quarter, with sales leveling out before rising in the fourth quarter,” he says. “Higher interest rates are slowing home sales, but we see this as another sign of a soft landing for the housing sector which remains at historically high levels.”

The national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 6.51 percent in April, up from 6.32 percent in March, according to Freddie Mac. The rate was 5.86 percent in April 2005.

The national median existing-home price for all housing types was $223,000 in April, up 4.2 percent from April 2005 when the median was $214,000. The median is a typical market price where half of the homes sold for more and half sold for less.

Price Run-Up is Over

NAR President Thomas M. Stevens from Vienna, Va., says the big run-up in home prices is over.

“After five years of booming sales, we are now experiencing normal market conditions across most of the country,” says Stevens, senior vice president of NRT Inc. “Inventories levels have come up to balanced levels between home buyers and sellers, so the pressure has come off of home prices and most owners can expect steadier gains in home values for the foreseeable future.”

Total housing inventory levels rose 5.8 percent at the end of April to 3.38 million existing homes available for sale, which represents a 6.0-month supply at the current sales pace.

Single-family home sales dipped 2.0 percent to a seasonally adjusted annual rate of 5.92 million in April from 6.04 million in March, and were 5.6 percent below the 6.27 million-unit pace in April 2005. The median existing single-family home price was $222,700 in April, up 4.3 percent from a year ago.

Condo, Co-op Sales Down 2.7%

Existing condominium and cooperative housing sales declined 2.7 percent to a seasonally adjusted annual rate of 839,000 units in April from an upwardly revised pace of 862,000 in March, and were 6.3 percent below the 895,000-unit pace in April 2005. The median existing condo price3 was $222,000 in March, down 0.2 percent from a year ago.

Regionally, existing-home sales in the Northeast slipped 0.8 percent to an annual sales rate of 1.18 million units in April, and were 2.5 percent below a year ago. The median price in the Northeast was $283,000, up 5.6 percent from April 2005.

Existing-home sales in the West declined 1.4 percent to an annual pace of 1.41 million in April, and were 13.0 percent below April 2005. The median price in the West was $348,000, up 4.8 percent from a year ago.

In the South, existing-home sales eased by 1.9 percent in April to a level of 2.61 million, and were 3.7 percent lower than a year ago. The median price in the South was $180,000, up 3.4 percent from April 2005.

Existing-home sales in the Midwest fell 3.7 percent to a pace of 1.57 million in April, and were 3.1 percent below April 2005. The median existing-home price in the Midwest was $166,000, down 1.2 percent from a year earlier.

For more housing market statistics and research reports,visit NAR's Research Department at REALTOR.org.

Read more!

Thursday, May 25, 2006

The Weekend Guide! May 25 - May 29, 2006

The Weekend Guide for May 25 - May 29, 2006.

Full Article:

Read more!

Smart Tax Tips for Second-Home Owners

Taxes can be tricky for owners of second-homes and investment properties.

By: Janet Novack: REALTOR® Magazine Online

And with 6.8 million vacation homes in the United States — on top of the more than 37 million investment units — it's safe to say that there are plenty of owners looking for some smart tax advice.

Here are four tips that will help owners avoid paying too much money to Uncle Sam. For more detailed information, consult a tax expert. • Pay cash. You can duck the rules on passive losses by paying cash for the

property.

• Be mindful of mortgages. Don’t take out a mortgage out on a paid-up house and

use the cash to buy a second home. The IRS doesn’t always allow these payments

to be deduced as personal mortgage interest.

• Be an involved landlord. Living in a different state and hiring someone to

pick out tenants will cause the IRS to take a closer look. If you want to take

deductions, you must actively participate in the management.

• Use the property. If you stay in the house for 15 days or more, not including

days you're really working on the properties, and for more than 10 percent of

the total days it's in use, it becomes a mixed-use property instead of a pure

investment property. You'll be able to claim itemized deductions for a large

portion of the mortgage interest and taxes.

Read more!

Wednesday, May 24, 2006

Top 2% of Market Still Selling As Overall Sales Volume Falls

Multimillion-dollar-home purchases aren't lagging, despite an apparent real-estate slowdown. What's driving this trend? Rising prices have made seven-figure residences more common, and the rich are seemingly more insulated from market fluctuations.

By: Troy McMullen: The Wall Street Journal Online

Despite growing indications of a cooling housing market, one niche continues to sell briskly - multimillion-dollar homes.

Over the past few months in the overall U.S. real-estate market, more homes have crowded the market and sales volumes have fallen in areas from Houston to Boston and Washington, D.C. Freddie Mac, the government-sponsored provider of mortgage-loan funding, predicts total home sales this year will be down by about 7% from 2005's record levels. Yet one area of the market appears immune to all that: In many locations, homes on the ultrahigh end of the price scale - those costing $3 million and up - have been selling in increasing numbers.

In San Francisco, 18 homes in that range sold in the first quarter, up from 15 in the same period last year, according to real-estate information service DataQuick. In Jackson, Wyo., that number rose to 21 homes from 17, according to Jackson Hole Real Estate and Appraisal. Higher up the scale, 10 homes at $5 million or more in Palm Beach, Fla., sold in the first quarter, up from eight last year, says the county assessor's office.

One factor in the growth could be that median prices of all homes have risen, pushing more homes into the luxury end. Also, inventory is up across the board. But at a time when the overall number of home sales has declined in many markets, the number in the ultra-high range has continued to grow. One possible message: Just as it is often said that the rich aren't like the rest of us, the real-estate market of the rich appears to bear a decreasing resemblance to the one experienced by most Americans.

Paying in Cash

Homes at $3 million and up represent less than 2% of the overall market, estimates the National Association of Realtors. Activity at this small upper end has traditionally been a leading indicator for the broader market, says Gregory Heym, chief economist for the New York real-estate brokerages Brown Harris Stevens and Halstead Property. Now, he says, there may be less of a connection between the two segments. The stock market has created new wealth and the number of millionaires has grown, so more buyers are paying in cash. (The National Association of Realtors found that 8% of home buyers paid in cash last year, up from 6% in 2003.) That has left luxury buyers mostly insulated from economic factors such as rising short-term interest rates.

Mark Zandi, chief economist at forecasting firm Moody's Economy.com, says the segment of high-end buyers "won't be immune from the unfolding travails of the rest of the market, but it will weather those difficulties much better than it has historically."

Walter Molony, a spokesman for the National Association of Realtors, says the highly volatile high-end market serves as a poor market indicator. Activity among first-time home-buyers, he says, is more telling. "That segment provides liquidity for people to be able to trade up to larger homes," he says. "Without strong entry-level activity, the market would sink."

When Todd Michael Glaser listed his 11-bedroom Miami home in February, overall sales volume in the city was slipping - sales fell 21% for the month over a year earlier. But he wasn't concerned. He listed it for $40 million, well above Miami-Dade County's record single-family home sale of $27.5 million in 1999.

Mr. Glaser, a 41-year-old real-estate investor, figured the property would sell based on its amenities and location. The 20,000-square-foot home is one of the biggest on North Bay Road, where neighbors include Billy Joel and Matt Damon. A month after hitting the market, it went under contract for purchase. Brokers with knowledge of the deal put the price at over $30 million, though Mr. Glaser wouldn't reveal the number. "It's not a property for the everyday home buyer," he says.

In Los Angeles County, 217 homes priced over $3 million sold during the first quarter, up from 114 during the same period last year, according to Cecelia Kennelly-Waeschle of Sotheby's International Realty. That is the biggest first-quarter jump since the firm started tracking sales in 1988. For the same period, the number of all sales in the county fell 10.3%, according to DataQuick. Two homes priced above $10 million sold in Santa Barbara, Calif., during the first quarter - including a $28.5 million, 17-acre oceanfront property to actor Kevin Costner - up from one a year earlier. (The data in this and other markets do not show how long the homes spent on the market or whether they sold at their original asking price.)

The Kravis Solution

Some affluent buyers don't limit themselves to what's on the market. When Henry Kravis, managing partner of New York-based Kohlberg Kravis Roberts, went shopping for a Palm Beach house in January, he didn't like any of the available properties. His broker, Lawrence Moens, identified a property that wasn't for sale, but fit Mr. Kravis's criteria: a 15,255-square-foot home on five acres along Lake Worth. "I just knocked on the door and said, 'I've got a buyer willing to pay a lot of money for your home,' " says Mr. Moens. A few weeks later, the deal closed for $50 million, public records show. Local brokers say it is the highest price ever paid for a non-oceanfront property there. Mr. Kravis declined to comment.

Not all markets are seeing a surge in high-end sales. In Manhattan, 212 homes priced above $4 million sold in the first quarter, from 226 in the year-earlier period, according to Brown Harris Stevens. Appraisers say that apartments are staying on the market longer.

Even where sales are falling, confidence hasn't always flagged. On the Nevada side of Lake Tahoe, sales of homes priced above $1 million fell 35% in the first quarter over a year earlier, according to Chase International Realty. That didn't stop Tom Gonzales from raising the price on his home in Incline Village, Nev. After staying on the market for a year at $60 million, he raised the price on the 4.5-acre property to $65 million last month, to account for the upkeep he's paid. "I don't think there's a shortage of people looking for a property like this," says Mr. Gonzales, 61, who co-founded software company Commerce One in the 1990s.

Yet in Fairfield County, Conn., Lake Forest, Ill., and San Diego County, brokers say many sellers are trimming prices amid a glut of pricey homes. Writer Jane Green and her husband, bank executive David Burke, cut the price of their Westport, Conn., property by $1 million after it sat for eight months at $5 million. Shortly afterwards, the property sold in January for $3.9 million, public records show.

Talk of a slowdown hasn't affected Sean Wolfington, a former Philadelphia Internet entrepreneur, who just outbid two other buyers on a six-bedroom estate in Key Biscayne, Fla., formerly owned by the singer Cher. The cost: $8.8 million, in cash. "Interest rates aren't a factor for me," says Mr. Wolfington, 34, who now runs an independent film company. "Waterfront properties like these are in limited supply. I saw this as an excellent buying opportunity."

Read more!

Tuesday, May 23, 2006

Condo Developers Add Clubs, Restaurants to Attract Buyers

As demand for condominiums cools, some developers in places like New York, Miami and Las Vegas are signing big-name chefs and opening trendy bars on their properties.

By: Cheryl Lu-Lien Tan: The Wall Street Journal Online

When Ten Museum Park is completed next year in Miami, it will feature a high-end restaurant and an exclusive lounge designed by Michael Capponi, a nightlife impresario best known for celebrity-studded parties he throws at local hotspots like Glass and Mansion.

The building isn't a hotel or resort - it's a condominium development aimed at second-home buyers that will feature 200 units priced from $400,000 to $4 million.

As the condo market cools - year-over-year sales of existing condos and co-ops were down 2% in March - some developers are trying a new tactic to entice buyers. Taking a cue from the boom in hotel condos, where developers combine residential units with hotel rooms, they are signing on big-name restaurants and chefs, opening trendy bars and building clubs on the property.

Celebrity chef Todd English says he is negotiating with developers to open his first Miami restaurant - an upscale chophouse, he says - next year at Paramount Bay, a condo project with 346 units that cost between $600,000 to $5 million.

The success of New York City's Time Warner Center, a condo project that has drawn star chefs such as Thomas Keller, has inspired its developer, Related Cos., to plan a similar development in downtown Los Angeles. The project, named Grand Avenue, is slated to have seven restaurants and a large bar or nightclub. Ken Himmel, executive vice president of Related, says he's talked to "every major restaurateur from Los Angeles, San Francisco and Las Vegas" about opening there.

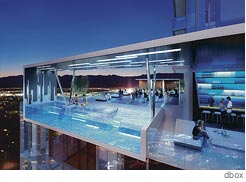

In Las Vegas, Fifield Realty is adding an upscale steakhouse to its Allure Las Vegas project and planning to offer room-service-like delivery to residents. And although Vegas 888 won't open until 2008, its developers are touting its 35th-floor nightclub, where owners and those who pay a hefty membership fee can sip cocktails while sitting in a pool and checking out sweeping views of the Strip.

Condos at Vegas 888 will come with membership in its 35th-floor private club.

"It's meant to be as exclusive as the building is," says Matt Brimhall, spokesman for Del American, which is building Vegas 888. "It'll have fire pits, outdoor rain showers - you can take guests there to have a drink and check it out."

Developers say they're turning to restaurants and nightlife to set themselves apart from competitors in an increasingly crowded high-end condo market. In Las Vegas, developers of three luxury condo projects - including one that had sold some units - recently scrapped their plans, citing concern that there wasn't enough demand. In Miami, says Daniel Kodsi, chief executive of Royal Palm Communities, which is developing Paramount Bay, "There are about 4,000 units that are built or currently under construction within a few blocks" of the project. "We wanted to offer something different."

Meanwhile hotel condos are continuing to push the envelope. The W Hotel condo project in Miami just signed up Mr. Chow, a New York City restaurant popular with celebrities, to open on its premises. And Hard Rock Hotels' condo hotel, scheduled to open next year in San Diego, will feature the city's first Nobu.

Developers say restaurants, bars and other hotel-like amenities appeal to second-home shoppers, who are increasingly picking condos over single-family houses. Rogelio Garcia, a retired property manager who lives in Laguna Hills, Calif., but regularly visits Las Vegas, says Allure Las Vegas's restaurant and high-end concierge service were "giant factors" in his decision to buy a $655,000 two-bedroom condo there. "Having all those things at your fingertips is important," he says.

Opening restaurants in condominiums hasn't always appealed to big-name chefs. Mr. Himmel, who worked for the company that built Water Tower Place in Chicago in 1976, recalls that it was hard to lure prominent restaurateurs. (California Pizza Kitchen eventually set up shop.) But the demographics of luxury condo buyers can be persuasive. Given the condo prices at Paramount Bay, says Mr. English, "the clientele would be a worldly, good clientele. And we would have that built-in business."

Putting nightclubs and restaurants in condos could have some drawbacks. Diners and clubgoers won't be able to access the residential floors, but crowds and rowdy drinkers could get in the way of a good night's sleep. At Mint, a Miami condo slated for completion in 2008, the restaurant is adjacent to the lobby. Inigo Ardid, vice president of developer Key International, says he plans to install a soundproof glass wall between the restaurant and the lobby and ban music in the restaurant after 10 p.m.

Ownership doesn't always have its privileges. Vegas 888 plans to offer residents full access to its clubs, but some properties are reserving the right to enforce a tight velvet rope. Kevin Venger, co-owner of Ten Museum Park, says he picked Mr. Capponi - whose South Beach parties draw A-listers like Jennifer Lopez - because he wanted it to attract a similar crowd. Condo owners may pay $4 million, but letting them all into the club could hurt the rep. "We have disclaimers saying there's no guarantee that you're going to be able to get in," he says.

Read more!

Sellers misled about real estate tax break

Large capital gains can't be erased with another purchase

By: Robert J. Bruss: Inman News

DEAR BOB: Due to a job promotion and transfer we must sell our house of 21 years. Our nice problem is the net profit will be about $625,000. My wife and I are aware $500,000 of that amount for a married couple will be tax-free, thanks to Internal Revenue Code 121. However, my insurance agent told me that if we buy a replacement principal residence of equal or greater cost, we could also avoid paying tax on the additional $125,000 capital gain. Is this true? -Cheryl R.

DEAR CHERYL: No. I hope your insurance agent knows more about insurance than he does about income taxes.

Since 1997, purchase of a replacement principal residence has nothing to do with avoiding capital gains tax on the sale of a former principal residence. Your insurance agent is nine years behind the times.

But the good news is the maximum federal long-term capital gains tax rate is only 15 percent, plus any applicable state tax. That is a small price to pay for enjoying your huge capital gain, which is tax-free except for $125,000. For more details, please consult your tax adviser.

HOW TO GET RID OF AN INEFFECTIVE HOME SALE LISTING AGENT

DEAR BOB: My husband and I are trying to sell our home. We stupidly chose a new Realtor who said she would list our house on a reduced sales commission. After almost two months, we have had only seven prospects inspect the house. Is there any way we can change Realtors? -Tracey P.

DEAR TRACEY: I suggest you contact the listing agent's broker or office manager to discuss the transfer of your listing to an experienced, successful agent within the same brokerage who sells homes in your vicinity.

To get more buyers' agents to show your home, you should adjust your sales commission upward to be competitive with other nearby listings.

After the listing transfer, your original listing agent will get a referral commission when the home sells and you will then have an experienced successful agent working hard to get your home sold. As the home sales market slows, primarily due to rising interest rates, you need the best available listing agent. This is no time to be cutting sales commissions or listing with an inexperienced new agent.

RECOMMENDED BOOK FOR FIXER-UPPERS

DEAR BOB: I am about to undertake my first fixer-upper house. I recall you recommended a "how to" book in the past. What is the title? – Frank C.

DEAR FRANK: A superb new book is "Find It, Fix It, Flip It," by Michael Corbett. You will love this unique book, which is not only "how to" but also explains how to upgrade a run-down house into a beautiful swan. The book is available in stock or by special order at local bookstores, public libraries, and www.Amazon.com.

CAN A 1 PERCENT CONDO OWNER BE EVICTED?

DEAR BOB: Fourteen months ago I rented a condo. The new owner resides out of town with no intent to live in the condo. We met each other and got along well. Then he learned the condo homeowner's association absolutely forbids rentals. So he deeded me a 1 percent ownership interest on the title so I can occupy as an owner. But I recently lost my job, am unable to collect unemployment, and am behind on the rent. Now the 99 percent owner has been threatening me, harassing me, and showing up to let himself into my unit without notice. He wants me out within a week. He is mean and relentless. What legal rights do I have? -Renee C.

DEAR RENEE: Your landlord must follow the unlawful detainer eviction procedures. They require giving you a Notice to Pay Rent or Quit. If you don't pay the rent, he must then serve you with a court summons and complaint, which gives you time to file an answer with the court. After that, a court hearing will be scheduled.

Only after the landlord has obtained a court judgment ordering eviction can he have you physically removed by the local sheriff. Meanwhile, the landlord has no right to enter your condo unit without at least 24 hours advance written notice (except in an emergency). If necessary, you can obtain a court restraining order against the landlord. For details, please consult a local real estate attorney.

SAVE ALL RECEIPTS FOR HOME IMPROVEMENTS AND REPAIRS

DEAR BOB: I recently bought a house where I hope to live for the next 30 to 40 years. But I have had to do costly repairs and maintenance, such as replacing aging wiring, replacing the main sewer line, installing a bathroom door, roof maintenance, interior painting, carpeting, and landscaping. Which of these expenses should be capitalized and added to my cost basis and which are non-deductible repairs? --Lauren C.

DEAR LAUREN: Save all your receipts for home improvements and repairs. Your goal is to capitalize as many expenses as possible and add the upgrade costs to your adjusted-cost basis.

For now, just save the receipts. When you eventually sell the house in 30 or 40 years, that's the time to categorize the expenses as improvements to be capitalized or repairs, which have no tax significance.

The general rule is if the expense extends the useful life of the property, or enhances its market value, it is a capital improvement. But other costs, such as painting, are repairs, which have no tax significance for your personal residence. More details are available from your tax adviser.

CHALLENGE PROPERTY TAX ASSESSMENT AS SOON AS POSSIBLE

DEAR BOB: In November 2005 I bought a brand-new house. But the county tax assessor recently sent me a letter than the assessed value will be approximately $25,000 higher than my purchase price. What should I do? -Paul C.

DEAR PAUL: You should pay a visit to the county tax assessor's office to review the appraisal for higher than your home's recent purchase price. Perhaps you got a bargain price because it was a builder's closeout or for another reason. As a property owner, you are entitled to look at your home's assessment file to determine if there was a mistake.

Unless there is a valid justification, after reviewing your file, you should consider filing an appeal with the assessor's office to get your assessed value reduced based on recent sales prices of comparable houses like yours.

DOES CONVERTING RENTAL HOUSE TO PERSONAL RESIDENCE ELIMINATE DEPRECIATION RECAPTURE?

DEAR BOB: About five years ago, I converted a rental house (that had been depreciated down to land value) to my personal residence. If I sell it today, can I take the $250,000 principal residence sale tax exemption, or will I have to recapture all the depreciation I deducted when it was a rental? - Thomas S.

DEAR THOMAS: Presuming you did not acquire the house in an Internal Revenue Code 1031 tax-deferred exchange, and you owned and occupied it at least 24 of the 60 months before its sale, as a single principal residence seller you can qualify for up to $250,000 tax-free profits. A qualified married couple filing a joint tax return in the year of home sale can qualify for up to $500,000 tax-free capital gains.

However, the depreciation you deducted while the house was a rental will be recaptured (that means "taxed" to us ordinary folks) at the special 25 percent federal tax rate. Please consult your tax adviser for full details.

SHOULD INVESTOR PAY OFF 10 PERCENT LOAN WITH 7.3 PERCENT LOAN?

DEAR BOB: I have an investor loan of $25,000 at 10 percent fixed interest with a two-year balloon payment on a rental property. Would it be beneficial to pay this loan off with my 7.3 percent variable home equity loan secured by my principal residence? -Eric P.

DEAR ERIC: Gosh, let me check my calculator. That 7.3 percent interest sounds much lower than 10 percent interest, especially since that high-interest loan has a balloon payment due in just two years. If there is no prepayment penalty, get rid of it.

EX-GIRLFRIEND NOT NEEDED TO ESTABLISH HOME'S BASIS

DEAR BOB: Fifteen years ago, my girlfriend was under a deluge of bills. She signed a quick claim deed on our house to me and disappeared. I've paid off the mortgage but can't locate her. The house has appreciated greatly in market value. I want to sell. How do I establish a cost basis? -Robert H.

DEAR ROBERT: As a general rule, your basis is the purchase price, plus closing costs that were not tax deductible at the time of home purchase, plus capital improvements added during ownership, minus any depreciation deducted for rental or business use of the property.

If your ex-girlfriend signed a quitclaim deed (not a quick claim deed) to you, and it was properly recorded, you don't need to locate her because you hold marketable title. For more details, please consult your tax adviser or a local real estate attorney.

The new Robert Bruss special report, "How to Get the Best Appraisal of Your House or Condominium," is now available for $5 from Robert Bruss, 251 Park Road, Burlingame, CA 94010 or by credit card at 1-800-736-1736 or instant Internet delivery at www.BobBruss.com. Questions for this column are welcome at either address.

Read more!

Monday, May 22, 2006

The Multimillion $ Market is Still Hot, Hot, Hot

Despite a cooling real estate market, one segment that remains red hot is the multi-million-dollar market.

By: Troy McMullen: REALTOR® Magazine Online

In San Francisco, 18 homes in that range sold in the first quarter, up from 15 in the same period last year, a DataQuick analysis shows.

In Palm Beach, Fla., 10 homes sold for $5 million or more in the first quarter, up from eight last year. And in Jackson, Wyo., 21 homes, up from 17, sold for more than $3 million, according to Jackson Hole Real Estate and Appraisal.

Mark Zandi, chief economist at forecasting firm Moody's Economy.com, says the segment of high-end buyers "won't be immune from the unfolding travails of the rest of the market, but it will weather those difficulties much better than it has historically."

Read more!

Condo Conversions Create Quandary

The L.A. City Council is beginning a series of hearings on how to protect affordable apartments before they’re converted to high-priced condominiums.

By: ANDY FIXMER: Los Angeles Business Journal

When it came to his cozy Valley Village apartment, James Norton had a rare combination in Los Angeles: a quiet, safe neighborhood to raise his two sons and affordable rent.

Now his world is being upturned.

Norton, an eight-year veteran of the Los Angeles Police Department, and his roughly 80 neighbors are being evicted to make way for a massive condo development.

Even though he got more than $8,000 for his relocation costs, Norton says he won’t be able to find another rent-controlled, two-bedroom apartment in his neighborhood – or anywhere else in L.A. – for $760 a month.

“I’m facing at least double the rent,” he said. “Everything has more than doubled.”

The situation of Norton and his neighbors is becoming more and more common in Los Angeles, where land prices have shot up and rents can’t reflect today’s values.

In response, some apartment owners are converting their buildings to condominiums or razing their property to make way for a new for-sale development.

With cases such as Norton’s mounting, the L.A. City Council is beginning a series of hearings on whether to enact a moratorium on such conversions while the city decides how to protect its remaining stock of affordable apartments before they’re converted to high-priced condominiums.

It’s no wonder why apartment building owners want to go condo.

While the average apartment rent in L.A County is close to $1,500 a month, according to Novato-based rent tracking firm RealFacts, the median priced L.A. County condo is selling for close to $415,000, according to Melville, NY-based housing market firm HomeData Corp.

Put another way: A completely occupied 25-unit apartment building with units renting at the county average could be sold for about $4.5 million while the same property could be sold for nearly $10.5 million if the units were median-priced condos.

The pace of conversions countywide has only heated up as the gap between rents and condo prices has grown larger during the past five years.

Since 2000, more than 11,000 “rent-stabilized” apartment units – those apartments built in L.A. before 1978 where landlords are limited to raising rents 4 percent annually – have been converted to condos. The majority of those, about 7,000 units, were converted within the last 18 months. (The rent stabilization law doesn’t prohibit conversions.)

“And that’s only the rent-stabilized apartments,” said Larry Gross, executive director of the Coalition for Economic Survival, a group that helped bring about rent control in Los Angeles. “That number doesn’t take into account the thousands of non-stabilized units that have been taken off the market for conversion.”

Renters priced out

Roger Temple, owner of the Valley Village apartment building where Norton lives, said he loses money on the rental property every month. “It’s totally unrealistic,” Temple said. “I have a negative cash flow on every single one of these buildings.”

Temple said he’s replacing buildings that have structural and environmental problems with new condos that meet modern housing codes.

“There’s no way to bring these buildings to modern standards and make them safe,” Temple said. “I’m trying to keep the costs down so the units will be entry level housing.”

Proponents of allowing apartment building owners to raze their property or convert their units to condos say L.A.’s codes are already unnecessarily strict. For example, the city requires 51 percent of a building’s tenants to agree to a conversion before a project can proceed.

“The City of Los Angeles already has a de facto moratorium on conversions,” said Alan Nevin, the California Building Industry Association’s chief economist. “It’s next to impossible to get approval.”

Nonetheless, landlords can evict tenants under the state’s Ellis Act, which allows property owners to get out of the apartment business. Even so, landlords can face hurdles getting approvals to convert or raze their property.

At the same time, apartment building owners and real estate agents say the conversions give first-time homebuyers a “last chance” opportunity to get into an L.A. real estate market that is increasingly becoming out of reach.

A prime example is Forest Glenn, a 204-unit Winnetka complex where the owners are converting the two- and three-bedroom townhouse-style apartments into condominiums.

The owner, Forest Glenn Development Partners LLC, bought Forest Glenn about two years ago and has sunk more than $1 million into renovating the property, where units had been rent stabilized, in preparation for conversion.

While single-family homes in the neighborhood are selling for $660,000 and nearby two-bedroom condos are trading for $350,000 – the units at Forest Glenn range from $288,000 to $390,000 and the town homes are selling quickly.

“This is the best thing to happen for first time buyers,” said Elaine Golden-Gealer, who is the listing agent at Forest Glenn and has represented numerous apartment building owners switching to condos. “There’s almost no other way to get into the market.”

Still, Golden-Gealer admits few if any of the original tenants buy their units. At Forest Glenn, she said, the developer had even given tenants a number of incentives to buy.

The developer allowed tenants to use their security deposits and relocation money – which ranged from $5,000 to $8,000 – toward the down payment. Tenants got first crack at any unit in the complex and could relocate to another unit within the complex while theirs was being remodeled.

Despite the incentives, there were few takers. “A lot of times, people who are renters can’t get that value as a condo,” Golden-Gealer said. “They always think it’s over priced.”

Nevin contends about 3 percent of tenants in converted buildings stick around to buy their unit. Of those buying the remaining units, three-quarters were formerly renters.

“It’s absolutely not a case of losing units in the inventory – the inventory size stays the same,” Nevin said. “You’re just moving renters into an ownership position.”

Elected officials are concerned, however, that apartment conversions could worsen L.A.’s affordable housing crisis by decreasing the number of rental units on the market.

Councilman Ed Reyes, who chairs the city council’s Planning and Land Use Management committee, worries that with the city’s home prices out of reach of most families, that vast numbers of residents could be displaced.

“While we understand the need to protect property rights, we simply cannot ignore the fact that more and more middle-class and working-class Angelenos are being forced out of their homes,” Reyes said. “We must consider all options and that’s what these hearings are all about.”

Few limits

Cities from San Francisco to San Diego are grappling with the same problem, but even adjusted for population L.A. now leads the state in evictions due to rental properties taken off the market.

The apartment conversion initiative is just one of a number of proposals the city is undertaking to maintain a supply of affordable housing.

Recently, the council put a moratorium on converting single room occupancy hotels, which provide cheap housing for the poor, into market rate apartments and condos.

Among other efforts, the city is stepping up its role in building subsidized rental housing for low-income families and considering an ordinance that would force developers to include some level of affordable housing at market-rate projects.

Last year, there were 586 buildings containing close to 5,000 units in L.A. County that were taken off the market under the Ellis Act.

Once emptied, those properties – some functionally sound apartment buildings – can either be converted to condos or be razed to make way for a new condo development.

While San Francisco has been trying to curb Ellis Act evictions and enact some protection for renters, Los Angeles has been slow to respond and has fewer limits on what property owners can do with their apartment buildings.

Some cities in L.A. County are already putting some restrictions in place. In Beverly Hills, for example, the city annually limits condo conversions to 0.5 percent and demolitions to 1 percent of its total apartment stock.

L.A.’s affordable housing advocates want a demolition and conversion moratorium while the council studies how the loss of rental housing is affecting the city.

Gross, at the Coalition for Economic Survival, said he’d like the city to make it harder for landlords to subdivide their rental properties for condominiums, especially in areas with already high housing costs or in buildings with elderly and disabled residents.

He also wants the city to require landlords to build replacement housing for being allowed to raze or convert their buildings. “These are all based on what other cities have done,” Gross said. “These aren’t some crazy ideas – they already work in other cities.”

But proponents of the conversions say that by not allowing for apartment conversions, building owners can’t raise money to fix-up their properties, which can lead to run-down and unsafe buildings.

“The inventory continues to rot,” Nevin said. “No one can afford to fix up their apartments so the units just continually go down hill and that’s why you get a slum.”

However, critics argue it’s a stretch that limiting conversions leads to slum-like conditions. Not addressing the issue could change the character of the city, they say.

“If we don’t stop this activity right now, and figure out a more equitable way to deal with this issue, the face of L.A. will change forever. The diversity that gives this city its strength will not exist in the future. We are going to be a city strictly of the wealthy,” Gross said.

For Norton and his two sons, that possibility has already become a reality. The family will likely have to move out of the neighborhood where Norton’s sons have grown up and where most of their friends live.

“Nobody thinks about renters’ rights,” he said. “People who have been living here for decades, we have no way or right to fight for our homes.”

Read more!

Old loan, new interest

Driven by capital-gains rules and soaring home appreciation, the appeal is growing for 'owner- carry' mortgages.

By: Jessica C. Lee: LA Times

Seller financing, once used to attract buyers forced out of the market by high interest rates on conventional loans, may be making a comeback thanks to California's handsomely appreciated market and the ceiling on tax-free home-sale profits.

"Owner-carry loans" or "take-back loans" — in which the seller holds the mortgage for an agreed-upon interest rate and period of time — gained popularity in the late 1970s and early 1980s when rates were in the double digits.

In 1981, when the average national 30-year fixed-rate mortgage reached a historical high of 18.63%, about 40% of all home sales utilized seller financing, according to the National Assn. of Realtors.

Nowadays, less than 4% of the nation's residential sales rely on the seller to finance the deal, according to the Realtors group. Low interest rates allow most buyers to qualify for institutional loans. But there is renewed appeal, brought on by soaring real estate appreciation and an Internal Revenue Service rule that limits tax-free home-sale profits to $250,000 for an individual or $500,000 per couple filing joint returns. Anything beyond that is subject to up to 15% in federal taxes.

As prices in Southern California have run up in the last few years, many people who want to sell homes — even modest ones — are discovering that if they do, they will exceed the tax-free capital-gains ceiling. One way to avoid a large capital-gains tax bill is to hold the mortgage for the person buying the house. In a seller-financed mortgage, consumers who sell a rental property or a home that is owned free and clear do not have to report their gain all in one year, says Jeffrey O. Goodfriend, a CPA at Fullerton Business Service.