The housing market continues to weaken in much of the country as inventories of unsold homes rise and many sellers cut their asking prices, a quarterly survey by The Wall Street Journal shows.

By: James R. Hagerty: The Wall Street Journal Online

There is no sign of a broad collapse of housing prices about a year after the once-hot coastal markets entered a long-anticipated cooling phase. But the general level of prices is edging down in some areas and leveling off in others, while the supply of homes for sale keeps rising.

The number of homes on the market in Orlando, Fla., for example, is nearly five times the year-earlier level, while the inventory has quadrupled in Phoenix and Tampa, Fla., and nearly tripled in the Washington, D.C., area.

Use an interactive tool to search the latest data on housing inventories and price trends in 26 real-estate markets and see photos of houses on the market.

In another sign of the housing market's growing weakness, the Commerce Department said housing starts fell 5.3% last month from May, to an annual rate of 1.85 million.

One effect of the softening in many markets is that more sellers are willing to dicker. "Let's make a smoking deal," John Nichols wrote in a Craigslist.org ad for his three-bedroom ranch house in Sacramento, Calif., this week. He is seeking $315,000 but adds, "Make an offer. You won't necessarily insult me." Although the backyard is "currently a dump," Mr. Nichols says, the kitchen countertops are granite and the dual-pane windows are new.

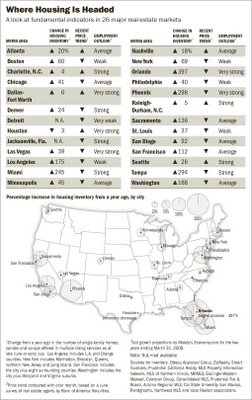

To examine the residential real-estate prospects for 26 major metro areas, The Wall Street Journal gathered data on inventories of homes for sale at the end of the second quarter from a variety of local sources; pricing trends based on surveys of real-estate agents by Daniel Oppenheim, an analyst at Banc of America Securities in New York, a unit of Bank of America Corp.; and projections of job creation by Moody's Economy.com, a research firm in West Chester, Pa. Employment trends are among the most important factors in determining demand for housing.

Metro areas showing large increases of homes for sale and relatively weak employment growth include Boston, Los Angeles, Philadelphia and New York. Among the strongest markets overall are Houston, Dallas-Fort Worth and Seattle. All three areas are benefiting from robust job markets, and modest home prices are drawing investors and new residents to Texas.

In Massachusetts, where the job market is flagging, the median sale price for single-family detached homes in May was down 1.2% from a year earlier and nearly 6% below the peak reached in July 2005, according to the state's Association of Realtors. The supply of homes available for sale in May was enough to last 11.3 months at the current sales pace, up from 8.7 months a year earlier.

A June survey of real-estate agents by Banc of America Securities found that home prices had weakened from the prior month in 30 of the 42 metropolitan areas covered. The markets with the weakest pricing trends included Boston, Detroit, Phoenix, St. Louis and Washington, D.C.

In Miami prices have been about flat in recent months, says Ronald A. Shuffield, president of the brokerage firm Esslinger-Wooten-Maxwell Inc. Mr. Shuffield says he expects prices of condos in less-attractive parts of the Miami area to fall slightly in coming months. For condos in better parts of the area, he believes prices during the next year will range from about flat to as much as 5% higher.

So many new homes are available on the outskirts of Phoenix that it is "a total bloodbath," says Ivy Zelman, a Cleveland-based housing analyst for Credit Suisse Group. She doesn't see a recovery in most major metro areas in the near term. "It could actually get worse before it gets better," she says.

Conditions can vary considerably within a metropolitan area and among different types of housing. Sherry Chris, chief operating officer of Prudential California Realty, says condo prices in downtown San Francisco are about level with a year ago because new buildings have helped supply catch up with demand. Overall, the number of homes on the market in the Bay Area has more than doubled from a year earlier.

But in the suburb of Palo Alto, where the median home price is nearly $1.4 million, the inventory of homes has declined 2% from a year ago. Ms. Chris says she believes that reflects lots of hiring by Google Inc. and other technology firms.

Among the 26 metro areas, Orlando shows the biggest surge in inventory. But the supply was unusually lean a year ago, says Beverly Pindling, president of the Orlando Regional Realtors Association, and job growth is very strong. Ms. Pindling says prices in the Orlando area generally are down about 3% to 7% from a year ago. Home builders, eager to make sales, are "romancing the Realtors," she says; some are offering agents who bring in buyers commissions of up to 10%.

Kent Fowler, a real-estate agent and investor in Washington, is bracing for an extended period of pain. Construction was recently completed on a condo near the city's Chinatown district that he bought in 2004 for $629,000. Mr. Fowler believes the two-bedroom condo, with a view of the Washington Monument, now is worth at least $800,000. But potential buyers are scarce in today's glutted market. So he is trying to find a renter for the condo for the next year or two at around $3,500 a month, even though that rental income would fall about $900 short of his monthly loan payments, condo fees, taxes and insurance.

Some sellers are advertising prices below recently appraised values, and others are offering to help pay closing costs for buyers who are short on cash.

Many Realtors say the media have overplayed weakness in the market. Richard A. Smith, vice chairman and president of Realogy Corp., the real-estate brokerage business due to be spun off from Cendant Corp. soon, says 2006 "will be the third best year in the history of the business" in terms of total home sales, despite the cooling trend. The National Association of Realtors projects that sales of previously owned homes will fall 6.7% from last year's record.

While many investors have been scared out of the market, Mr. Smith says, plenty of other people must buy new houses because of changes in their lives, such as a new job or a divorce.

Others sound more cautious. "I do think we're going to see some tougher times ahead," says Scott Anderson, senior economist at Wells Fargo & Co. in Minneapolis. By August, he says, most cities in California will be showing modest declines from a year earlier in home prices, and prices also may decline further in parts of Florida, Nevada, Arizona and the Northeast.

Headlines about falling prices could make buyers more aggressive in negotiating and persuade some sellers to "get out with what they can," Mr. Anderson says.

Mr. Anderson expects the current downswing to last into next year; by late 2007, he thinks the market will be stabilizing. Though he doesn't expect a recession in the next couple of years, he says the housing market would be much weaker if one occurs. In the past, steep declines in home prices have tended to hit only metropolitan areas that have suffered major job losses, he says.

William Wheaton, a housing economist at the Massachusetts Institute of Technology, says the wild cards include how many investors or second-home owners will dump properties on the market and how many borrowers will default. Even if there is no surge in defaults or selling by investors, he says, some of the formerly hot local markets may be heading into five or 10 years of flat to slightly higher home prices. He believes many baby boomers on the coasts will cash out of expensive homes and move to cheaper areas; that would restrain price increases along the coasts.

skip to main |

skip to sidebar

With the latest news and trends in the Real Estate Market

ABOUT

Links

ADD VF CONSULTING REAL ESTATE BLOG TO YOUR FAVORITES!

Blog Archive

-

▼

2006

(591)

-

▼

July

(44)

- Home seller should rethink listing with discount b...

- A little cash relief is as close as your W-4 form

- Five Tips for Getting Your Home Appraised Before S...

- Does a Vacation Home Qualify For a 1031 Exchange?

- UPDATE: Housing Bill Headed For Ballot

- The Weekend Guide! July 27 - July 30, 2006

- Median Home Price in California reaches record hig...

- Home Sales Dip in June as Market Stabilizes

- Hold off on that panic attack

- A Cooling California Market Isn't Necessarily Bad

- Fed Chief Says Housing Slowdown Going Smoothly

- Top 5 ways to buy a profitable house or condo

- Small defects become big turnoff for home buyers

- Prepaying mortgage principal offers best bang for ...

- For-Sale Signs Multiply Across U.S. As Supplies Ri...

- The Weekend Guide! July 20 - July 23, 2006

- Renting Can Cost 7 Times More Than Owning

- Buying a Duplex Has Clear Advantages

- Make Your Real Estate Investment More Successful

- Home Depot Cozying Up to Female Customers

- Federal Real Estate and Mortgage Tax Incentives

- Tax Deductions for Housing Not Always Equal

- Be prepared: Your motto for a successful remodel

- Mortgage Applications Climb 1% in Week

- The Weekend Guide! July 13 - July 16, 2006

- California disbursing $2 billion housing bond

- Economists say housing market cooling, not crashing

- Assessed Property Values Jump in L.A.

- Home sales stabilizing

- Overnight real estate rates down

- High-End Home Prices Squeezed By Interest Rates

- Kitchens & Baths that Clear up Chaos

- Pros and cons of joint-tenancy home ownership

- New Study Details Importance of Homeownership Tax ...

- Mortgage Rates Dip Following Fed Announcement

- The Weekend Guide! July 6 - July 9, 2006

- Falling interest rates fuel home-buying spree

- Pending real estate sales increase in May

- Home equity loan may not be homeowner's best bet

- California Drops Earthquake Insurance Rates

- 6 Simple Ideas for Beautifying a House

- Is this the big moment?

- Trespasser may be granted legal use of your property

- Six home-improvement tools top must-have list

-

▼

July

(44)